Pound Sterling gains after soft US Job vacancy data, UK budget in focus

- The Pound Sterling consolidates below 1.3000 against the US Dollar ahead of a US data-heavy week and the UK’s Autumn Forecast Statement.

- UK Chancellor Rachel Reeves is expected to announce massive funding for the health service sector.

- Soft US JOLTS Job Openings data points to a slowdown in labor demand.

The Pound Sterling (GBP) rises sharply to near the psychological resistance of 1.3000 against the US Dollar (USD) in Tuesday’s North American session. The GBP/USD pair strengthens after the release of the United States (US) JOLTS Job Openings data for September, which showed that growth in job vacancies was slower than expected.

Fresh job openings came in at 7.443 million, lower than estimates of 7.99 million and the prior release of 7.861 million, downwardly revised from 8.04 million. This is the slowest growth since January 2021 and would prompt Federal Reserve (Fed) dovish bets.

This week, investors will focus on a slew of United States (US) economic data, which will provide cues about the direction of the Federal Reserve’s (Fed) monetary policy by the year-end.

Market participants will keenly focus on the first estimate of the Q3 Gross Domestic Product (GDP), the Personal Consumption Expenditure Price Index (PCE), the Nonfarm Payrolls (NFP), and the ISM Manufacturing Purchasing Managers’ Index (PMI) data to understand the current status of economic growth and inflation.

Meanwhile, recent commentaries from an array of Fed officials have shown that they are more worried about downside risks to economic growth, with firm confidence that inflation remains on track toward the bank’s target of 2%.

If the data to be published later this week show signs of robust economic expansion and upbeat labor demand, bets that the Fed will cut interest rates sharply will diminish. On the contrary, Fed rate cut bets would strengthen if the data points to slower growth and a weak job market.

According to the CME FedWatch tool, 30-day Federal Fund Futures pricing data shows that the central bank is expected to cut interest rates by 25 basis points (bps) in both policy meetings in November and December.

Daily digest market movers: Pound Sterling outperforms its major peers

- The Pound Sterling strengthens against its major peers on Tuesday. The British currency gains sharply ahead of the United Kingdom (UK) Autumn Forecast Statement, which will be unveiled on Wednesday. This will be the first budget announcement by a Labor government in over 15 years.

- UK Chancellor of the Exchequer Rachel Reeves is expected to raise taxes and increase public spending as suggested by Prime Minister Keir Starmer in his speech at Birmingham on Monday, reported by BBC News. The government would take "tough decisions," opting to raise taxes in order to “prevent austerity and rebuild public services," Starmer said.

- Meanwhile, Rachel Reeves discussed the need to spend heavily on the National Health Service (NHS) in order to improve medical facilities, Reuters reported. "I am putting an end to the neglect and underinvestment (the NHS) has seen for over a decade now”, Reeves said.

- Market participants will keenly focus on the overall spending plans as these will influence the Bank of England’s (BoE) interest rate path. According to a Reuters poll, the BoE is all set to cut interest rates by 25 basis points (bps) to 4.75% in its monetary policy meeting on November 7. This will be the BoE’s second interest rate cut this year. The central bank left its key borrowing rates unchanged at 5% in its last policy meeting in September.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.05% | -0.21% | 0.09% | 0.00% | 0.26% | 0.16% | 0.19% | |

| EUR | -0.05% | -0.25% | 0.00% | -0.05% | 0.21% | 0.11% | 0.17% | |

| GBP | 0.21% | 0.25% | 0.28% | 0.21% | 0.46% | 0.35% | 0.42% | |

| JPY | -0.09% | 0.00% | -0.28% | -0.07% | 0.20% | 0.07% | 0.16% | |

| CAD | -0.00% | 0.05% | -0.21% | 0.07% | 0.26% | 0.15% | 0.22% | |

| AUD | -0.26% | -0.21% | -0.46% | -0.20% | -0.26% | -0.11% | -0.06% | |

| NZD | -0.16% | -0.11% | -0.35% | -0.07% | -0.15% | 0.11% | 0.06% | |

| CHF | -0.19% | -0.17% | -0.42% | -0.16% | -0.22% | 0.06% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Technical Analysis: Pound Sterling stays at make or a break near 1.3000

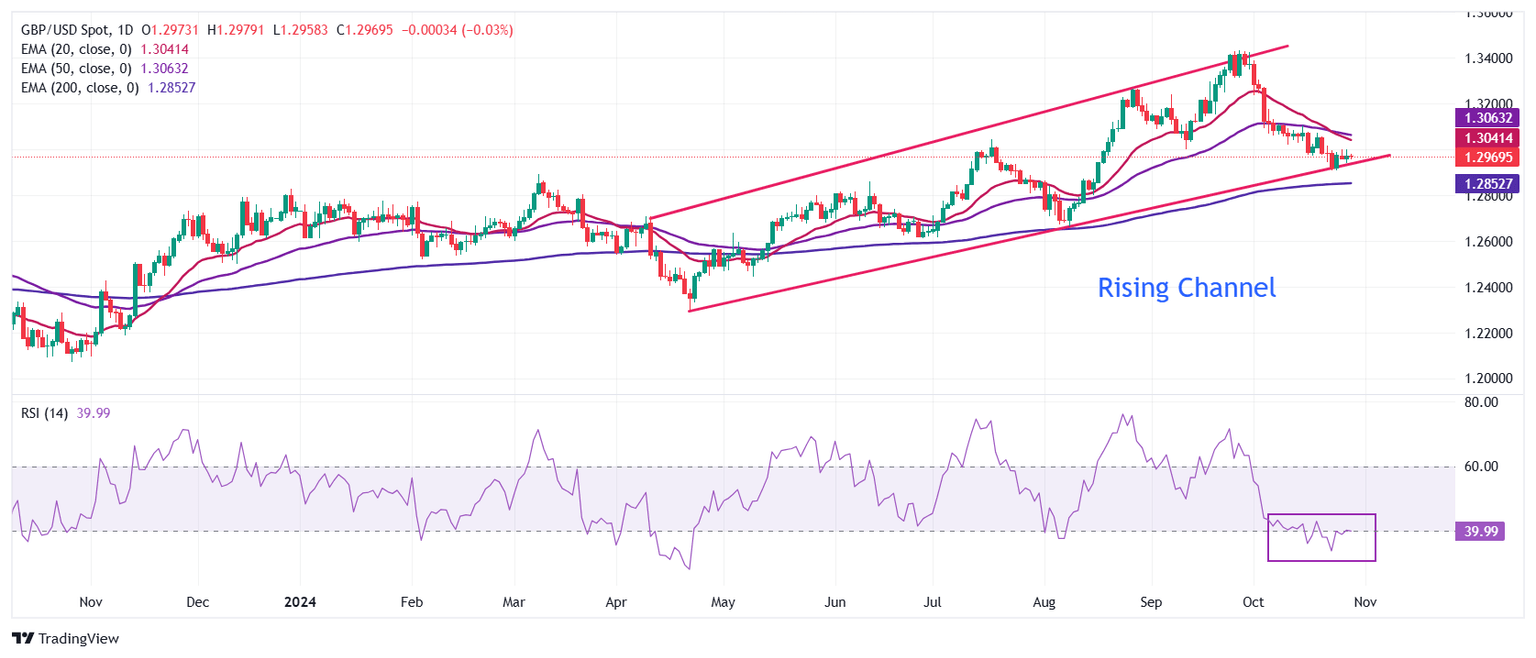

The Pound Sterling strives to break above 1.3000 against the US Dollar (USD) in North American trading hours on Monday. The GBP/USD pair remains at make or a break near the lower boundary of a Rising Channel chart formation around 1.2900 on the daily time frame.

The near-term trend of the Cable remains uncertain as it stays below the 50-day Exponential Moving Average (EMA), which trades around 1.3070.

The 14-day Relative Strength Index (RSI) rebounds to nearly 40.00. A fresh bearish momentum would trigger if it fails to climb above it.

Looking down, the 200-day EMA near 1.2845 will be a major support zone for Pound Sterling bulls. On the upside, the Cable will face resistance near the 20-day EMA around 1.3060.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.