GBP/USD Forecast: Pound Sterling retreats but clings to bullish stance

- GBP/USD trades below 1.2950 in the European session on Wednesday.

- The improving risk mood could help the pair hold its ground.

- Investors await February inflation data from the US.

After rising to a fresh multi-month high near 1.2970 on Tuesday, GBP/USD corrects lower and trades below 1.2950 in the European session on Wednesday. The positive shift seen in risk mood, however, could help the pair hold its ground in the near term.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.73% | -0.17% | 0.45% | 0.45% | 0.29% | 0.16% | 0.33% | |

| EUR | 0.73% | 0.52% | 1.17% | 1.20% | 1.12% | 0.87% | 0.94% | |

| GBP | 0.17% | -0.52% | 0.58% | 0.64% | 0.59% | 0.29% | 0.49% | |

| JPY | -0.45% | -1.17% | -0.58% | -0.00% | -0.09% | -0.36% | -0.05% | |

| CAD | -0.45% | -1.20% | -0.64% | 0.00% | -0.20% | -0.29% | -0.15% | |

| AUD | -0.29% | -1.12% | -0.59% | 0.09% | 0.20% | -0.24% | -0.12% | |

| NZD | -0.16% | -0.87% | -0.29% | 0.36% | 0.29% | 0.24% | 0.24% | |

| CHF | -0.33% | -0.94% | -0.49% | 0.05% | 0.15% | 0.12% | -0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The Trump administration's global 25% tariffs on steel and aluminum imports went into effect on Wednesday. Following this development, UK Trade Minister Jonathan Reynolds said they are negotiating a wider economic agreement to eliminate additional tariffs. "We will keep all options on the table and won't hesitate to respond in the national interest," Reynolds added.

Later in the session, February inflation data from the US will be scrutinized by market participants. On a monthly basis, the core Consumer Price Index (CPI), which excludes volatile food and energy prices, is expected to rise 0.3%, after increasing 0.4% in January. A stronger-than-forecast core monthly inflation print could cause investors to refrain from pricing in a rate cut in May and help the US Dollar (USD) stay resilient against its rivals. On the flip side, a reading of 0.2%, or lower, in this data could trigger another leg lower in the USD and open the door for additional gains in GBP/USD.

Meanwhile, US stock index futures were last seen rising between 0.4% and 0.7%. Following the bearish action seen on Monday and Tuesday, a decisive rebound in Wall Street's main indexes could make it difficult for the USD to find demand.

GBP/USD Technical Analysis

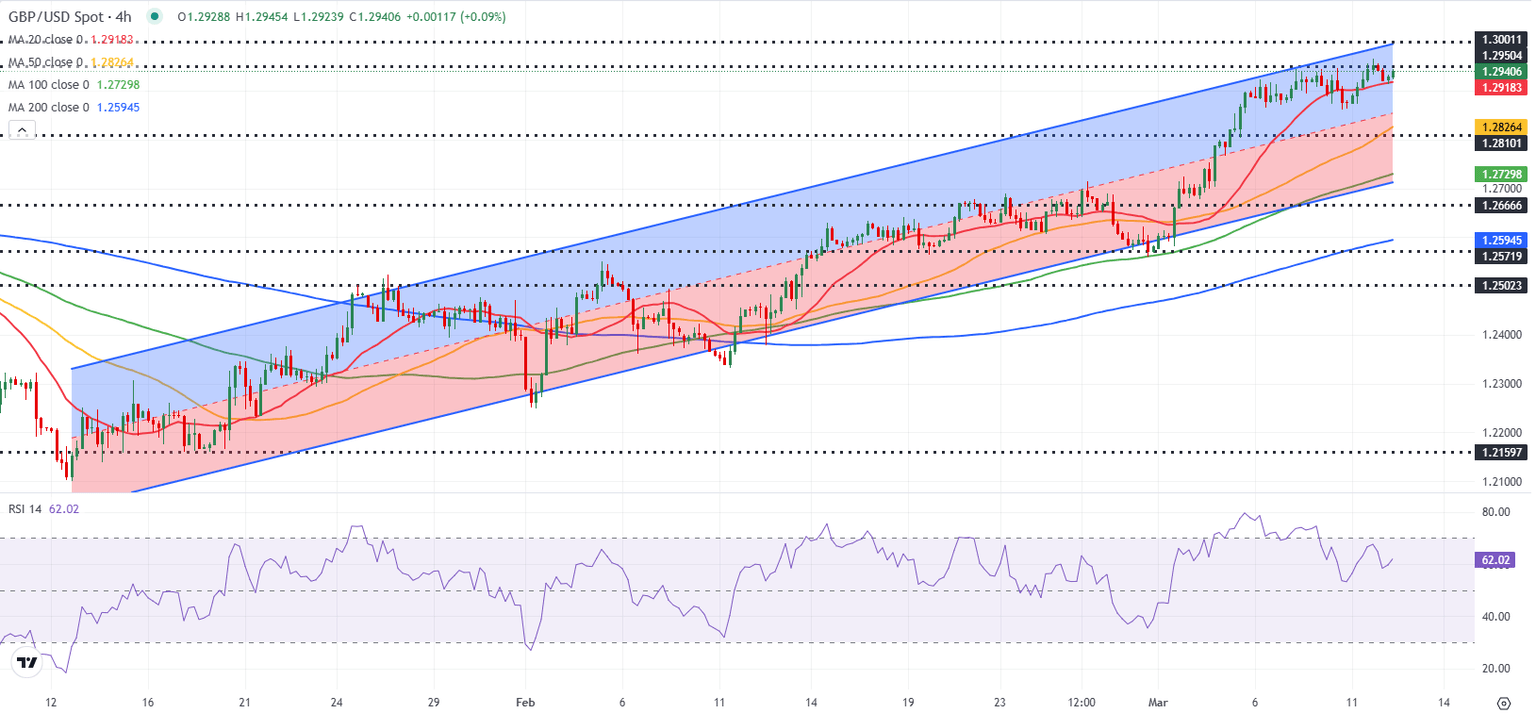

GBP/USD remains in the upper half of the ascending regression channel and the Relative Strength Index (RSI) indicator on the 4-hour chart holds above 60, reflecting the bullish stance.

On the upside, 1.2950 (static level) aligns as interim resistance before 1.3000 (round level, static level, upper limit of the ascending channel) and 1.3040 (static level). Supports, on the other hand, could be spotted at 1.2900 (static level, round level), 1.2850 (mid-point of the ascending channel) and 1.2800 (200-day Simple Moving Average).

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.