NZD/USD Price Analysis: Steps back from six-week-old horizontal resistance

- NZD/USD snaps three-day uptrend, refreshes intraday low of late.

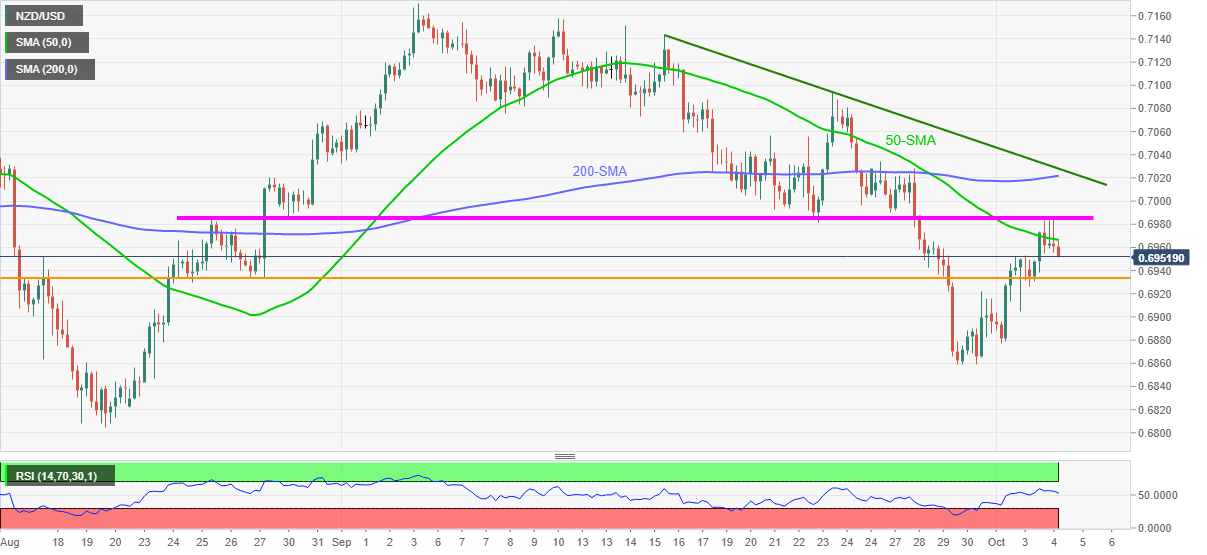

- 50-SMA, multiday-old horizontal resistance challenge short-term bulls.

- 200-SMA, falling trend line from mid-September adds to the upside filters.

NZD/USD pulls back from a one-week high to snap the latest recovery moves, offered around 0.6955 during early Tuesday.

The kiwi pair’s previous three-day advances failed to cross 50-SMA and a horizontal area comprising multiple levels marked since late August.

Even so, firmer RSI and sustained trading beyond the 0.6930 resistance-turned-support keeps the NZD/USD buyers hopeful.

In addition to the 0.6930 support from August, the 0.6900 threshold and September’s low near 0.6860 also challenges the pair sellers.

On the contrary, an upside break of the stated horizontal area surrounding 0.6985 will aim for the 200-SMA level of 0.7021.

However, any further advances past 200-SMA will be questioned by a downward sloping trend line from September 15, near 0.7030.

NZD/USD: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.