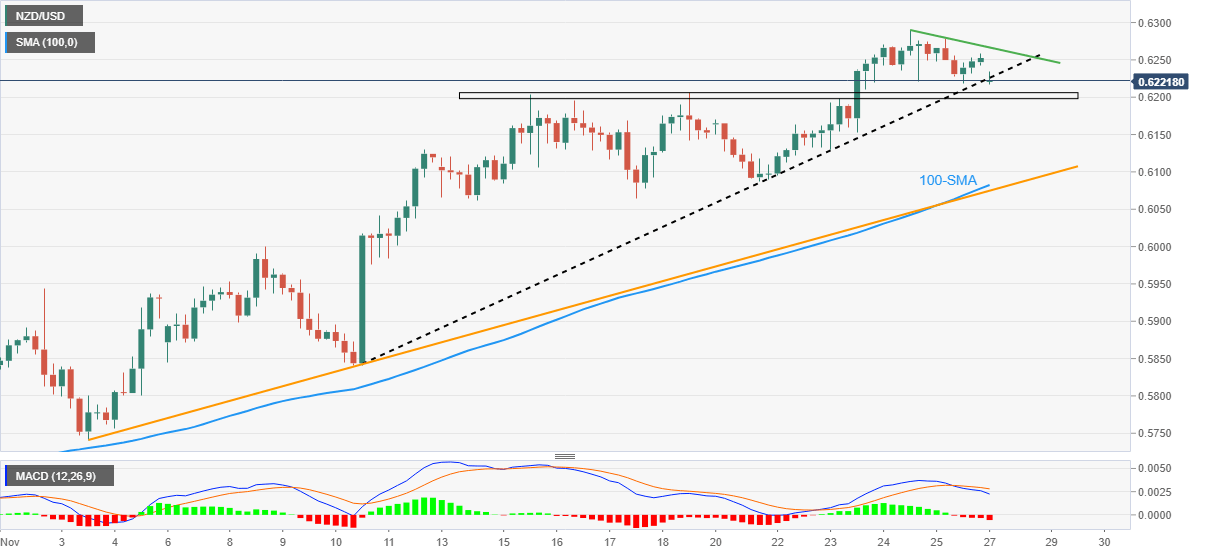

NZD/USD Price Analysis: Sellers attack fortnight-old support above 0.6200

- NZD/USD extends Friday’s pullback from three-month high, begins the week with a downside gap.

- Bearish MACD signals favor downside towards two-week-long horizontal support but further downside appears limited.

- 100-SMA, ascending trend line from early November offer strong challenge to sellers.

- Bulls need validation from 0.6270 to retake control.

NZD/USD holds lower ground near 0.6220, after beginning the week’s trading with a downside gap, as bears jostle with a short-term key support line during early Monday in Asia. In doing so, the Kiwi pair extend Friday’s pullback from the highest levels since early August.

That said, bearish MACD signals and failure to refresh the monthly-day high keep the NZD/USD sellers hopeful of breaking the 0.6220 immediate support.

However, multiple levels marked since November 15 could challenge the Kiwi pair’s further downside near 0.6200.

In a case where the quote breaks the 0.6200 key support, the odds of witnessing a slump toward the 100-SMA level surrounding 0.6080 can’t be ruled out. Even so, an upward-sloping support line from November 04, close to 0.6075 by the press time, could probe the NZD/USD bears afterward.

Meanwhile, recovery remains elusive unless the quote crosses a downward-sloping resistance line from November 24, near 0.6270 at the latest.

Following that, the monthly high of 0.6290 and the 0.6300 threshold may act as the upside filters before directing the bulls towards the early August highs near 0.6355 and the August month’s peak surrounding 0.6470.

NZD/USD: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.