Pound Sterling slumps against US Dollar despite US economic turbulence

- The Pound Sterling retraces against the US Dollar to near 1.3310 as the former underperforms across the board.

- The US economy contracted by 0.3% in the January-March period.

- BoE Greene expects Trump’s tariff policy to be net disinflationary for the economy.

The Pound Sterling (GBP) extends correction to near 1.3310 against the US Dollar (USD) in Wednesday’s North American session from its fresh three-year high of 1.3445 posted on Tuesday. The GBP/USD pair trades near its intraday low as the US Dollar (USD) gains after the release of a string of top-tier key United States (US) economic data.

The US data has shown that the economy has contracted in the first quarter of the year, and job growth remained sluggish in April.

The US Bureau of Economic Analysis (BEA) has reported that the Gross Domestic Product (GDP) declined by 0.3% on an annualized basis, while economists expected a moderate growth of 0.4%. In the last quarter of 2024, the economy grew at a robust pace of 2.4%. This is the first time since the first quarter of 2022 that the US economy has contracted.

The US ADP has reported that the private sector hired 62K fresh workers in April, almost half of what economists had projected, against 155K in March.

Meanwhile, US core Personal Consumption Expenditure Price Index (PCE) data for March has grown at a moderate pace of 2.6% year-on-year, as expected, compared to the 2.8% increase seen in February.

A steep GDP contraction, soft job growth, and easing inflationary pressures indicate that the economy has become fragile in the face of hefty tariffs imposed by US President Donald Trump earlier this month.

Trump’s sweeping additional tariffs on its trading partners have led to an increase in global economic uncertainty, including in the US. Theoretically, Trump’s protectionist policies should prompt domestic industry to ramp up their production to offset lower imports, but ever-changing headlines from the White House over import duties have forced them to put their expansion plans on hold.

Cooling labor market conditions and GDP contraction are expected to boost market expectations that the Fed could reduce interest rates in the June policy meeting. According to the CME FedWatch tool, there is a 62.5% chance that the central bank will reduce interest rates in June. For the May policy meeting, traders are almost fully pricing in that the Fed will keep interest rates unchanged in the range of 4.25%-4.50%.

Fed officials have been indicating that interest rates should remain at their current level until they get clarity on how new economic policies by Donald Trump shape the economic outlook. On Tuesday, Trump criticized Fed Chair Jerome Powell again for not lowering interest rates, while commemorating his first 100 days in office. Trump didn’t mention Powell explicitly, but his comments and past record with him indicated so.

“You’re not supposed to criticize the Fed, you’re supposed to let him do his own thing, but I know much more than he does about interest rates, believe me,” Trump said.

Daily digest market movers: Pound Sterling underperforms across the board

- The Pound Sterling underperforms its peers, except the Japanese Yen (JPY), in European trading hours on Wednesday as traders have become increasingly confident that the Bank of England (BoE) will reduce interest rates by 25 basis points (bps) in its monetary policy meeting on May 8. BoE dovish bets have escalated amid fears that the new tariff policy by the US will ease inflationary pressures and weaken United Kingdom (UK) economic growth.

- BoE policymaker Megan Greene said that the potential trade war would be “net disinflationary” for the UK economy, in a discussion with the Atlantic Council think tank on Friday. Greene warned about shockwaves in the job market in the face of an increase in employers’ contribution to social security schemes to 15% from 13.8%, which has become effective this month.

- Last week, BoE Governor Andrew Bailey stressed the need to consider trade war risk by the central bank. "We do have to take very seriously the risk to growth, Bailey said at the sidelines of the International Monetary Fund’s (IMF) Spring Meetings in Washington.

- This week, the UK economic calendar has nothing important to offer. Therefore, external forces would be the key driver of the British currency.

- The Pound Sterling has remained underpinned against the US Dollar amid elevated uncertainty over the US-China trade war. Washington wants China to initiate trade discussions with it, given its significant reliance on its exports to the US. “I believe that it’s up to China to de-escalate, because they sell five times more to us than we sell to them, Bessent said in an interview on CNBC’s Squawk Box on Monday. Meanwhile, Beijing has vowed to fight the tariff war to protect its interests and dignity.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.20% | 0.54% | 0.46% | -0.03% | 0.09% | 0.19% | -0.03% | |

| EUR | -0.20% | 0.34% | 0.24% | -0.24% | -0.13% | -0.01% | -0.23% | |

| GBP | -0.54% | -0.34% | -0.10% | -0.57% | -0.45% | -0.35% | -0.58% | |

| JPY | -0.46% | -0.24% | 0.10% | -0.49% | -0.37% | -0.21% | -0.47% | |

| CAD | 0.03% | 0.24% | 0.57% | 0.49% | 0.12% | 0.22% | 0.00% | |

| AUD | -0.09% | 0.13% | 0.45% | 0.37% | -0.12% | 0.10% | -0.11% | |

| NZD | -0.19% | 0.01% | 0.35% | 0.21% | -0.22% | -0.10% | -0.22% | |

| CHF | 0.03% | 0.23% | 0.58% | 0.47% | -0.00% | 0.11% | 0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Technical Analysis: Pound Sterling holds key EMAs

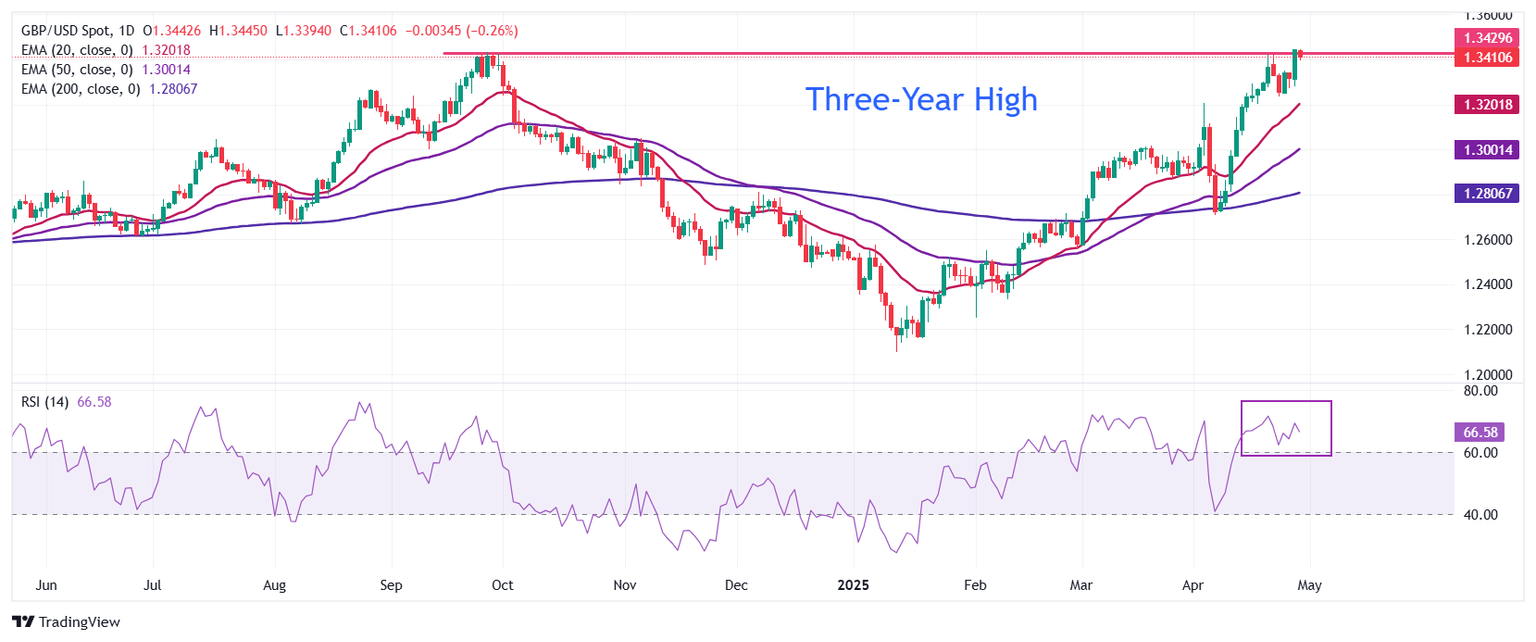

The Pound Sterling retraces below 1.3400 against the US Dollar from the three-year high of 1.3445. However, the overall outlook of the pair remains bullish as all short-to-long Exponential Moving Averages (EMAs) are sloping higher.

The 14-day Relative Strength Index (RSI) rebounds after cooling down to 60, currently at around 65, indicating a resurgence in the upside trend.

On the upside, the round level of 1.3600 will be a key hurdle for the pair. Looking down, the April 3 high around 1.3200 will act as a major support area.

Economic Indicator

Gross Domestic Product Annualized

The real Gross Domestic Product (GDP) Annualized, released quarterly by the US Bureau of Economic Analysis, measures the value of the final goods and services produced in the United States in a given period of time. Changes in GDP are the most popular indicator of the nation’s overall economic health. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year’s time, had it continued to grow at that specific rate. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Apr 30, 2025 12:30 (Prel)

Frequency: Quarterly

Actual: -0.3%

Consensus: 0.4%

Previous: 2.4%

Source: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) releases the Gross Domestic Product (GDP) growth on an annualized basis for each quarter. After publishing the first estimate, the BEA revises the data two more times, with the third release representing the final reading. Usually, the first estimate is the main market mover and a positive surprise is seen as a USD-positive development while a disappointing print is likely to weigh on the greenback. Market participants usually dismiss the second and third releases as they are generally not significant enough to meaningfully alter the growth picture.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.