Pound Sterling Price News and Forecast: GBP nosedives as Trump wins US presidential elections

Pound Sterling nosedives as Trump wins US presidential elections

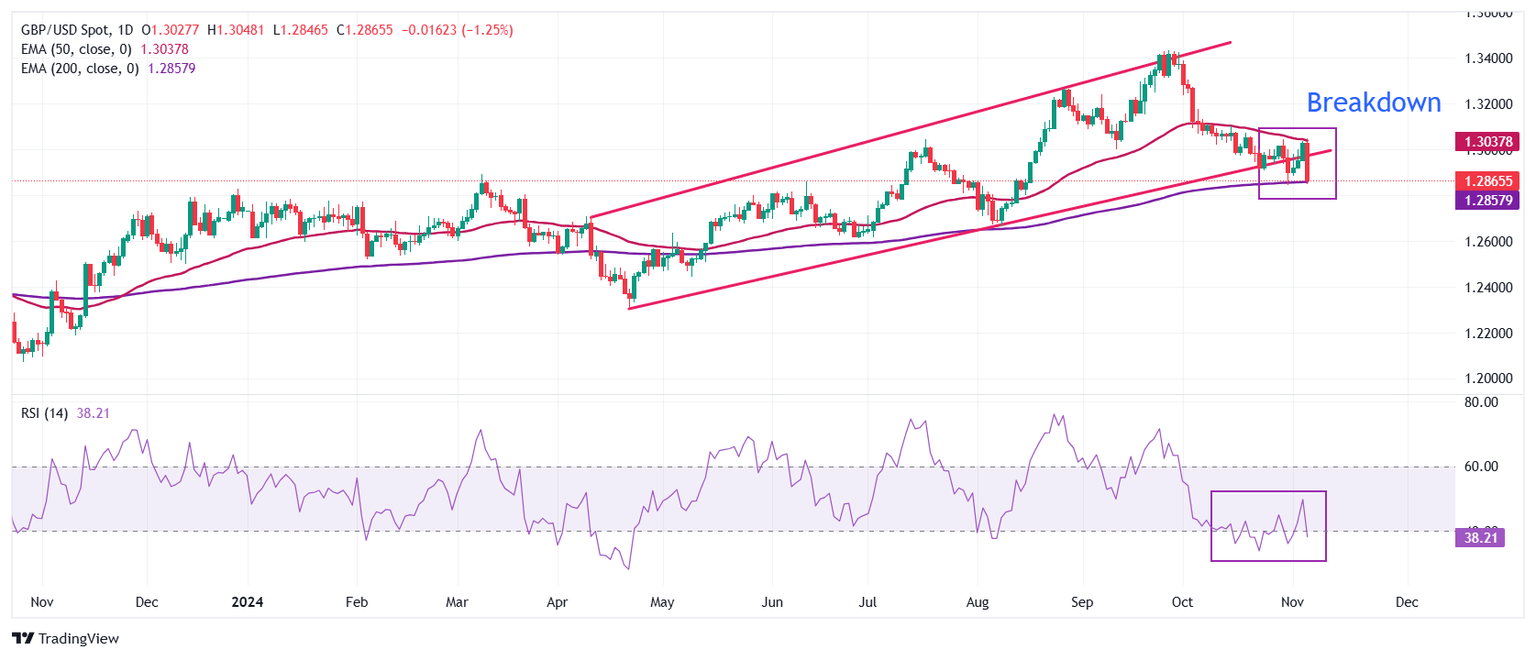

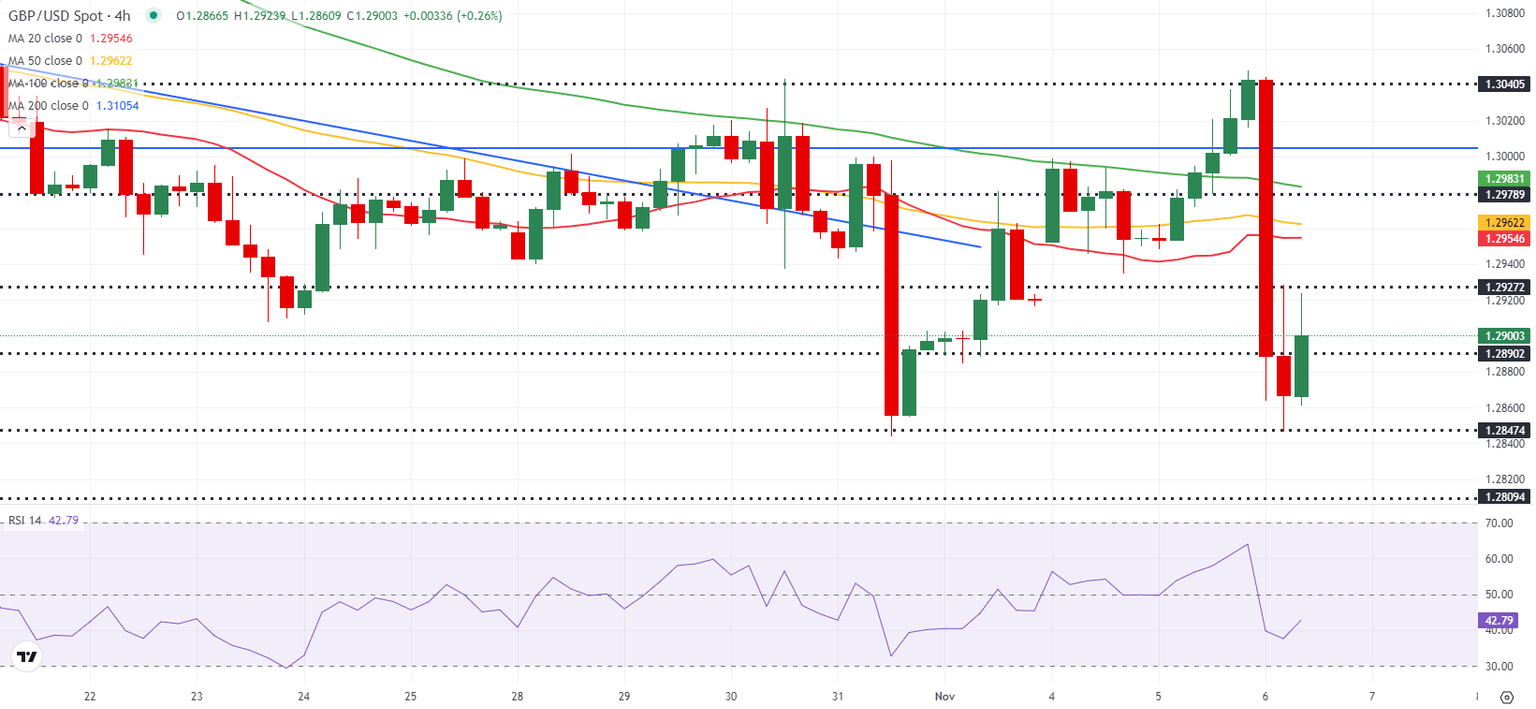

The Pound Sterling (GBP) plummets to near 1.2850 against the US Dollar (USD) in London trading hours on Wednesday. The GBP/USD pair faces an intense sell-off as investors rush to the so-called ‘Trump trades’, with Republican candidate Donald Trump winning the United States (US) presidential election over Democratic rival Kamala Harris.

According to the Associated Press, Trump has been elected as the 47th President of the US after he cleared the 270 seats hurdle after winning in the key battleground state of Wisconsin. Read more...

GBP/USD Forecast: Pound Sterling struggles to rebound as US election fuels USD rally

GBP/USD declined sharply early Wednesday as the US Dollar (USD) gathered strength on developments surrounding the US presidential election. The pair managed to stage a rebound in the European morning and was last seen trading near 1.2900.

Once news outlets started calling Georgia and North Carolina for Donald Trump, two battleground states Republicans lost in the previous election, the USD gathered bullish momentum. In the early European session, Pennsylvania, another swing state that was seen as Kamala Harris' last chance to turn the election around, went to Trump, all but officially confirming his victory. Read more...

Author

FXStreet Team

FXStreet