Pound Sterling attracts bids after BoE leaves interest rates unchanged at 4.5%

- The Pound Sterling bounces back against its major peers after the BoE's policy decision.

- The BoE kept interest rates steady at 4.5% and guided a gradually declining monetary policy path.

- UK Average Earnings Excluding Bonuses rose steadily by 5.9%, as expected, in three months ending January.

The Pound Sterling (GBP) rebounds against its major peers in the early North American session on Thursday. The British currency bounces back after the Bank of England (BoE) keeps interest rates steady at 4.5%, as expected. Eight out of nine Monetary Policy Committee (MPC) members voted for leaving borrowing rates at their current levels, while one supported a 25 basis points (bps) interest rate reduction against two anticipated by market participants.

BoE Governor Andrew Bailey has guided that there is a lot of uncertainty at the moment, but still, he thinks that the monetary policy is on a gradually declining path. In the February policy meeting, the BoE also guided a 'gradual and cautious' monetary easing approach after reducing borrowing rates by 25 basis points (bps) to 4.5%. The BoE has raised the Gross Domestic Product (GDP) forecast for the current quarter to 0.25% from 0.1%.

Earlier in the day, the British currency faced slight pressure after the release of the United Kingdom (UK) labor market data for three months ending in January. The Office for National Statistics (ONS) reported that the ILO Unemployment Rate came in at 4.4%, which aligns with expectations and the prior reading. The UK economy added 144K fresh workers, significantly higher than 107K additions in the three months ending December.

Average Earnings Excluding bonuses, a key measure of wage growth that has been a major driver of high inflation in the services sector, rose in line with estimates and the former release of 5.9%. Technically, upbeat employment and steady wage growth data are a favorable scenario for the British currency. However, market participants see wage growth momentum softening and employment growth slowing in the near term as business owners are planning to freeze hiring plans amid dissatisfaction over the UK government’s decision to increase employers’ contributions to social security schemes.

UK Chancellor of the Exchequer Rachel Reeves announced an increase in employers’ contribution to National Insurance (NI) from 13.8% to 15% in the Autumn Budget, which will be executed from April.

Such a scenario would be unfavorable for the Pound Sterling as easing labor market conditions could force Bank of England (BoE) officials to ditch their ‘gradual and cautious’ monetary easing approach guided in the February policy meeting.

British Pound PRICE Today

The table below shows the percentage change of the British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.46% | 0.24% | -0.12% | 0.34% | 1.14% | 1.39% | 0.52% | |

| EUR | -0.46% | -0.23% | -0.58% | -0.12% | 0.67% | 0.92% | 0.06% | |

| GBP | -0.24% | 0.23% | -0.37% | 0.09% | 0.90% | 1.15% | 0.30% | |

| JPY | 0.12% | 0.58% | 0.37% | 0.45% | 1.26% | 1.49% | 0.73% | |

| CAD | -0.34% | 0.12% | -0.09% | -0.45% | 0.80% | 1.04% | 0.18% | |

| AUD | -1.14% | -0.67% | -0.90% | -1.26% | -0.80% | 0.26% | -0.58% | |

| NZD | -1.39% | -0.92% | -1.15% | -1.49% | -1.04% | -0.26% | -0.87% | |

| CHF | -0.52% | -0.06% | -0.30% | -0.73% | -0.18% | 0.58% | 0.87% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling weakens against US Dollar

- The Pound Sterling slumps to near 1.2940 against the US Dollar (USD) in European trading hours on Thursday. The GBP/USD pair falls sharply as the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, jumps to near 104.00 in the aftermath of the Federal Reserve’s (Fed) monetary policy decision on Wednesday.

- As expected, the Fed kept interest rates steady in the range of 4.25%-4.50% for the second time in a row and stuck with its two interest rate cuts projection for the year, as anticipated in the December meeting. The central bank guided that the net effect of implementation of significant policy changes by the new administration is what matters for the economy and monetary policy.

- Fed Chair Jerome Powell said in the press conference that the tariff policy by United States (US) President Donald Trump has resulted in a “unusually elevated” uncertainty over the US economic outlook, which tends to bring “growth down and inflation up”. This led them to revise their core Personal Consumption Expenditures (PCE) inflation forecast for this year to 2.8%, up from the 2.5% projected in the December meeting. The Fed also updated their GDP growth forecast for this year to 1.7%, down from their prior forecast of 2.1%.

- Meanwhile, Donald Trump said that the Fed should have cut interest rates as the impact of tariffs has started to blend into the economy. “The Fed would be much better off cutting rates as US tariffs start to transition (ease!) their way into the economy. Do the right thing,” Trump said in a post on Truth Social after the Fed’s policy decision.

- In Thursday’s session, investors will focus on the US Initial Jobless Claims data for the week ending March 15, which will be published at 12:30 GMT. The Department of Labor is expected to report that individuals claiming jobless benefits for the first time increased to 224K from the former release of 220K.

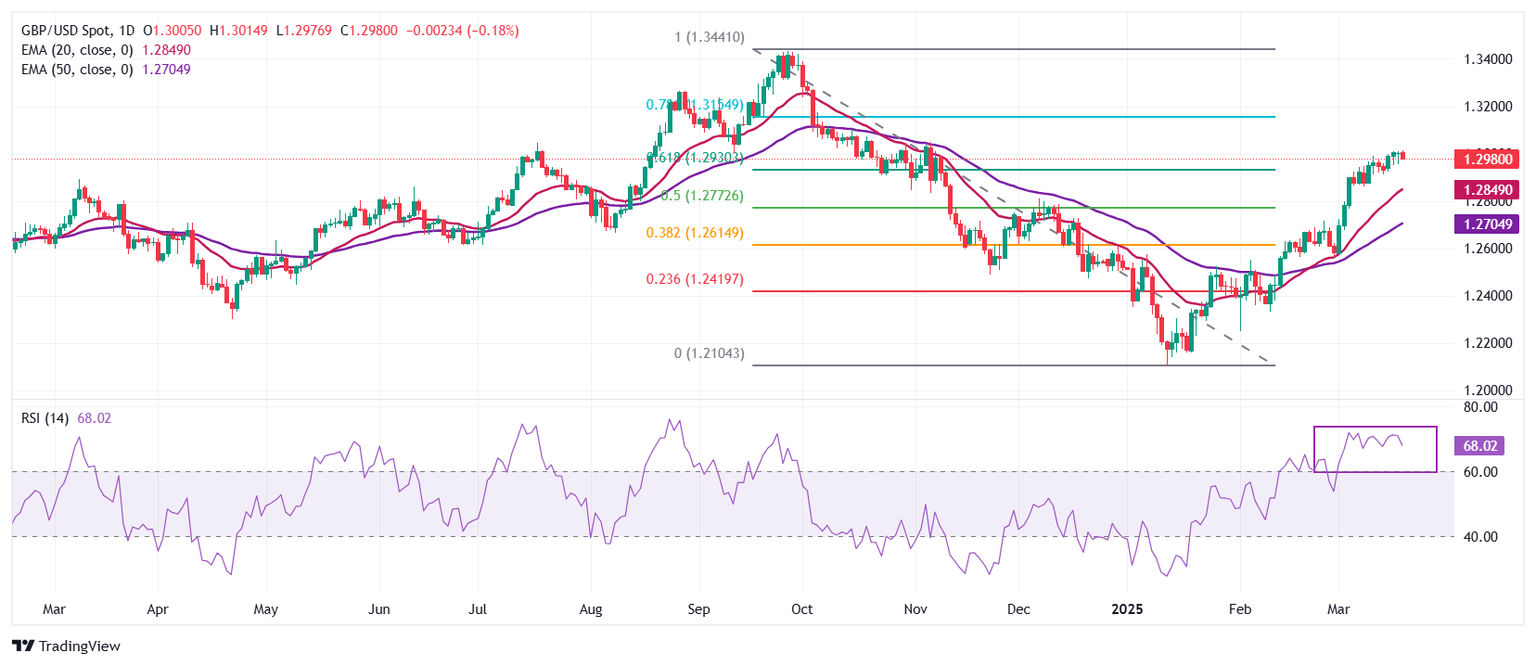

Technical Analysis: Pound Sterling remains above 20- and 50-day EMAs

The Pound Sterling struggles to extend its two-month rally above the key level of 1.3000 against the US Dollar on Thursday. GBP/USD bulls take a breather as the 14-day Relative Strength Index (RSI) reached overbought levels above 70.00. However, this doesn’t reflect that the bullish trend is over. The upside trend could resume once the momentum oscillator cools down to near 60.00.

Advancing 20-day and 50-day Exponential Moving Averages (EMAs) near 1.2850 and 1.2705, respectively, suggest that the overall trend is bullish.

Looking down, the 50% Fibo retracement at 1.2770 and the 38.2% Fibo retracement at 1.2615 will act as key support zones for the pair. On the upside, the October 15 high of 1.3100 will act as a key resistance zone.

BRANDED CONTENT

Finding the right broker for your trading strategy is essential, especially when specific features make all the difference. Explore our selection of top brokers, each offering unique advantages to match your needs.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.