Pound Sterling Price News and Forecast: Decline in UK Retail Sales sets stage for BoE rate cuts

Pound Sterling tumbles as decline in UK Retail Sales sets stage for BoE rate cuts

The Pound Sterling (GBP) falls sharply against its major peers on Friday as the United Kingdom (UK) Office for National Statistics (ONS) reported that Retail Sales surprisingly contracted in December, another data that adds to the weak economic outlook. The Retail Sales data, a key measure of consumer spending, declined by 0.3% month-on-month. Economists expected the consumer spending measure to have risen at a faster pace of 0.4% than 0.2% growth in November. Read More...

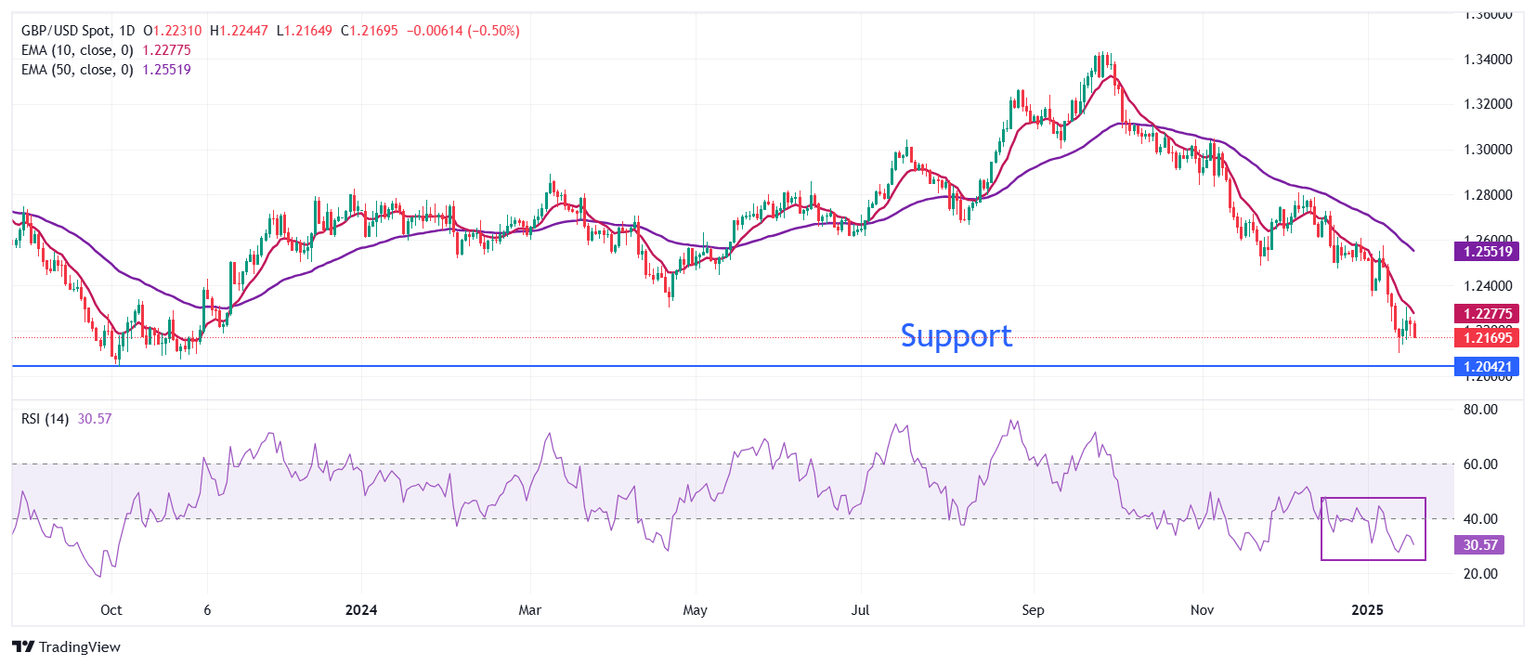

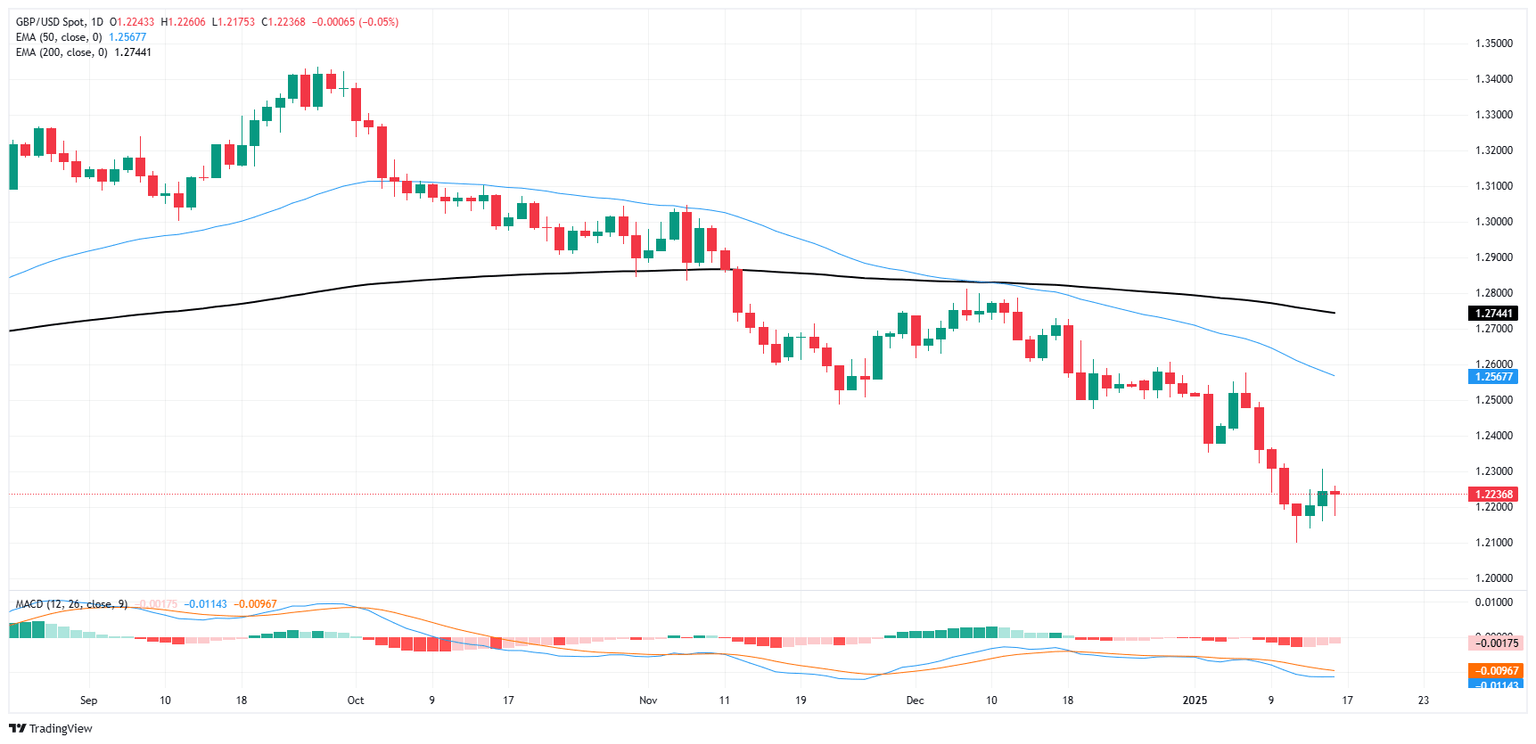

GBP/USD Price Forecast: Remains below 1.2250 barrier near nine-day EMA

The GBP/USD pair remains subdued for the second successive day, trading near 1.2230 during the Asian session on Friday. However, technical analysis of the daily chart suggests a persistent bearish bias, with the pair continuing to move within a descending channel pattern. Read More...

GBP/USD snaps two-day win streak, UK Retail Sales in the pipe

GBP/USD churned chart paper near familiar levels on Thursday, chalking in a flat day after exploring some intraday downside and snapping a two-day win streak as price action gets hung up on the 1.2200 handle. Read More...

Author

FXStreet Team

FXStreet