Pound Sterling Price News and Forecast: GBP corrects sharply against USD ahead of US GDP

Pound Sterling corrects sharply against USD ahead of US GDP, inflation, and labor data

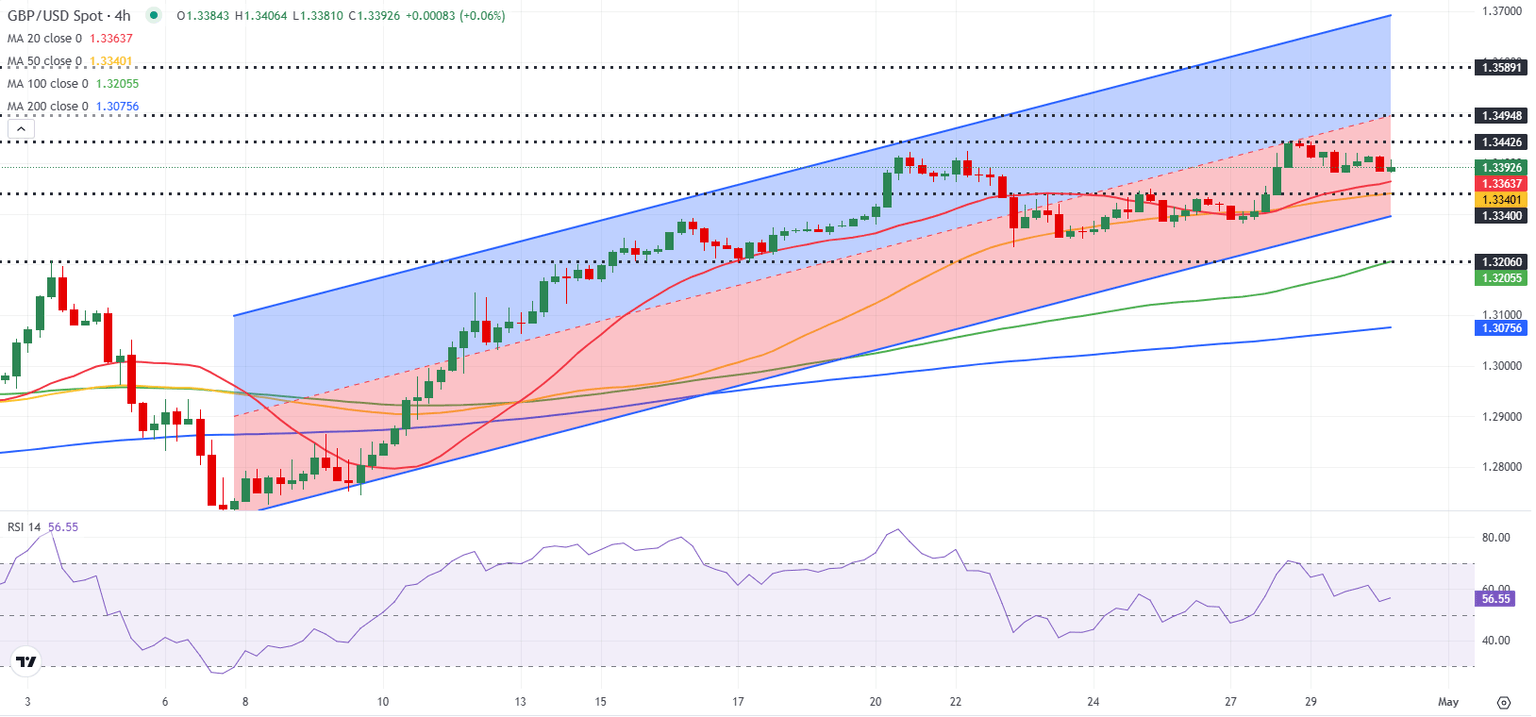

The Pound Sterling (GBP) extends correction to near 1.3355 against the US Dollar (USD) in Wednesday’s European session from its fresh three-year high of 1.3445 posted on Tuesday. The GBP/USD pair drops slightly as the US Dollar (USD) ticks higher ahead of a string of top-tier key United States (US) economic data, notably the preliminary Q1 Gross Domestic Product (GDP) data release in the North American session.

The US Bureau of Economic Analysis (BEA) is expected to report that the economy grew at a slower pace of 0.4% on an annualized basis, much lower than the prior reading of 2.4%. Economists have anticipated a moderate GDP growth on expectations of a slowdown in economic activity in the face of hefty tariffs imposed by US President Donald Trump earlier this month. Read more...

GBP/USD Forecast: Pound Sterling buyers could take action on weak US data

After posting strong gains on Monday, GBP/USD struggled to hold its ground and closed marginally lower on Tuesday. The pair stays relatively quiet and moves sideways below 1.3400 as investors refrain from taking large positions ahead of key macroeconomic data releases from the United States (US).

On Tuesday, the data from the US showed that JOLTS Job Openings declined to 7.19 million in March. This reading came in below the market expectation of 7.5 million and made it difficult for the US Dollar (USD) to gather strength. Nevertheless, easing fears over a further escalation of the US-China trade conflict helped the currency stay resilient against its rivals and didn't allow GBP/USD to gain traction. Read more...

Author

FXStreet Team

FXStreet