Pound Sterling Price News and Forecast: GBP strengthens on surprisngly upbeat flash UK PMI data

Pound Sterling strengthens on surprisngly upbeat flash UK PMI data

The Pound Sterling (GBP) strengthens against its major peers on Friday as the preliminary United Kingdom (UK) S&P Global/CIPS Purchasing Managers Index (PMI) data for January has come in surprisingly stronger than expected. The agency reported that the Composite PMI expanded at a faster pace to 50.9 from 50.4 in December. Economists expected the PMI to have hardly grown, with the data coming in at 50.0. The robust growth in the Composite PMI came from strong business activity in the services as well as the manufacturing sector.

Though the overall business activity remains robust in January, analysts at S&P Global showed concerns over weakening labor demand amid falling dales and worries over business prospects. Read more...

GBP/USD Forecast: Pound Sterling shows signs of life ahead of PMI data

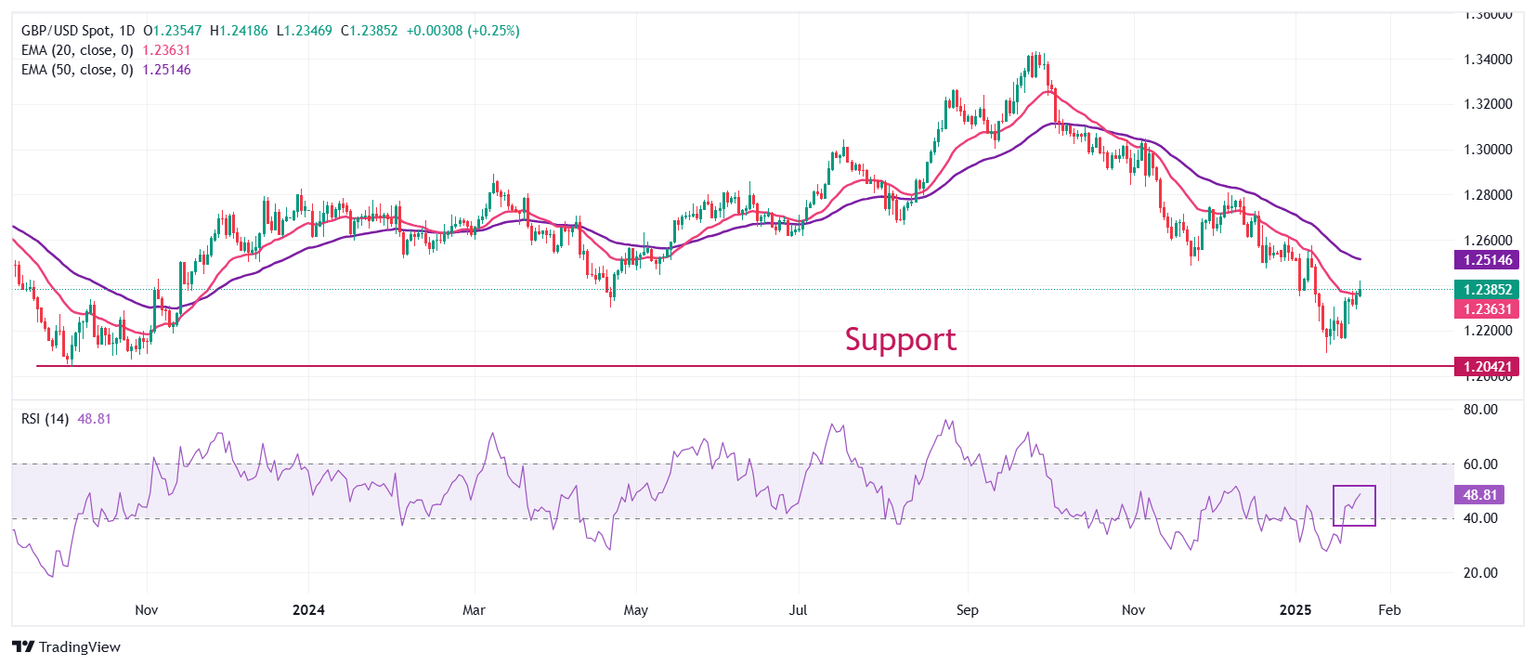

GBP/USD holds its ground early Friday and trades in positive territory slightly below 1.2400 after posting modest daily gains on Thursday. Market participants await preliminary January PMI reports from the UK and the US.

GBP/USD holds its ground early Friday and trades in positive territory slightly below 1.2400 after posting modest daily gains on Thursday. Market participants await preliminary January PMI reports from the UK and the US. Read more...

Author

FXStreet Team

FXStreet