Oil holds above $80 on surprise drawdown in EIA stockpile numbers

- WTI Oil at session's low despite EIA bigger drawdown.

- Oil traders are seeing earlier bullish bets play out with several supply issues at hand.

- The US Dollar Index trades firmly higher ahead of the Fed rate decision.

Oil prices at session's low on Wednesday with the US Crude stockpile numbers from the Energy Information Administration (EIA) being published. A surprise drawdown of 1.519 million barrels against a small expected build was not enough to keep WTI from further fading. Pressure now builds on the $80 area with two support levels nearby.

The US Dollar, meanwhile, has performed a similar five-day winning streak after it got an accelerator on Tuesday during Asian trading hours with the Bank of Japan rate decision. Looking ahead to this Wednesday, the US Dollar is facing the US Federal Reserve monetary policy decision. Besides the speech from Fed Chairman Jerome Powell, the economic projections – which include the dot plot – will be the most important piece of information to look at.

Crude Oil (WTI) trades at $80.90 per barrel, and Brent Oil trades at $85.19 per barrel at the time of writing.

Oil news and market movers: EIA drawdown again

- Chinese Customs figures show that China has imported Oil from Venezuela in February for the first time since 2019, Bloomberg reports.

- Russian crude exports have dropped because of maintenance work at the Baltic port of Primorsk and severe weather conditions (strong winds) around Kozmino on the Pacific Coast have hit shipments from the two most important oil ports. This translates into a three-day delay in loading and shipping.

- China secured another lot of 2 million barrels from Abu Dhabi, bought by Cnooc.

- Overnight, the American Petroleum Institute released that the US Crude stockpile is facing more drawdowns. Last week it saw a drawdown of 5.521 million barrels, against 1.519 million for this week.

- The Energy Information Administration has released its US stockpile numbers. Expectations were for a small build of 13,000 barrels against the draw last week of 1.536 million barrels. The actual number came in at a drawdown of 1.519 million barrels.

Oil Technical Analysis: All aboard

Oil prices are setting the stage for more upside with a mixture of supply issues and bigger drawdowns in the US. This is the plan OPEC+ was hoping for to soon play out, with the US unable to keep up the pace of its constant Oil production for filling up the gap of the OPEC+ Oil cuts. With the US production falling back now and even Russia supply facing some delay, a squeeze to the upside is taking place. Last week FXStreet reported several bullish positions being taken in the options markets, which are now playing out.

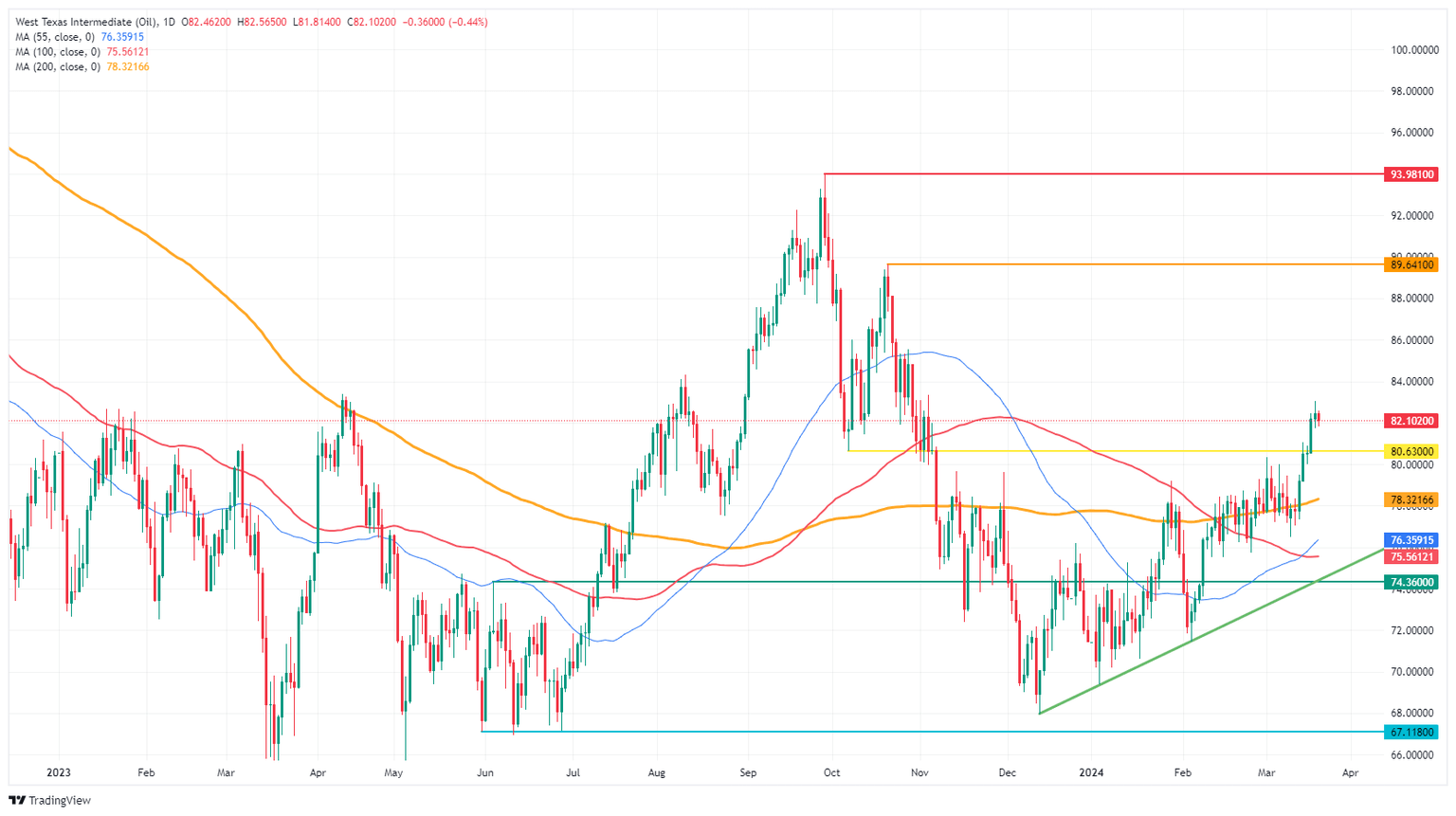

Oil bulls will see $86 appearing as the next cap. Further up, $86.90 follows suit before targeting $89.64 and $93.98 as top levels.

On the downside, both $80.00 and $80.60 should be acting as support now with the 200-day Simple Moving Average (SMA) as the level to catch any falling knives near $78.33. The 100-day and the 55-day SMA’s are near $75.56 and $76.35, respectively. Add the pivotal level near $75.27, and it looks like the downside is very limited and well-equipped to resist the selling pressure.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.