NZD/USD Price Analysis: Pair inches up to 0.5780, selling pressure easing slightly

- NZD/USD gains on Monday, settling around 0.5780 after recent declines.

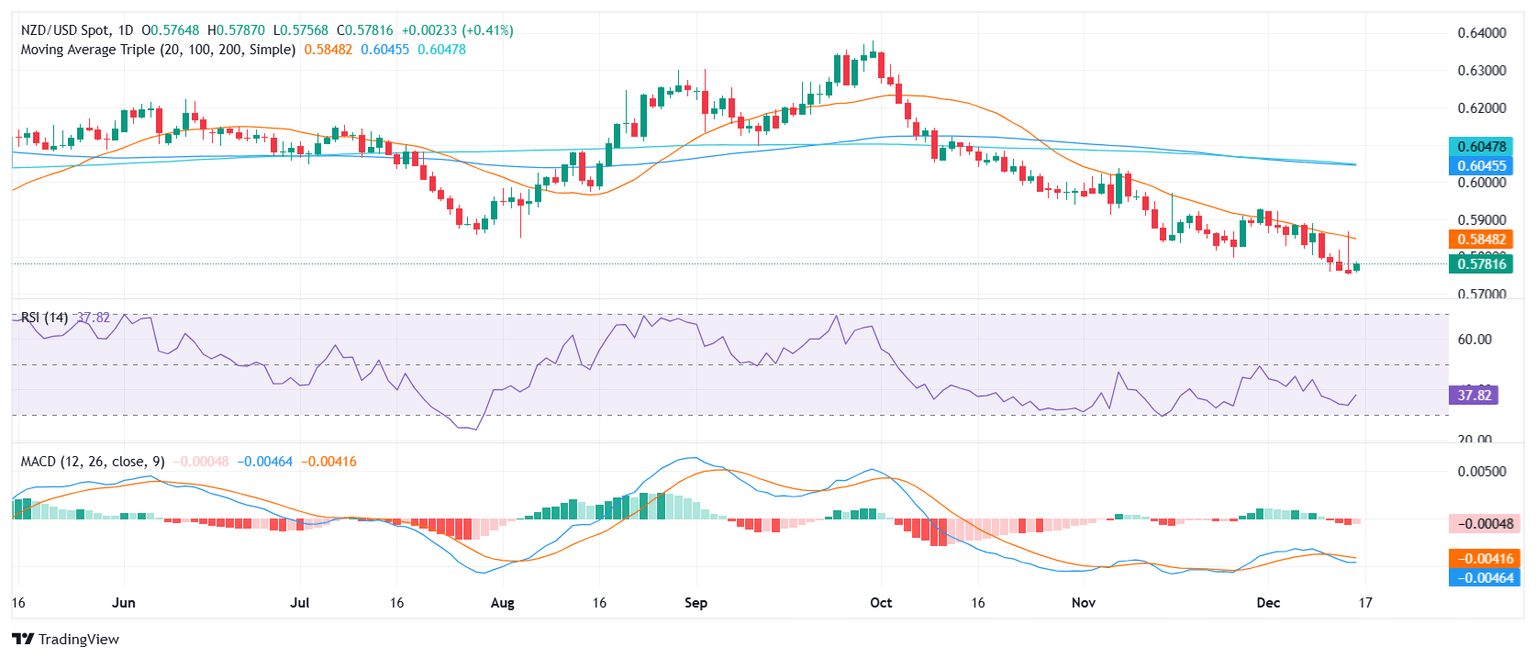

- Pair remains below the 20-day SMA, limiting upside potential and keeping the bearish bias intact.

- RSI rises sharply to 39, while MACD histogram shows decreasing red bars, suggesting easing selling pressure.

The NZD/USD pair managed a modest recovery on Monday, gaining 0.29% to trade near 0.5780. Although this uptick indicates a slight reduction in selling pressure, the pair continues to trade below the 20-day Simple Moving Average (SMA), currently near 0.5850, which remains a key hurdle to overcome.

Technical indicators reflect a tentative improvement but maintain a bearish slant. The Relative Strength Index (RSI) has climbed to 39, up from near-oversold territory, suggesting fading downside momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram prints decreasing red bars, signaling that bearish traction may be waning. Still, the pair’s inability to rise above its 20-day SMA keeps the overall outlook negative.

Looking ahead, a decisive break above the 20-day SMA would be required to shift sentiment and encourage buyers to engage more confidently. On the downside, immediate support emerges around the 0.5750 region, followed by the 0.5700 mark if sellers regain control.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.