Oil surges just shy of 1% with Red Sea focus back in play

- Oil price trades in the green, trying to snap a three-day losing streak.

- The UK Marine reported that a vessel has been hit in the Red Sea by Houthi rebels.

- The US Dollar Index hits rock bottom before bouncing a touch.

Oil trades positive on Wednesday, following three sessions of sharp selloffs, after several news outlets reported that a tanker got hit in the Red Sea by Houthi rebels. Delta Tankers has confirmed that one of its vessels, Sounion, has been attacked and is suffering minor damage. This element is very unwelcome at the moment Hamas is considering the ceasefire proposal in Gaza that both Israel and the US have put on the table.

The US Dollar Index (DXY), which tracks the performance of the US Dollar against six major currencies, is in a similar pattern as Crude Oil as it tries to snap this week’s losing streak. However, the DXY had to hit rock bottom in order to do so, giving up all gains for 2024 and literally falling flat on the year before a small bounce could occur. The main event this Wednesday is the Federal Open Market Committee (FOMC) Minutes release ahead of Jackson Hole on Friday, together with the Nonfarm Payrolls Benchmark Revision that will possibly change nonfarm data over one year up until March of this year.

At the time of writing, Crude Oil (WTI) trades at $73.51 and Brent Crude at $77.12

Oil news and market movers: Red Sea in focus again

- OPEC+ doesn’t seem to have not much room, if any, to boost production as that would put further pressure on Oil prices given the increased supply from the US and Brazil, according to BP Chief Economist Spencer Dale, Bloomberg reports.

- Uganda Minister of Energy Ruth Nankabirwa communicated that the country is moving forward with TotalEnergies and Cnooc to bring a $20 billion Crude development project to the country.

- Delta Tankers has reported that its tanker, Sounion, has been attacked at least three times. It is still assessing whether the ship is adrift or not and continues its course, Reuters reports.

- The overnight Crude stockpile change from the American Petroleum Institute (API) posted a small build of just 347,000 barrels. Still, this was way above the 2.8 million drawdown expected by analysts.

- This Wednesday, the weekly Crude stockpile numbers from the Energy Information Administration (EIA) will be released. The previous number was a build of 1.357 million, with a drawdown of 2.8 million barrels expected.

Economic Indicator

EIA Crude Oil Stocks Change

The EIA Crude Oil stockpiles report is a weekly measure of the change in the number of barrels in stock of crude oil and its derivates, and it's released by the Energy Information Administration. This report tends to generate large price volatility, as oil prices impact on worldwide economies, affecting the most, commodity related currencies such as the Canadian dollar. Despite it has a limited impact among currencies, this report tends to affect the price of oil itself, and, therefore, had a more notorious impact on WTI crude futures.

Read more.Next release: Wed Aug 21, 2024 14:30

Frequency: Weekly

Consensus: -2.8M

Previous: 1.357M

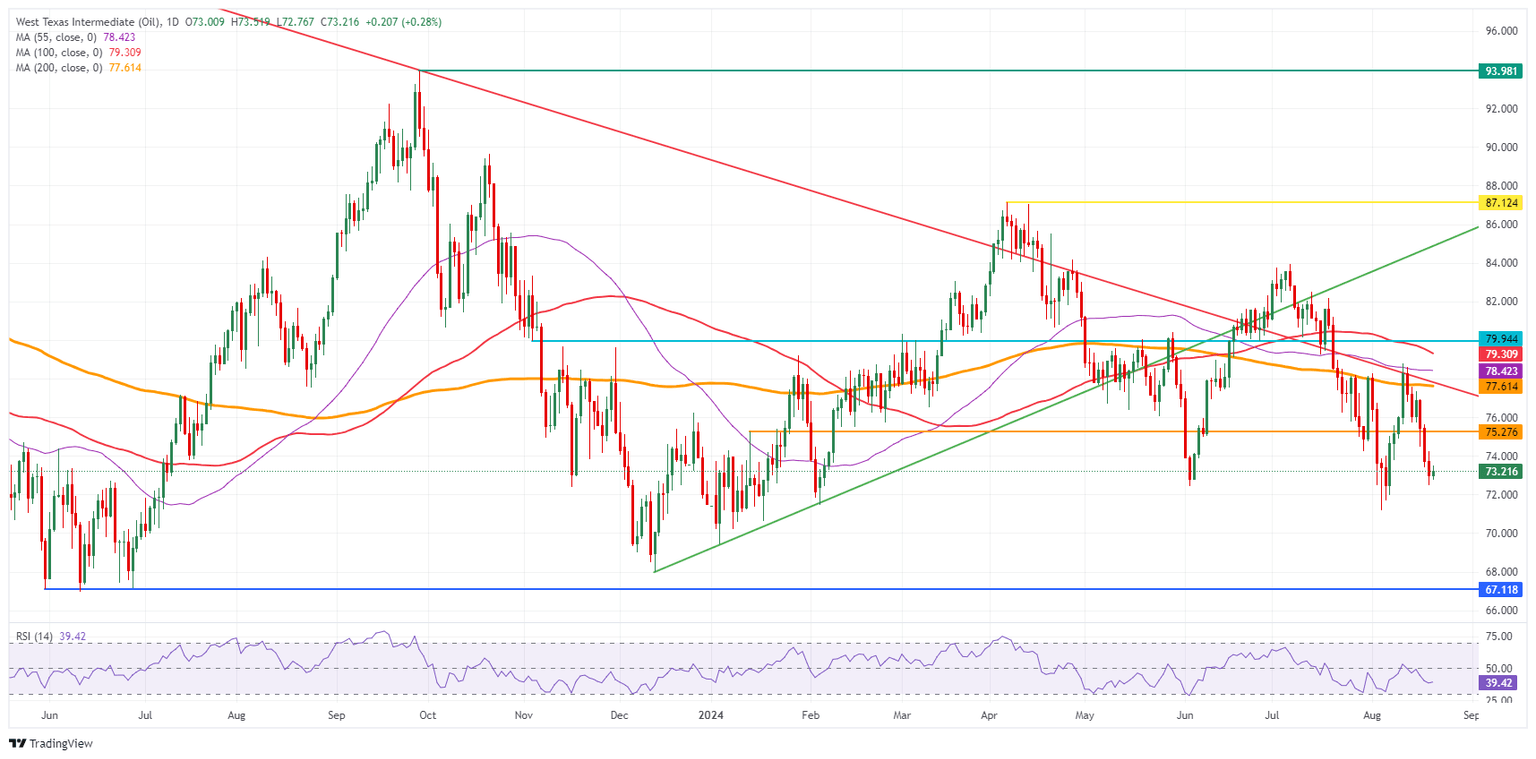

Oil Technical Analysis: Good start

Oil tries to snap its losing streak and boot-start a recovery, although this looks rather bleak.. Still, the recent surge in attacks in the Red Sea could mean headaches ahead for the ceasefire deal that is on the table for Hamas to consider at the moment, and could quickly see a surge in violence again if the situation escalates further.

On the upside, it becomes very difficult to be bullish with a lot of resistance levels nearby. The first element to look out for is the pivotal $75.27. Next up is the double level at $77.65, which aligns with both a descending trendline and the 200-day Simple Moving Average (SMA). In case bulls are able to break above it, the 100-day SMA at $78.45 could trigger another rejection as it did last week.

On the downside, the low from August 5 at $71.17 is the best level for a bounce. It might not be bad to start considering levels below $70.00, particularly if ceasefire talks bear fruit and hedge funds start selling their speculative stake in Oil contracts. The $68.00 big figure level is the first level to watch followed by $67.11, which is the lowest point from the triple bottom seen back in June 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.