Pound Sterling Price News and Forecast: GBP outperforms US Dollar on hopes of Russia-Ukraine truce

Pound Sterling outperforms US Dollar on hopes of Russia-Ukraine truce

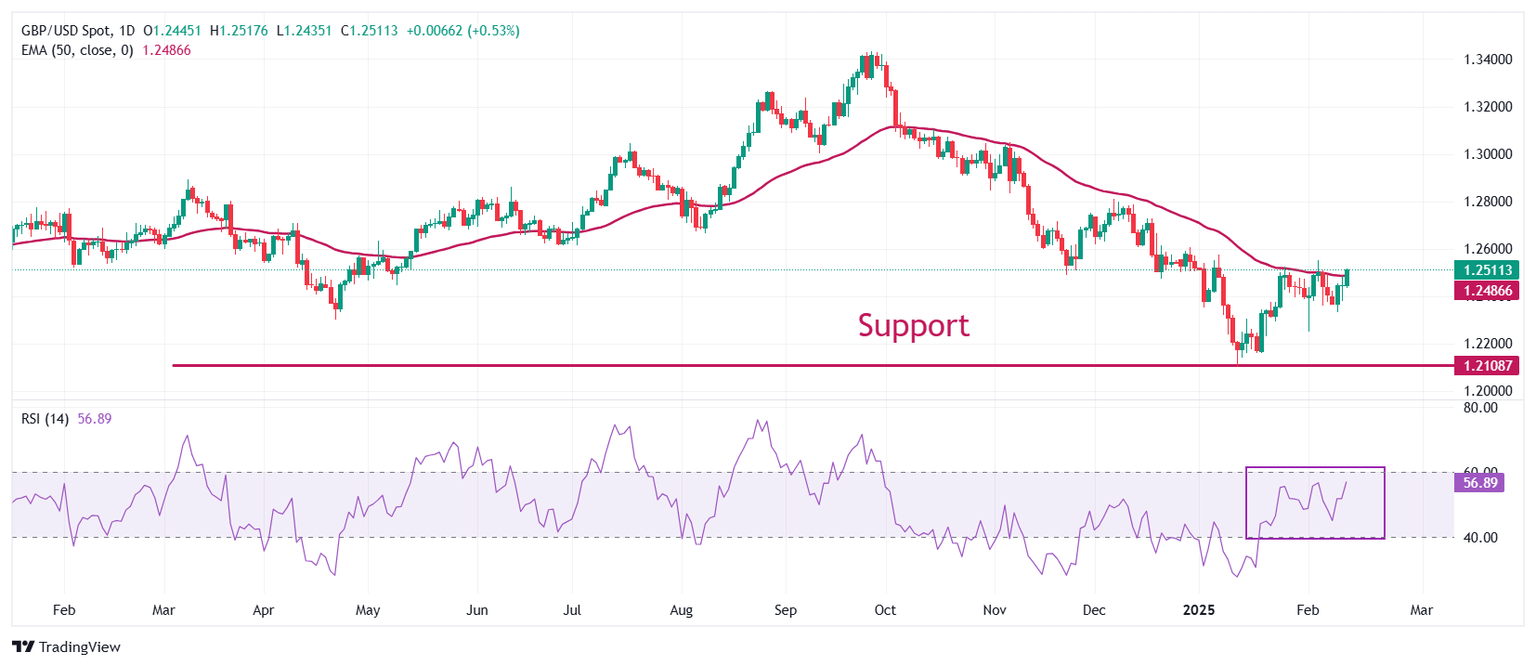

The Pound Sterling (GBP) climbs to near the psychological resistance of 1.2500 against the US Dollar (USD) in European trading hours on Thursday. The GBP/USD pair strengthens as positive developments in peace talks between Russia and Ukraine have overcome the impact of hotter-than-expected United States (US) Consumer Price Index (CPI) data for January released on Wednesday, which boosted expectations that the Federal Reserve (Fed) will keep interest rates at their current levels for longer.

US President Donald Trump confirmed on Wednesday that Russian leader Vladimir Putin and Ukrainian President Volodymyr Zelenskiy had expressed a desire for peace in separate phone calls. He also ordered his top officials to begin truce talks, Reuters reports. This scenario has increased investors' risk appetite and diminished demand for safe-haven assets, such as the US Dollar. The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, slides to near 107.50. Read more...

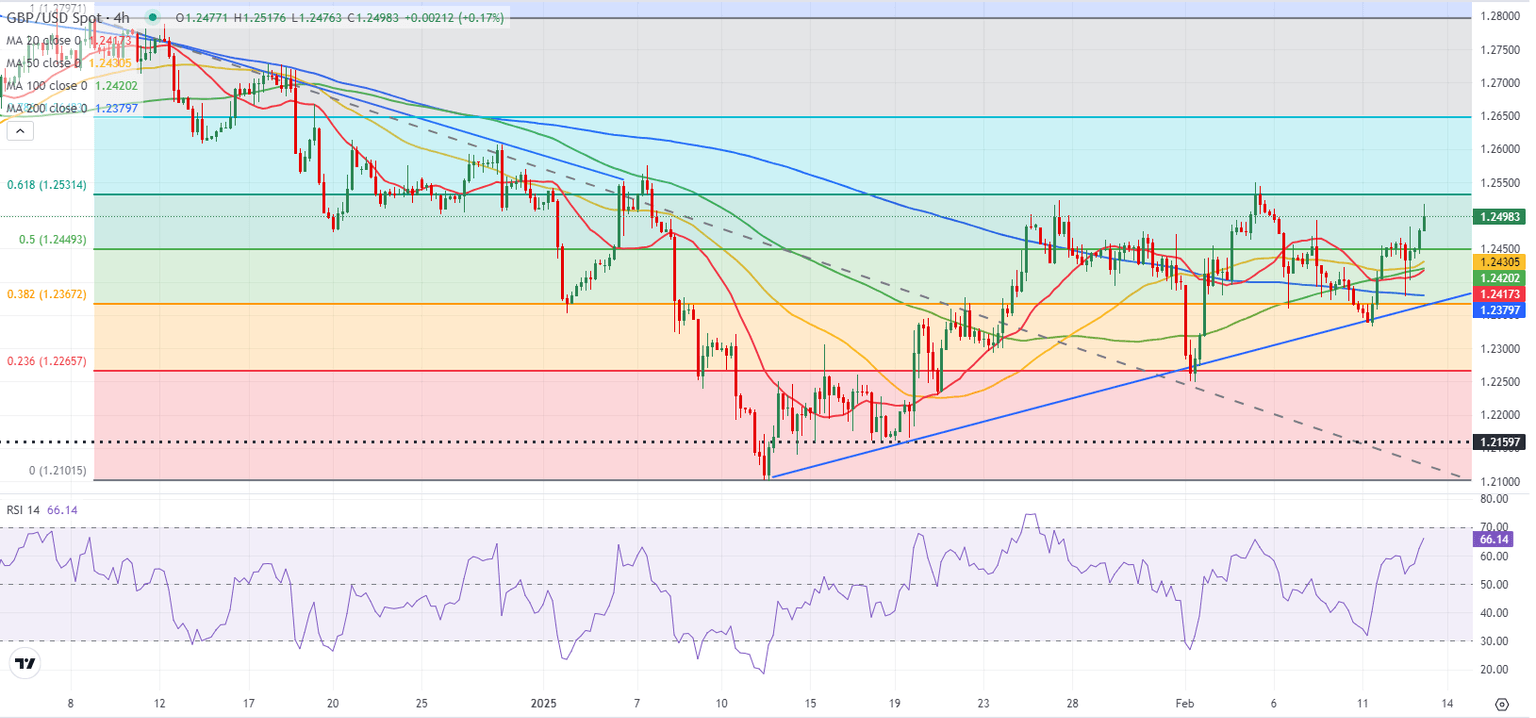

GBP/USD Forecast: Pound Sterling could meet next resistance at 1.2530

GBP/USD trades at a fresh weekly high at around 1.2500 in the European session on Thursday, supported by upbeat macroeconomic data releases from the UK and the broad-based selling pressure surrounding the US Dollar (USD).

The UK's Office for National Statistics (ONS) reported early Thursday that the UK's Gross Domestic Product (GDP) expanded at an annual rate of 1.4% in the fourth quarter. This reading followed the 1% growth recorded in the previous quarter and surpassed the market expectation of 1.1%. Other data from the UK showed that Industrial production and Manufacturing Production increased by 0.5% and 0.7%, respectively, on a monthly basis in December. Read more...

Author

FXStreet Team

FXStreet