NZD/USD Price Analysis: Sellers break 200-HMA on the way to weekly support

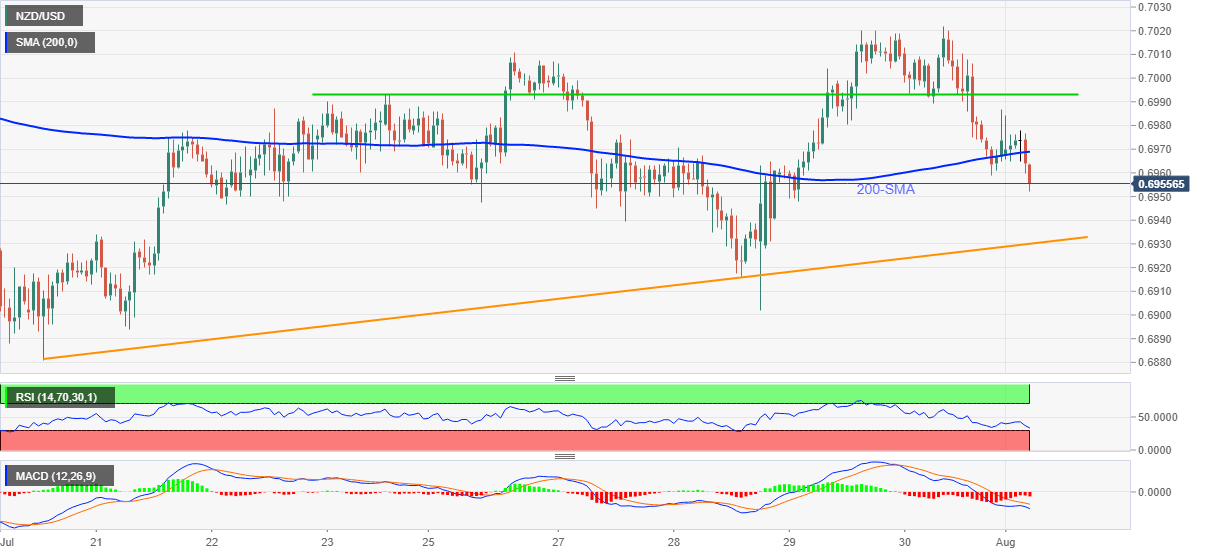

- NZD/USD remains pressured amid downbeat MACD signals, descending RSI line.

- A clear break of 200-HMA also favor bears, bulls need to cross immediate horizontal line.

- Downbeat China, Aussie data, US dollar gains add strength to the bearish bias.

NZD/USD takes offers near 0.6553, down 0.28% intraday to refresh the day’s low, amid early Monday. The kiwi pair’s latest weakness could be traced to the weaker-than-expected data from Australia and China.

Read: AUD/USD drops towards 0.7300 on downbeat China Caixin Maunfacturing PMI

The quote’s drop below 200-HMA amid bearish MACD signals and downward sloping RSI line, not oversold, also justify the downbeat fundamentals, suggesting further weakness towards a short-term support line near 0.6930.

However, any further downside past a one-week-old ascending support line may not hesitate to challenge the yearly low near 0.6880.

On the flip side, corrective pullback below the 200-HMA level of 0.6970 will aim for an immediate horizontal hurdle surrounding 0.6990 and then to the 0.7000 threshold.

Though, a clear run-up past 0.7000 may recall short-term NZD/USD bulls targeting July’s top near 0.7105.

Overall, NZD/USD remains on the bears’ radar, indicating a fresh yearly low.

NZD/USD hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.