Outlook negative for the US stock markets ahead of FOMC rate decision

-

Emini S&P March has a potential bear flag, so a break below 5610 should be a sell signal for today.

The low & high for the last session were 5600 - 5686. -

Emini Nasdaq March collapsed from strong resistance at 19850/950 with shorts working as we hit targets of 19750, 19650.

Last session high & low for the last session were: 19397 - 19858. -

Emini Dow Jones March resistance at 42000/42200.

Last session high & low for the last session were: 41435 - 41920.

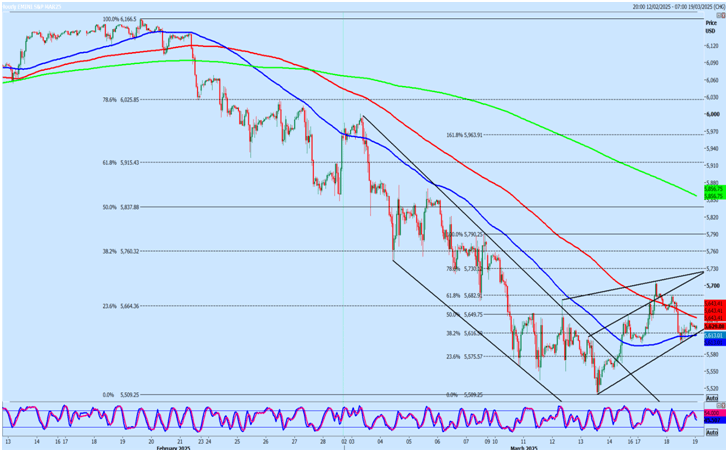

Emini S&P March futures

-

Emini S&P has a potential bear flag, so a break below 5610 should be a sell signal for today.

-

Targets: 5580, 5550, 5530

-

Try longs at support at 5530/20 with stop below 5505 again this week.

-

Targets: 5555, 5570

-

A break below 5505 is a sell signal targeting 5500, 5680, perhaps as far as 5660.

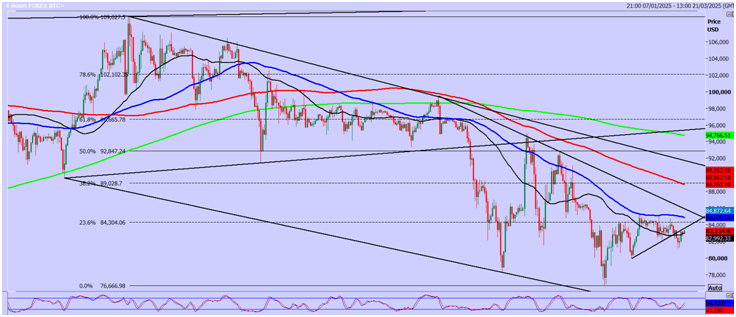

Nasdaq March futures

-

Emini Nasdaq did target strong resistance at 19850/950 with a high for the day but shorts need stops above 20050.

-

Targets: 19750, 19650.

-

The break below 19600 can target 19400.

-

Emini Nasdaq has probably broken to the downside of a rising wedge in the short term bear trend & holding short term resistance at 19600 adds pressure to the downside targeting that support at 19250/19150.

-

Shorts need stops above 19800.

-

A buying opportunity at 19250/150 but longs need stops below 19000.

-

A break below 19000 is a sell signal targeting 18850, 18600

-

A break above 20050 can target a sell opportunity at 20300/20400 & shorts need stops above 20550.

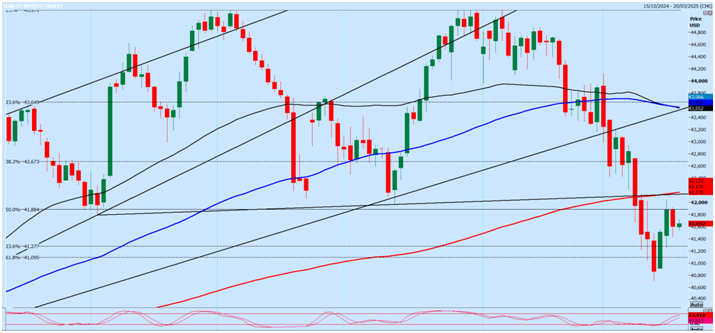

Emini Dow Jones March futures

-

Strong resistance at 42000/200 & shorts need stops above 42350.

-

Targets: 41800, 41600.

-

We could fall as far as 41400/300.

-

A break below 40700 targets 40400, perhaps as far as 40100.

Author

Jason Sen

DayTradeIdeas.co.uk