NZD/USD Price Forecast: 200-EMA acts as key support

- NZD/USD gains to near 0.5955 as the US Dollar takes a breather after gains for over two weeks.

- Fed Waller reiterates the need to reduce interest rates in the policy meeting later this month.

- Investors await NZ’s Q2 CPI data, which will be released on Monday.

The NZD/USD pair rises 0.4% to near 0.5955 during the Asian trading session on Friday. The Kiwi pair gains as the US Dollar (USD) struggles to extend its over two-week rally amid uncertainty surrounding trade talks between the United States (US) and the European Union (EU).

US President Donald Trump expressed confidence on Wednesday that there is a possibility of a trade deal with the EU. Meanwhile, EU trade chief Maros Sefcovic has headed to Washington for a fresh round of trade talks. Last weekend, Trump imposed 30% tariffs on imports from the trading bloc.

On the domestic front, Federal Reserve (Fed) Governor Christopher Waller has reiterated views that the central bank should cut interest rates in the July policy meeting. “The Fed should cut interest rates by 25 basis points (bps) at July meeting as rising risks to economy and employment favour easing policy rate,” Waller said on Thursday in a gathering at New York University.

Contrary to Waller’s remarks, the CME FedWatch tool shows that the Fed is certain to leave interest rates steady in the range of 4.25%-4.50% in the policy meeting later this month.

In New Zealand (NZ), investors await the Q2 Consumer Price Index (CPI) data, which will be published on Monday. The CPI report is expected to show that inflationary pressures grew at a moderate pace of 0.6%, compared to a 0.9% increase seen in the first quarter.

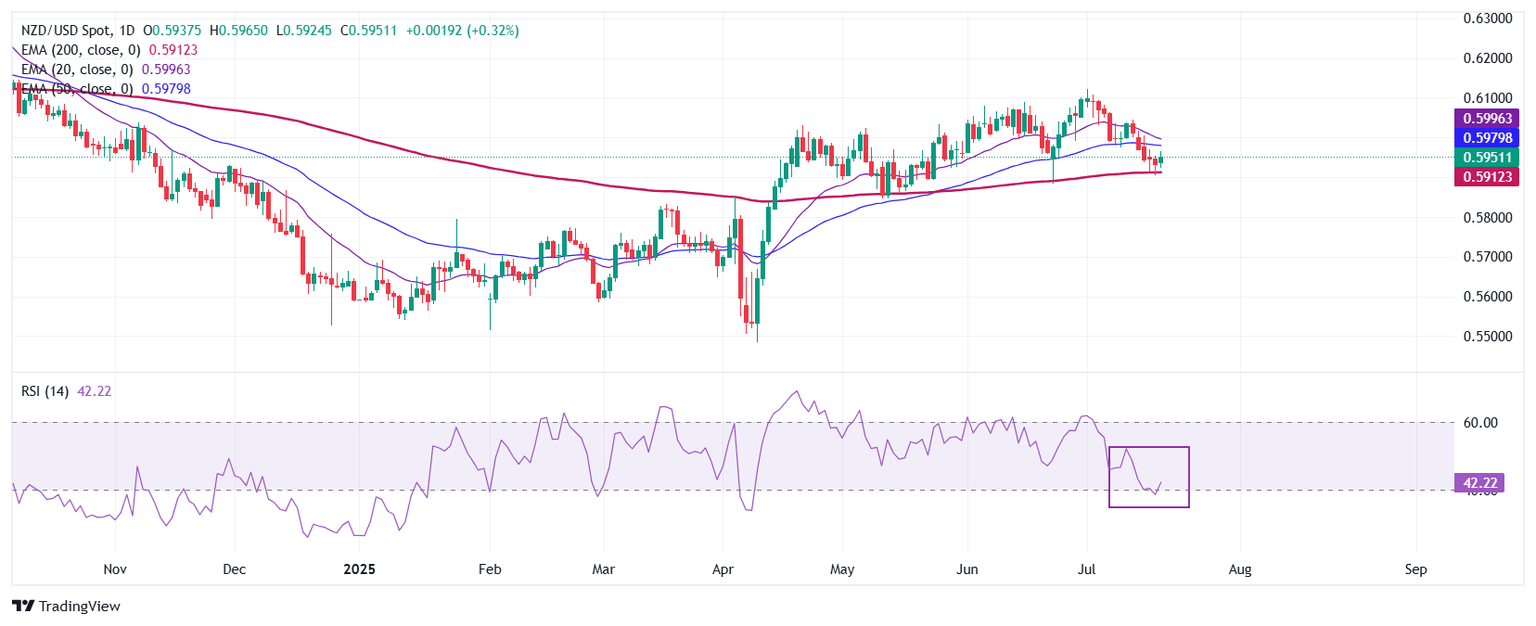

NZD/USD attracts bids near the 200-day Exponential Moving Average (EMA), which is around 0.5910. However, the overall trend remains bearish as the 20- and 50-day EMAs slope downwards.

The 14-day Relative Strength Index (RSI) slides to near 40.00. A fresh bearish momentum would trigger if the RSI falls below that level.

Going forward, a downside move by the pair below the June 23 low of 0.5883 will expose it to the May 12 low of 0.5846, followed by the round-level support of 0.5800.

In an alternate scenario, the Kiwi pair would rise towards the June 19 high of 0.6040 and the September 11 low of 0.6100 if it manages to return above the psychological level of 0.6000.

NZD/USD daily chart

Economic Indicator

Consumer Price Index (QoQ)

The Consumer Price Index (CPI), released by Statistics New Zealand on a quarterly basis, measures changes in the price of goods and services bought by New Zealand households. The CPI is a key indicator to measure inflation and changes in purchasing trends. The QoQ reading compares prices in the reference quarter to the previous quarter. A high reading is seen as bullish for the New Zealand Dollar (NZD), while a low reading is seen as bearish.

Read more.Next release: Sun Jul 20, 2025 22:45

Frequency: Quarterly

Consensus: 0.6%

Previous: 0.9%

Source: Stats NZ

With the Reserve Bank of New Zealand's (RBNZ) inflation target being around the midpoint of 2%, Statistics New Zealand’s quarterly Consumer Price Index (CPI) publication is of high significance. The trend in consumer prices tends to influence RBNZ’s interest rates decision, which in turn, heavily impacts the NZD valuation. Acceleration in inflation could lead to faster tightening of the rates by the RBNZ and vice-versa. Actual figures beating forecasts render NZD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.