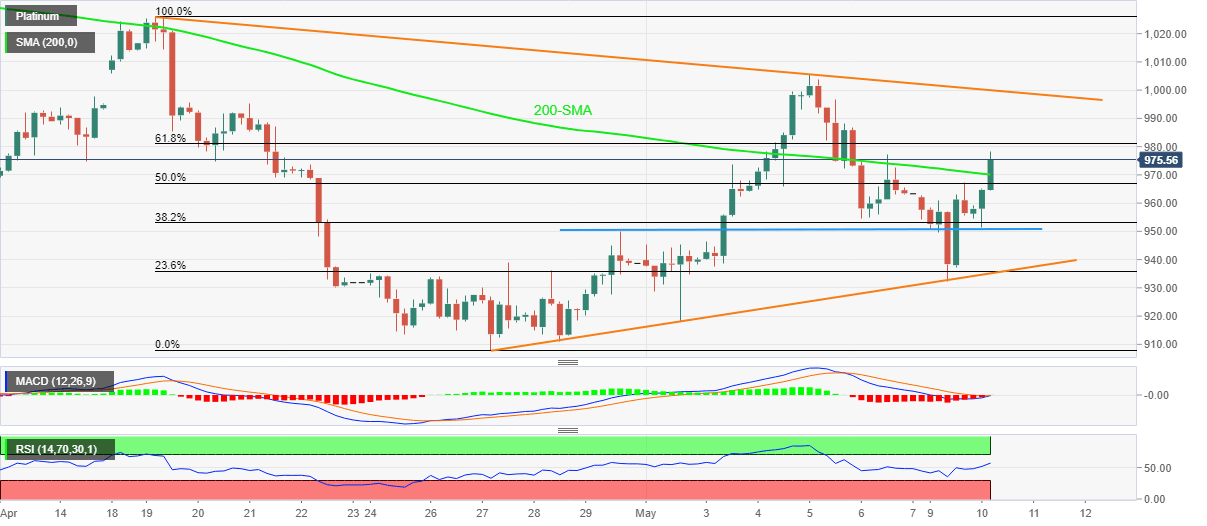

Platinum Price Analysis: XPT/USD crosses 200-SMA as MACD teases bulls

- Platinum portrays the first daily gains in four despite recent pullback from intraday high.

- MACD, RSI favor upside break of 200-SMA to keep buyers hopeful.

- Two-week-old rising trend line limits short-term downside, bulls approach 61.8% Fibo.

Platinum (XPT/USD) prices remain firmer around $975.00 while snapping the three-day downtrend heading into Tuesday’s European session.

In doing so, the precious metal pierces the 200-SMA, as it did on Friday before refreshing a one-week low.

However, the MACD conditions are more supportive of the latest XPT/USD rebound. On the same line is the firmer RSI (14).

Hence, the latest run-up stays ready to poke the 61.8% Fibonacci retracement (Fibo.) of April 19-27 downside, around $980.00.

Following that, a three-week-old resistance line, around the $1,000 psychological magnet, appears a tough nut to crack for the platinum buyers.

Meanwhile, the 200-SMA and 50% Fibo, respectively around $970.00 and $967, test the pullback moves of XPT/USD.

In a case where platinum sellers manage to conquer $967 support, a horizontal line from April 29, near $950, will precede an upward sloping support line from April 27, close to $935, to restrict the metal’s further downside.

Platinum: Four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.