Pound Sterling gives back some gains against US Dollar after upbeat US ISM Services PMI

- The Pound Sterling faces pressure against the US Dollar near the intraday high of 1.3330.

- The Fed is expected to leave interest rates steady, while the BoE is almost certain to cut borrowing costs by 25 bps.

- US-China trade uncertainty is expected to persist for longer.

The Pound Sterling (GBP) struggles to extend its upside above the intraday high of 1.3330 against the US Dollar (USD) during North American trading hours on Monday. The GBP/USD pair faces pressure as the US Dollar (USD) rebounds after the release of the United States (US) ISM Services PMI data for April, which showed that activities in the services sector grew unexpectedly at a faster-than-expected pace. However, the pair is still 0.30% higher to near 1.3300, at the press time.

The Services PMI landed at 51.6, higher than estimates of 50.6 and the March reading of 50.8. The New Orders Index also expanded at a faster pace to 52.3 from the prior reading of 50.4.

This week, the major trigger for the US Dollar will be the Federal Reserve’s (Fed) monetary policy decision, which will be announced on Wednesday.

According to the CME FedWatch tool, markets almost fully price in that the central bank will keep interest rates steady in the range of 4.25%-4.50%. Therefore, the major trigger for the US Dollar will be monetary policy guidance by the Fed and its Chairman, Jerome Powell, for the remainder of the year.

Fed officials have stated that monetary policy adjustments would become appropriate only if they see cracks in the labor market and the economy. However, recent United States (US) Nonfarm Payrolls data for April showed a better-than-expected job growth trend despite the tariff policy by President Donald Trump. Additionally, Q1 Gross Domestic Product (GDP) data was not as bad as it appeared at first glance, as the contraction was due to a robust increase in imports.

Another key limiting factor for the Fed to lower interest rates is elevated consumer inflation expectations. Business owners are hiking selling prices to offset the impact of rising input costs amid higher import duties, fuelling price pressures on the economy.

Meanwhile, US President Trump has insisted that the Fed should bring interest rates down. “Gasoline just broke $1.98 a Gallon, the lowest in years, groceries (and eggs!) down, energy down, mortgage rates down, employment strong, and much more good news, as Billions of Dollars pour in from Tariffs. Just like I said, and we’re only in a transition stage, just getting started!!! Consumers have been waiting for years to see pricing come down. No inflation, the Fed should lower its rate!!!” Trump wrote in a post on Truth.Social on Friday.

Trump has also pushed back fears of assaulting the Fed’s autonomy by clarifying that he will not fire Chairman Powell. "No, no, no. That was a total – why would I do that? I get to replace the person in another short period of time," Trump said in an interview with NBC News on Sunday, Reuters reported.

Daily digest market movers: Pound Sterling trades mixed ahead of BoE policy

- The Pound Sterling exhibits a mixed performance in a holiday-thinned trade as the United Kingdom (UK) markets are closed at the start of the week on account of Early May. Investors brace for significant volatility in the British currency this week as the Bank of England (BoE) is scheduled to announce the interest rate decision on Thursday.

- According to analysts at Bank of America (BofA), the BoE will cut borrowing rates by 25 basis points (bps) to 4.25%, with a majority vote of 8-1. The BofA expects that Monetary Policy Committee (MPC) member Swati Dhingra to vote for a larger-than-usual interest rate reduction of 50 bps.

- The BofA also believes that potential economic risks in the face of Trump’s tariffs, improving domestic inflation, and declining energy costs justify the rate reduction. For the remaining year, the bank has anticipated that the BoE could reduce interest rates twice more, excluding the rate cut on Thursday.

- On the global front, persistent uncertainty over US-China trade relations will keep the British currency and UK assets under pressure. The comments from US President Trump over the weekend indicated that the Sino-US trade war will not resolve in the near term. Trump said on Sunday that he is not going to speak with Chinese President Xi Jinping this week, but signaled that higher tariffs on imports from Beijing will be reduced ahead. “At some point, I’m going to lower them, because otherwise, you could never do business with them, and they want to do business very much,” he said.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.09% | -0.37% | -0.68% | 0.16% | -0.37% | -0.50% | -0.41% | |

| EUR | 0.09% | -0.01% | -0.36% | 0.52% | -0.01% | -0.15% | -0.06% | |

| GBP | 0.37% | 0.01% | -0.57% | 0.53% | 0.00% | -0.14% | -0.05% | |

| JPY | 0.68% | 0.36% | 0.57% | 0.87% | 0.35% | 0.29% | 0.40% | |

| CAD | -0.16% | -0.52% | -0.53% | -0.87% | -0.83% | -0.66% | -0.57% | |

| AUD | 0.37% | 0.00% | 0.00% | -0.35% | 0.83% | -0.14% | -0.04% | |

| NZD | 0.50% | 0.15% | 0.14% | -0.29% | 0.66% | 0.14% | 0.08% | |

| CHF | 0.41% | 0.06% | 0.05% | -0.40% | 0.57% | 0.04% | -0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

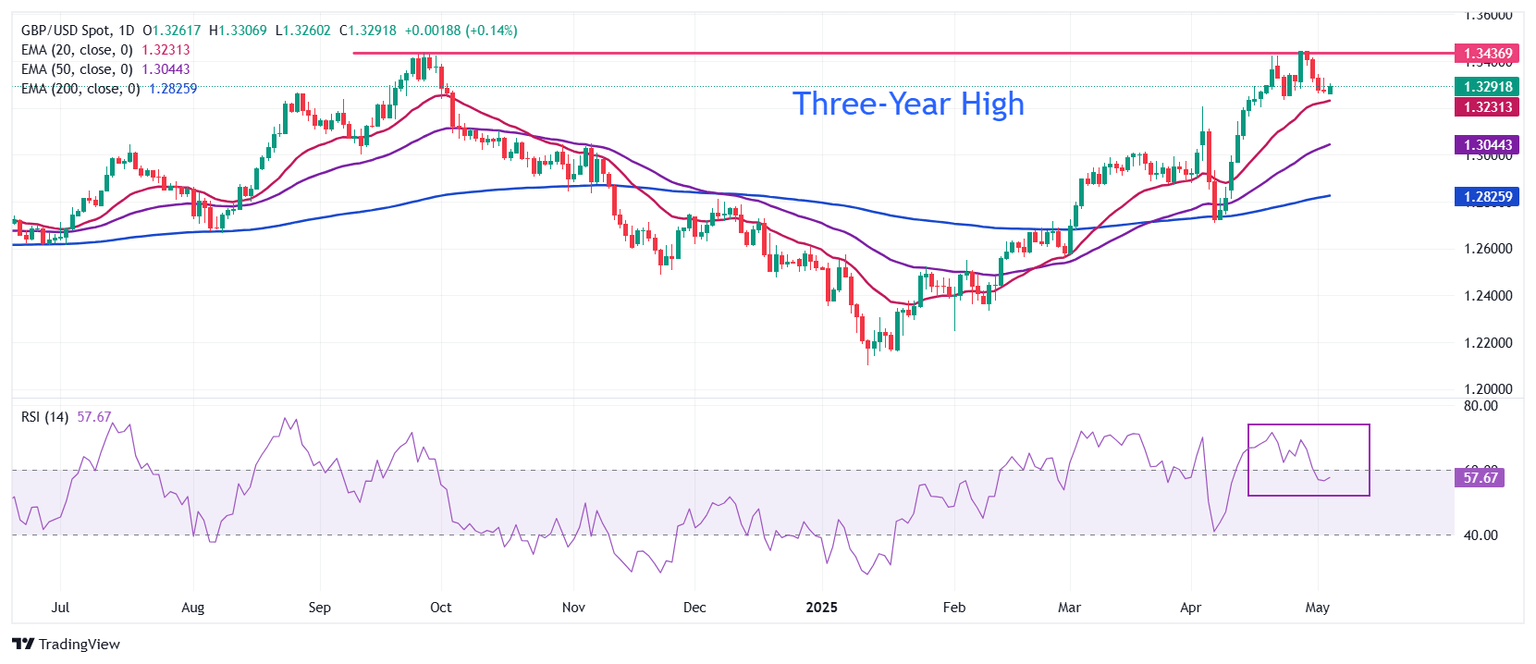

Technical Analysis: Pound Sterling bounces back above 1.3300

The Pound Sterling jumps above 1.3300 against the US Dollar on Monday. The overall outlook remains bullish as all short-to-long Exponential Moving Averages (EMAs) are sloping higher.

The 14-day Relative Strength Index (RSI) strives to return above 60.00. A fresh bullish momentum would trigger if the RSI manages to do so.

On the upside, the three-year high of 1.3445 will be a key hurdle for the pair. Looking down, the April 3 high around 1.3200 will act as a major support area.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.