Oil Price Forecast: WTI eases as markets eye Israel-Iran conflict, hopes for de-escalation

- West Texas Intermediate (WTI) is heading lower on Monday after a nearly 6% rally on Friday.

- The Israel-Iran conflict places the Strait of Hormuz at risk, raising concerns over potential supply disruptions.

- WTI breaks $70.00 support level as Iran seeks assurances of US non-intervention before proceeding with nuclear talks.

WTI Oil prices are easing on Monday, retracing part of Friday’s nearly 6% surge after slipping from the key $70 level, now holding as resistance.

Traders remain on edge over escalating Israel–Iran tensions, most recently encapsulated by US President Donald Trump’s comments outside the White House on Monday.

According to Reuters, Trump said that he “hopes Israel and Iran can broker a deal,” yet conceded that “sometimes they have to fight it out.” Such mixed signals of potential de-escalation alongside outright conflict keep the crude risk premium elevated.

Meanwhile, the Wall Street Journal (WSJ) reported that Iran has used intermediaries in Arab capitals to convey messages that it seeks to avoid direct US military involvement while negotiating a pause or de-escalation. An Arab official said that “The Iranians know the US is supporting Israel in its defense, and they are sure the U.S. is supporting Israel logistically,” But they want guarantees the US won’t join the attacks.”

In response, Oil has moved below $70.00, which now provides resistance for the near-term move.

However, if there is no deal and the conflict persists, additional risks remain, primarily those associated with the Strait of Hormuz.

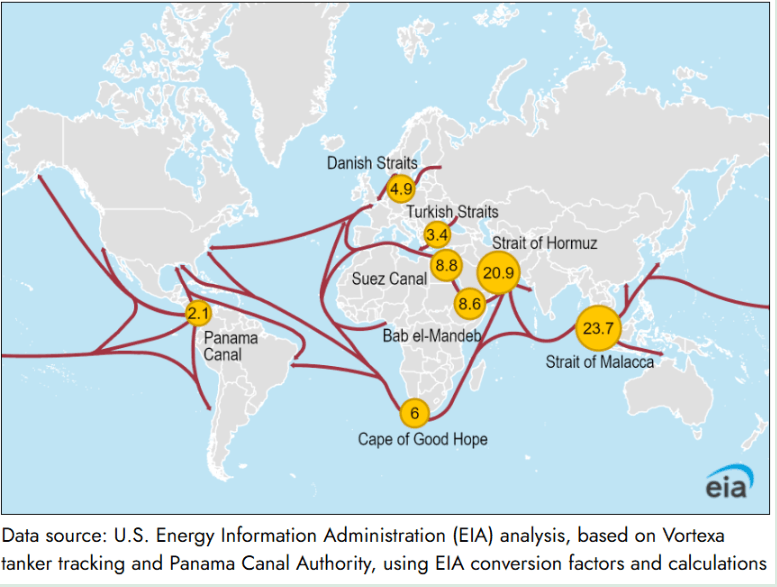

As illustrated in the chart below, this is a critical chokepoint through which about 18–19 million barrels per day, or roughly 20% of global oil consumption, passes.

The Strait of Hormuz is a slim waterway wedged between Iran’s southern coast and Oman’s Musandam peninsula, serving as the lone sea exit for Persian Gulf oilfields into the Arabian Sea.

Because it narrows to barely 20–30 miles across with only two designated tanker lanes, and because there is no fully equivalent shipping alternative, any military flare-up or threat of closure there immediately chokes off a fifth of the world’s oil trade. That instant squeeze on supply drives up tanker rates and insurance premiums and, in turn, pushes benchmarks like WTI sharply higher.

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

As shown in the chart below, published by the US Energy Information Administration, approximately 20.9 million barrels per day, roughly 20% of global petroleum-liquids consumption and over 25% of seaborne-traded crude, was shipped through this corridor in 2023.

Because there is no fully equivalent shipping alternative and only limited bypass capacity via pipelines in Saudi Arabia and the United Arab Emirates (UAE), any military flare-up, blockade, or threat of closure instantly tightens global supply, pushes tanker freight and insurance rates higher, and can spark a rapid surge in WTI prices.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.