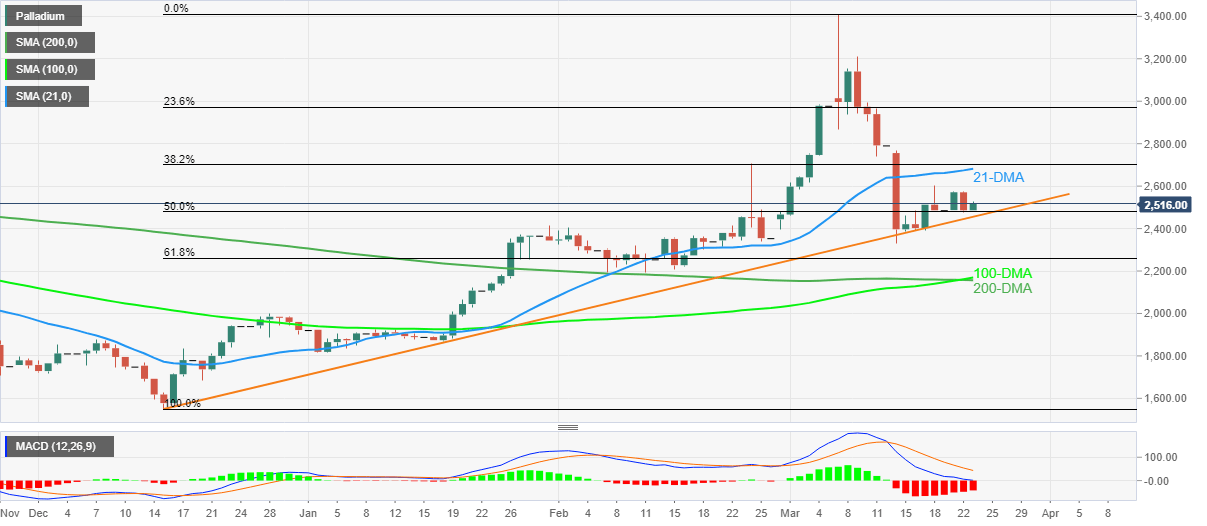

Palladium Price Analysis: Two-month-old support line defends XPD/USD bulls above $2,500

- Palladium prices fade bounce off multi-day-long support trend line.

- Bearish MACD, failures to cross 21-DMA keep sellers hopeful.

- Convergence of 50-DMA, 100-DMA appears tough nut to crack for bears.

Palladium (XPD/USD) retreats to $2,515 while paring the intraday gains ahead of Wednesday’s Asian session.

The precious metal bounced off an upward sloping support line from mid-December 2021 during the last week. However, the following rebound couldn’t even cross the 21-DMA.

That said, bearish MACD signals also favor sellers even if the quote stays 1.30% up intraday as the 50% Fibonacci retracement (Fibo.) of December-March upside, near $2,487, limits the short-term downside.

In a case where the quote drops below $2,487, the aforementioned support line from late 2021, around $2,455 by the press time, will be crucial to watch for the XPD/USD bears as a break of which will direct the quote towards 61.8% Fibonacci retracement level of $2,261.

Should palladium bears keep reins past $2,261, a confluence of the 100-DMA and the 200-DMA surrounding $2,160-70, will be on their radar.

Alternatively, recovery moves beyond the 21-DMA level of $2,682 needs validation from the $3,000 round figure to recall the XPD/USD buyers eyeing the monthly top near $3,411.

Palladium: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.