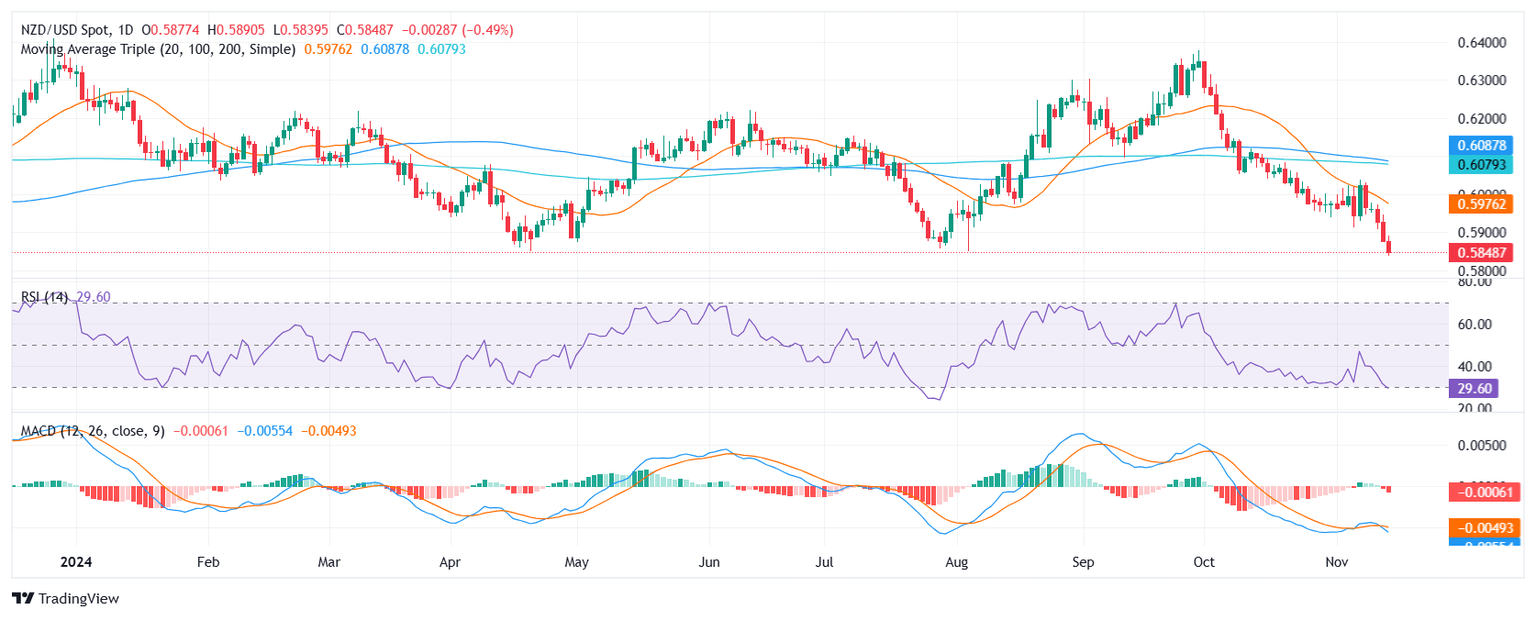

NZD/USD Price Analysis: Pair logs three consecutive losses, RSI oversold

- NZD/USD declines 0.65% during Thursday's session.

- The pair resumed downturn and printed fresh multi-month lows as bears extended the control.

- The NZD/USD RSI slipped into oversold territory after falling below 30, indicating rising selling pressure.

The NZD/USD pair declined by 0.65% during Thursday's session and fell below the 0.5900 mark, extending declines for the sixth day and hitting lows since November 2023. The bearish momentum escalated and oversold signals emerged.

The NZD/USD pair's bearish sentiment is reinforced by technical indicators. The Relative Strength Index (RSI) has slipped below 30, indicating oversold territory and rising selling pressure. The declining slope of the RSI suggests that this pressure is intensifying. Furthermore, the Moving Average Convergence Divergence (MACD) remains bearish, with the histogram declining and red. These indicators align with the price action, confirming the pair's downward trajectory.

Support levels are at 0.5830, 0.5810, and 0.5800, while resistance levels are at 0.5900, 0.5950, and 0.5970. Traders should monitors these levels in case the oversold nature of the movements push the pair into a consolidation mode.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.