Pound Sterling steadies above two-week low after release of US core PCE inflation

- The Pound Sterling holds the two-week low support at 1.2845 against the US Dollar after the US core PCE Price index data release.

- The BoE is expected to cut interest rates next week.

- Robust US Q2 GDP growth has improved the economic outlook.

The Pound Sterling (GBP) remains sideways above fresh two-week low of 1.2845 against the US Dollar (USD) in Friday’s American session after the release of the United States (US) Personal Consumption Expenditures price index (PCE) report for June. The report showed that annual core PCE Inflation grew steadily by 2.6%, higher than the estimates of 2.5%. Also, the underlying inflation rose by 0.2% month-on-month, higher than the estimates and the prior release of 0.1%.

The core PCE Price Index is a Federal Reserve’s (Fed) preferred inflation measure and its sticky nature is unfavorable for market expectations for Federal Reserve (Fed) rate cuts. According to the CME FedWatch tool, 30-day Federal Fund futures pricing data shows that the central bank will start reducing interest rates in September.

Despite stubborn inflation data, the first reaction came from the US Dollar Index's (DXY) price action was negative. The USD Index, which tracks the Greenback’s value against six major currencies, declines to near 104.20.

On Thursday, the US Dollar (USD) also failed to capitalize on robust US Q2 Gross Domestic Product (GDP) growth as the impact was offset by subsiding price pressures. The US economy expanded at a robust pace of 2.8% in the second quarter, double the 1.4% growth recorded in the first quarter. Still, speculation for Fed rate cuts in September remained intact as GDP Price Index decelerated at a slower-than-expected pace to 2.3%.

Daily digest market movers: Pound Sterling remains steady against its major peers

- The Pound Sterling exhibits a steady performance against its major peers on Friday. The British currency is expected to remain on the sidelines as investors shift focus to the Bank of England’s (BoE) monetary policy meeting, which is scheduled for Thursday.

- A Reuters poll on July 18-24 showed that more than 80% of economists said the BoE would announce a rate-cut decision in its August meeting for the first time in more than four years. The BoE will ditch its restrictive monetary policy framework, which it has been maintaining since the pandemic hit global markets. The BoE is expected to reduce its key borrowing rates by 25 basis points (bps) to 5% in the August meeting. However, traders see a 46% chance of the BoE pivoting to policy-normalization. It appears that the absence of BoE officials’ endorsement for rate cuts has limited BoE rate-cut expectations.

- Despite the return of the annual headline Consumer Price Index (CPI) in the United Kingdom (UK) to the central bank’s target of 2%, BoE policymakers hesitate to support interest rate cuts amid worries about strong wage growth momentum that has been resulting in sticky price pressures in the service sector.

- Also, signs of wage growth easing ahead remain absent due to the shortage of labor in the United Kingdom. The UK labor market has faced a shortage of workers for a long period due to voluntary retirements by individuals and the Brexit event.

- Meanwhile, the UK’s economic prospects remain firm due to expanding activities in manufacturing as well as the service sector and political stability after Prime Minister Keir Starmer’s outright victory in parliamentary elections.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| GBP | EUR | USD | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | 0.05% | 0.14% | 0.58% | 0.06% | -0.23% | -0.01% | 0.35% | |

| EUR | -0.05% | 0.09% | 0.52% | 0.01% | -0.29% | -0.06% | 0.31% | |

| USD | -0.14% | -0.09% | 0.42% | -0.09% | -0.37% | -0.16% | 0.23% | |

| JPY | -0.58% | -0.52% | -0.42% | -0.52% | -0.77% | -0.57% | -0.19% | |

| CAD | -0.06% | -0.01% | 0.09% | 0.52% | -0.28% | -0.07% | 0.30% | |

| AUD | 0.23% | 0.29% | 0.37% | 0.77% | 0.28% | 0.23% | 0.62% | |

| NZD | 0.00% | 0.06% | 0.16% | 0.57% | 0.07% | -0.23% | 0.36% | |

| CHF | -0.35% | -0.31% | -0.23% | 0.19% | -0.30% | -0.62% | -0.36% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Technical Analysis: Pound Sterling stays below 1.2900

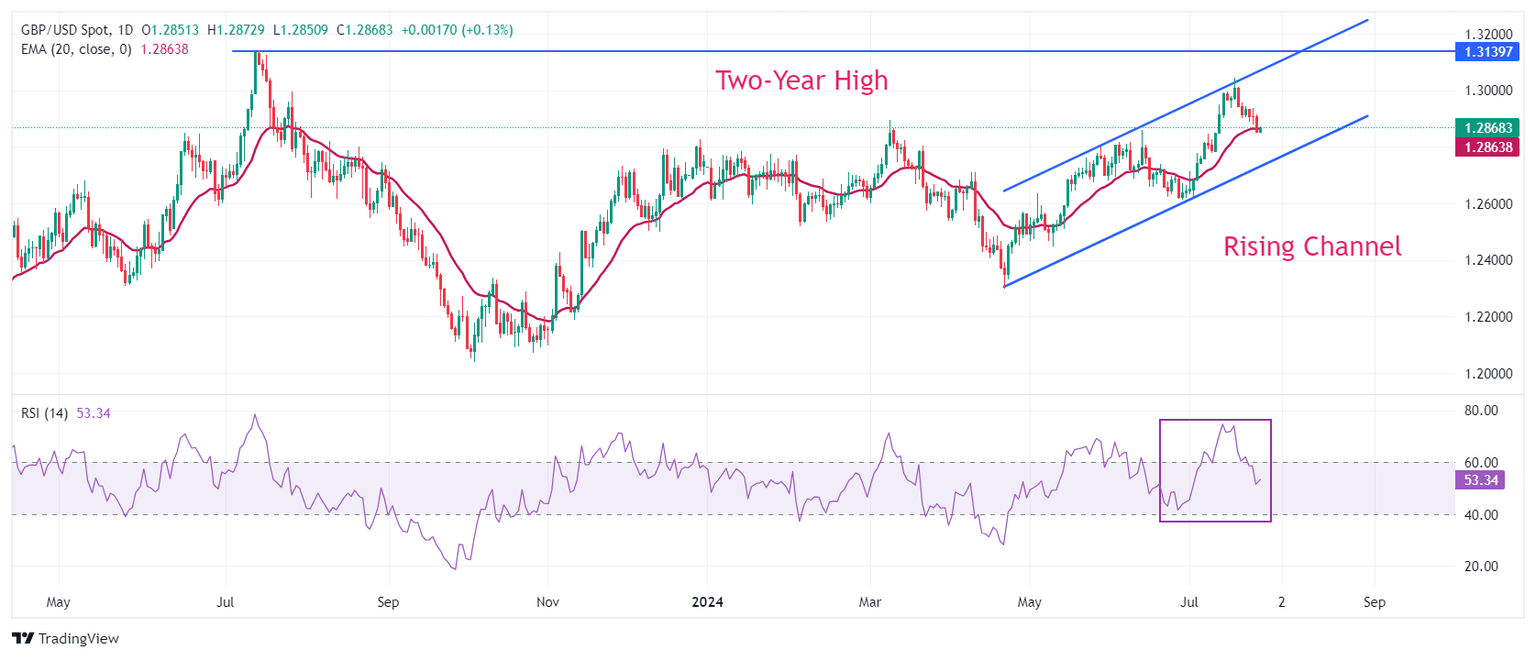

The Pound Sterling remains on the back foot against the US Dollar after sliding below the crucial support of 1.2900. The GBP/USD pair trades in a Rising Channel pattern on a daily timeframe, in which each pullback move is considered as a buying opportunity by market participants. The Cable holds the key 20-day Exponential Moving Average (EMA), which trades around 1.2866.

The 14-day Relative Strength Index (RSI) returns within the 40.00-60.00 range, suggesting the bullish momentum has faded. However, the bullish bias remains intact.

On the upside, a two-year high near 1.3140 will be a key resistance zone for the Cable.

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Fri Jul 26, 2024 12:30

Frequency: Monthly

Actual: 2.6%

Consensus: 2.5%

Previous: 2.6%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.