NZD/USD Price Forecast: Rebounds from sub-0.5500 levels/multi-year low; not out of the woods yet

- NZD/USD reverses an intraday slide to a multi-year low after the RBNZ’s rate decision.

- Bets for multiple Fed rate cuts undermine the USD and offer some support to the pair.

- The setup favors bears and warrants some caution before positioning for further gains.

The NZD/USD pair stages a modest recovery from levels below the 0.5500 psychological mark, or the lowest since March 2020 touched earlier this Thursday after the Reserve Bank of New Zealand (RBNZ) announced its policy decision. The intraday move up, however, lacks follow-through, with spot prices currently trading around the 0.5535-0.5540 region or nearly unchanged for the day.

The escalating US-China trade war, along with worries about the potential global economic fallout from US President Donald Trump's sweeping tariffs, continues to weigh on investors; sentiment. This, in turn, keeps a lid on the perceived riskier New Zealand Dollar (NZD). The US Dollar (USD), on the other hand, attracts sellers for the second straight day amid bets for multiple interest rate cuts by the Federal Reserve (Fed) and offers some support to the NZD/USD pair.

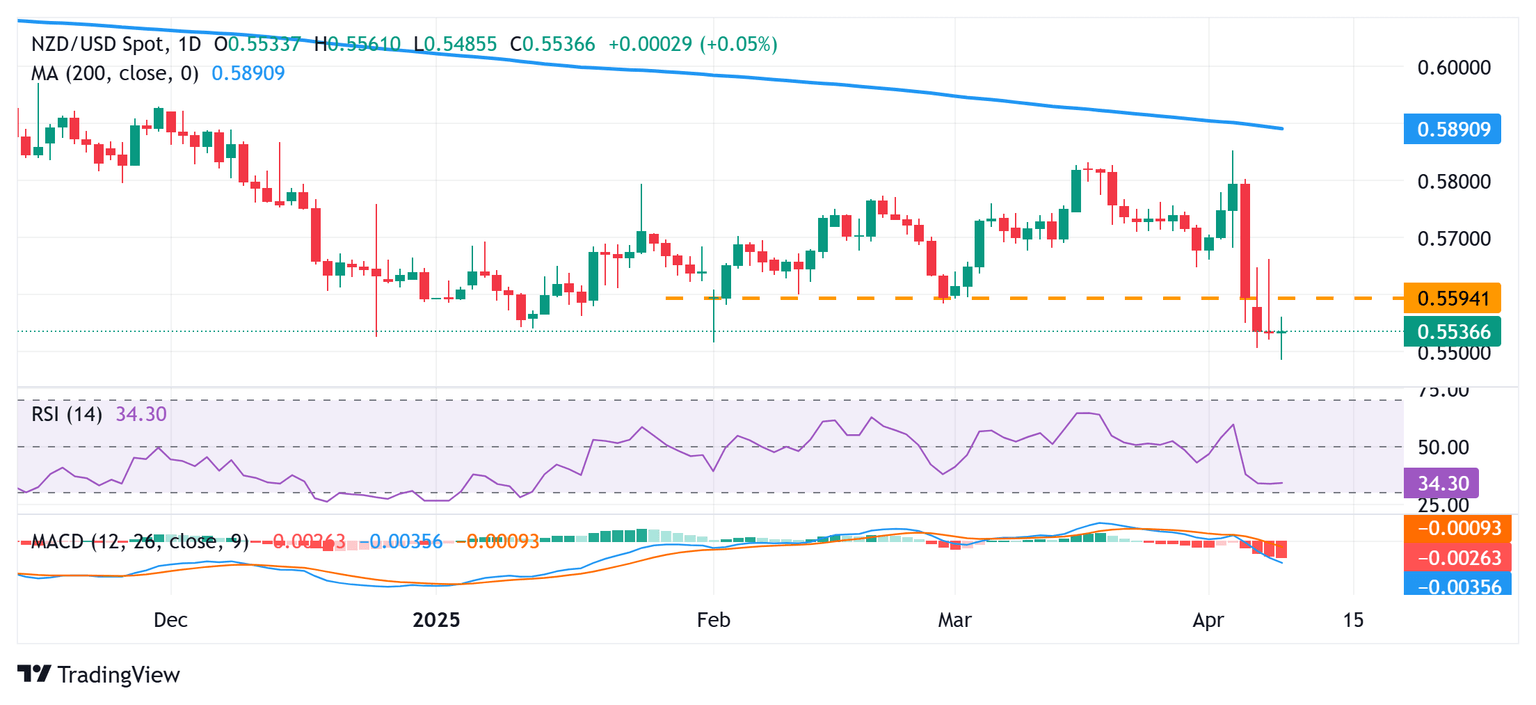

From a technical perspective, the recent breakdown below the 0.5575-0.5580 horizontal support was seen as a key trigger for bearish traders. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone. This, in turn, suggests that the path of least resistance for the NZD/USD pair is to the downside and that any subsequent move up might still be seen as a selling opportunity near the said support breakpoint.

However, some follow-through buying, leading to a subsequent move beyond the 0.5600 mark, might prompt a short-covering rally. The momentum might then lift spot prices beyond the 0.5640-0.5645 intermediate hurdle and allow bulls to reclaim the 0.5700 mark. The subsequent move up would shift the bias in favor of bullish traders and pave the way for a further near-term appreciating move.

On the flip side, the 0.5500 mark, followed by the 0.5485 region, or the multi-year low, now seems to protect the immediate downside. A sustained break below would set the stage for an extension of the recent sharp downfall from the 200-day Simple Moving Average (SMA) barrier, around the 0.5850-0.5855 region, or the year-to-date touched earlier this month. The NZD/USD pair might then accelerate the fall further towards the 0.5400 round-figure mark.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.