Pound Sterling trades firmly against USD as Trump assaults Fed's independence

- The Pound Sterling demonstrates firmness against the US Dollar near 1.3400 as Trump aims to sack Fed Powell for not cutting interest rates.

- The US Dollar is the major casualty of the feud between Trump and Powell.

- Investors expect the BoE to cut interest rates in May.

The Pound Sterling (GBP) remains resilient around a three-year high above 1.3400 against the US Dollar (USD) in Tuesday’s North American session. The GBP/USD pair is expected to see more upside as the USD continues to bleed due to United States (US) President Donald Trump’s attack on the Federal Reserve’s (Fed) independence for not reducing interest rates.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, looks for temporary support after printing a fresh three-year low near 98.00.

On Monday, US President Trump slammed Fed Chair Jerome Powell again for supporting a “wait and see” approach on interest rates and warned that the economy could face shockwaves if the monetary policy is not eased. “There can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW,” Trump said through a post on TruthSocial.

Last week, Donald Trump threatened to sack Jerome Powell for maintaining a restrictive stance on the monetary policy outlook. Trump said, "I am not happy with him. If I want him out of there, he’ll be out real fast, believe me." Financial market participants saw the event as an attack on the “autonomous” status of the Fed, whose decisions may not be influenced by political operations.

This led to investors reassessing the safe-haven status of the US Dollar, which had already been vulnerable due to ever-changing tariff policies by Donald Trump. His decision to impose worse-than-expected reciprocal tariffs and a sudden announcement of a 90-day pause on the same forced traders to doubt the credibility of Trump’s policy objectives, weighing on the US Dollar and US assets.

Daily digest market movers: Pound Sterling shows mixed performance ahead of flash UK PMI data

- The Pound Sterling demonstrates a mixed performance against its major peers on Tuesday as investors are cautious over how the Bank of England (BoE) will shape the monetary policy outlook under the threat of Trump’s international policies.

- Traders have become increasingly confident that the BoE could cut interest rates in the May policy meeting amid ongoing global economic tensions. There is a great chance that the UK will have a trade deal with Washington after Trump's administration imposed 10% reciprocal tariffs and 25% levies on steel and foreign cars. However, the major threat to the UK is intense competition with other nations, assuming that Trump’s protectionist policies will force his trading partners to sell their products in other territories at lower prices.

- In the Financial Policy Committee (FPC) in April, the BoE warned that a major shift in “global trading arrangements” could harm “financial stability by depressing growth”.

- Additionally, cooler-than-expected UK Consumer Price Index (CPI) data for March also adds to expectations that the BoE could reduce borrowing rates in May. Inflation in the services sector, which is closely tracked by BoE officials, grew moderately by 4.7% against a 5% increase seen in February.

- Meanwhile, BoE policymaker Megan Greene warned in an interview with Bloomberg TV during European trading hours that she is still worried about service inflation, which points to persistent price pressures. On the impact of Trump tariffs, Greene said, "Tariffs actually represent more of a disinflationary risk than an inflationary risk." She doesn't see any shakeout in the labor market. Market participants anticipated a slowdown in job postings as London's decision to increase employers' contributions to social security schemes has become effective this month.

- This week, investors will focus on the release of the preliminary S&P Global/CIPS Purchasing Managers’ Index (PMI) data for April and the UK Retail Sales data for March, which will be published on Wednesday and Friday, respectively.

Technical Analysis: Pound Sterling holds onto gains near 1.3400

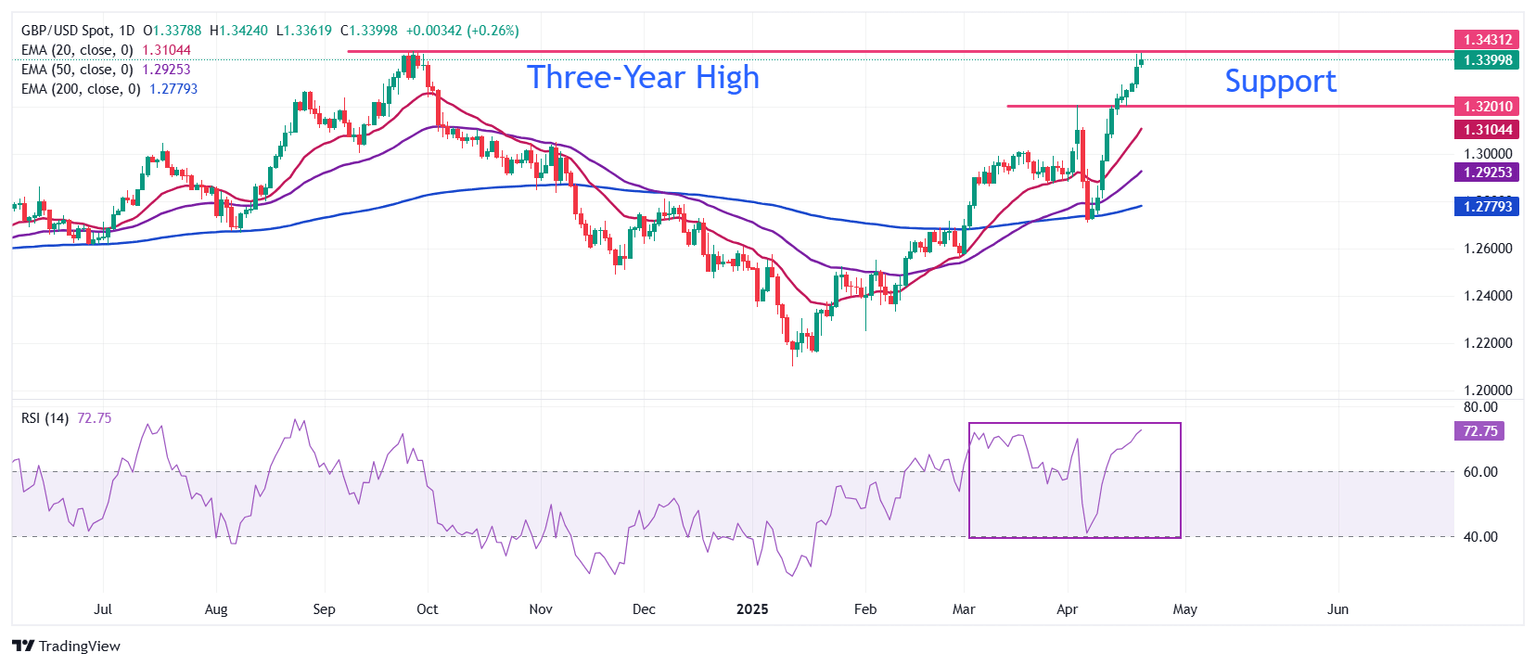

The Pound Sterling revisits the three-year high slightly above 1.3400 against the US Dollar on Tuesday. The GBP/USD pair could witness more upside as all short-to-long Exponential Moving Averages (EMAs) are sloping higher.

The 14-day Relative Strength Index (RSI) reaches overbought levels above 70.00. This indicates a strong bullish momentum, but investors should be prepared for some correction ahead.

On the upside, the psychological level of 1.3500 will be a key hurdle for the pair. Looking down, the April 3 high around 1.3200 will act as a major support area.

Economic Indicator

S&P Global/CIPS Composite PMI

The Composite Purchasing Managers Index (PMI), released on a monthly basis by the Chartered Institute of Procurement & Supply and S&P Global, is a leading indicator gauging private-business activity in UK for both the manufacturing and services sectors. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation.The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the UK private economy is generally expanding, a bullish sign for the Pound Sterling (GBP). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for GBP.

Read more.Next release: Wed Apr 23, 2025 08:30 (Prel)

Frequency: Monthly

Consensus: 50.4

Previous: 51.5

Source: S&P Global

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.