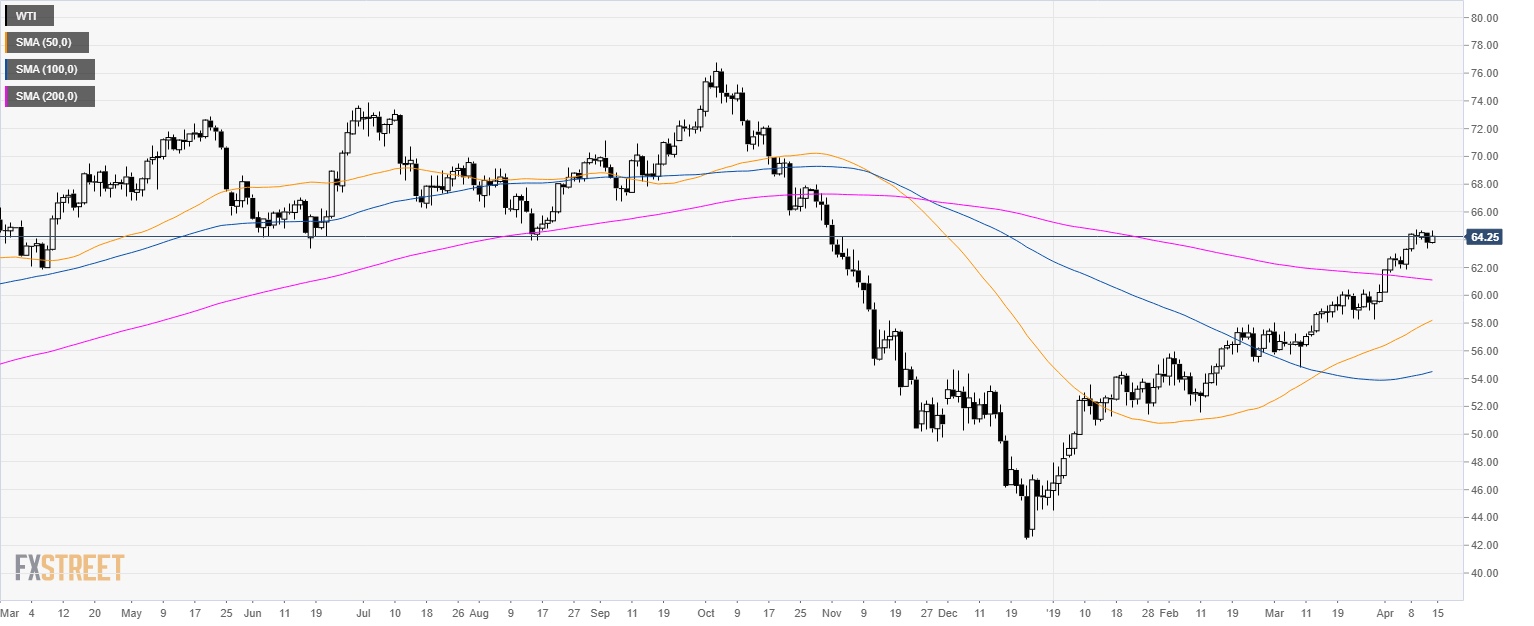

Oil Technical Analysis: WTI is about to end the week near $64.00 a barrel

Oil daily chart

- WTI is evolving above its main simple moving averages (SMAs) suggesting a bullish bias.

- Crude oil WTI is trading above its main SMAs suggesting a bullish bias in the medium-term.

Oil 30-minute chart

- WTI is trading above its main SMAs as the uptrend remains intact.

- The level to beat for bulls remains 64.30 resistance, then 64.70 followed by 65.10.

- To the downside, support is seen at 63.50 and 63.00 level.

Additional key levels

Author

Flavio Tosti

Independent Analyst