Pound Sterling Price News and Forecast: GBP gains against US Dollar

Pound Sterling gains against US Dollar as Trump's tariff agenda seems less fearful

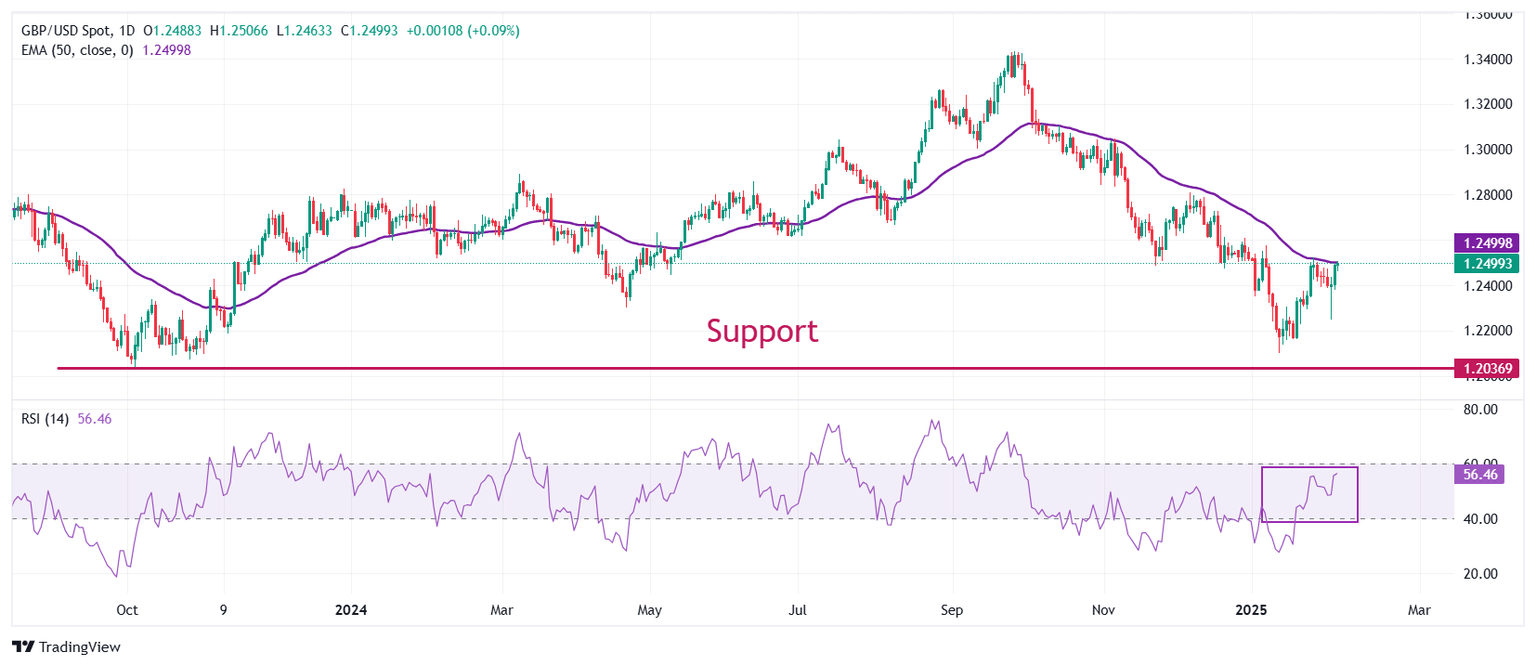

The Pound Sterling (GBP) gains to near 1.2500 against the US Dollar in Wednesday’s European session. The GBP/USD pair advances as the US Dollar gives up its initial weekly gains as it loses risk-premium after United States (US) President Donald Trump postponed tariffs on Canada and Mexico.

Market participants have interpreted this scenario as President Trump’s negotiation tactic to close better deals with his major trading partners. Trump called for an immediate suspension of 25% tariff orders on his North American peers after they agreed to cooperate on criminal enforcement. Read more...

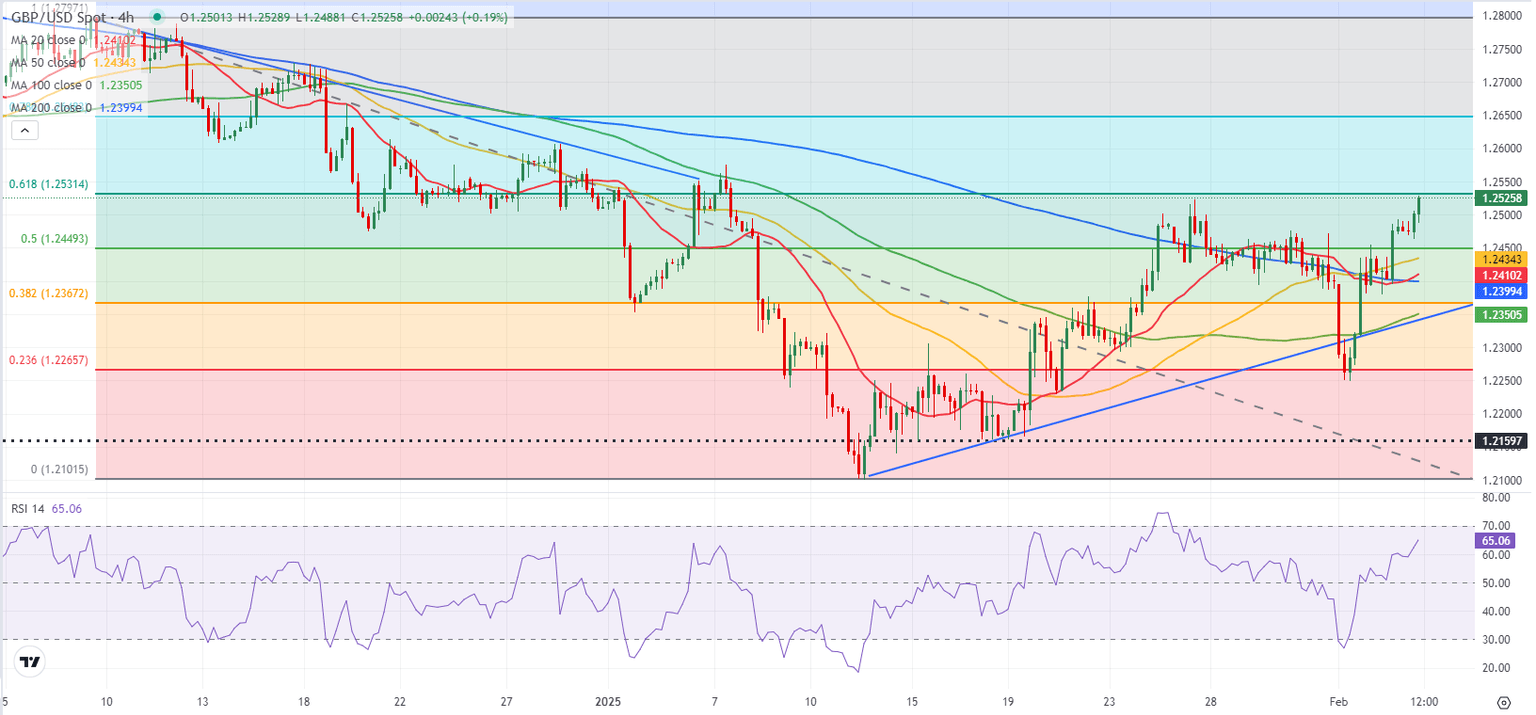

GBP/USD Forecast: Pound Sterling could face next hurdle at 1.2530

After posting gains for two consecutive days, GBP/USD continues to stretch higher and trades at a new weekly high above 1.2500 on Wednesday. The technical outlook highlights a buildup of bullish momentum as market focus shifts to key macroeconomic data releases from the US.

The US Dollar (USD) weakened against its major rivals on Tuesday as the recovery seen in Wall Street's main indexes pointed to an improving risk mood. Moreover, the US Bureau of Labor Statistics announced that JOLTS Job Openings declined to 7.6 million in December, falling short of the market expectation of 8 million and putting additional weight on the USD's shoulders. Read more...

Author

FXStreet Team

FXStreet