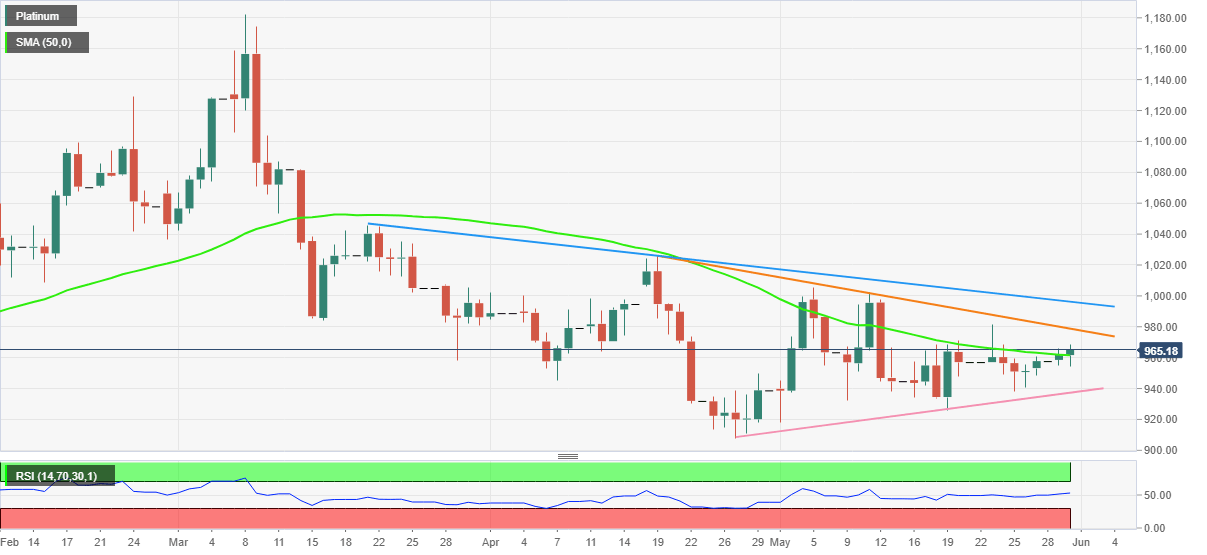

Platinum Price Analysis: XPT/USD bulls stay on the way to $980

- Platinum prices grind higher around one-week top after crossing 50-DMA.

- Descending trend line from mid-April lures buyers, monthly support line defends upside momentum.

- RSI (14) hints at gradual run-up towards a two-month-long resistance line.

Platinum (XPT/USD) justifies the upside break of the 50-DMA by renewing the weekly top around $968, close to $965 by the press time of early Tuesday morning in Europe.

In addition to the metal’s ability to cross the key moving average, the recently firmer RSI also keeps XPT/USD bulls hopeful.

That said, a downward sloping resistance line from April 19, close to $980, lures short-term buyers of the bullion.

Following that, a two-month-long descending trend line, close to the $997, quickly followed by the $1,000 threshold, will challenge the platinum bulls.

Meanwhile, pullback moves remain elusive until staying beyond the 50-DMA level surrounding $961.

Also keeping XPT/USD bears away is the monthly support line, close to $937 at the latest.

Overall, platinum prices are ready for short-term advances but a reversal of the bearish trend from early March needs validation from the $1,000 round figure.

Platinum: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.