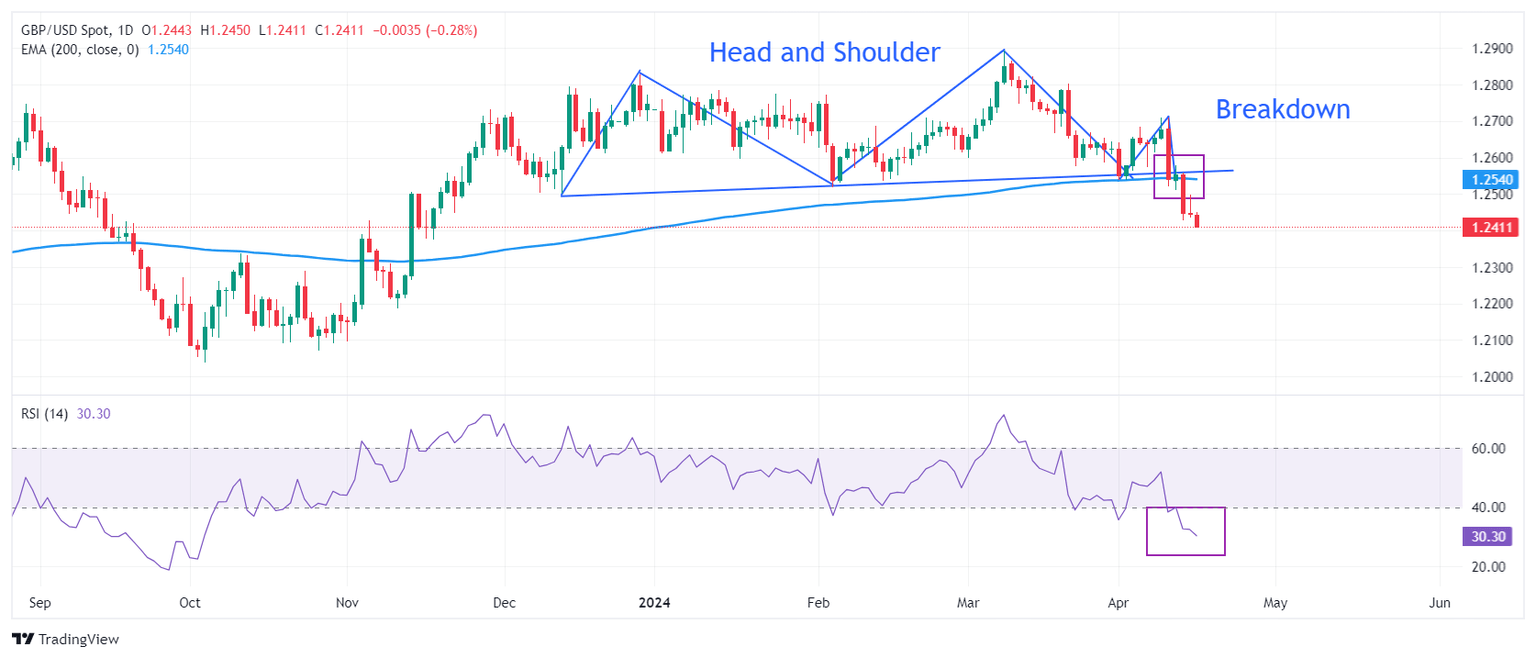

GBP/USD keeps pushing against 1.2430 support weighed by weak UK employment data

The Sterling has resumed its broader bearish trend during Tuesday’s London trading session. The uninspiring UK employment figures have endorsed the theory that the

BoE might start cutting rates ahead of schedule, which has punished the GBP.

Read More...

Pound Sterling seems vulnerable near 1.2400 after weak UK labor market data

The Pound Sterling (GBP) remains on the backfoot in Tuesday’s early New York session. The GBP/USD pair remains vulnerable as the United Kingdom Office for National Statistics (ONS) reported that labor market conditions have significantly cooled down in the three months ending February. The Unemployment Rate grew strongly to 4.2% and the overall labor market witnessed that 156K workers were laid-off.

Read More...

GBP/USD slides to its lowest level since November, eyes 1.2400 ahead of UK jobs data

The GBP/USD pair drifts lower for the third straight day on Tuesday – also marking the fourth day of a negative move in the previous five – and drops to its lowest level since November 17 during the Asian session. Spot prices currently trade around the 1.2420 region as traders now look to the UK monthly employment details for a fresh impetus.

Read More...