NZD/USD Price Analysis: mild bounce overshadowed by multi-year lows

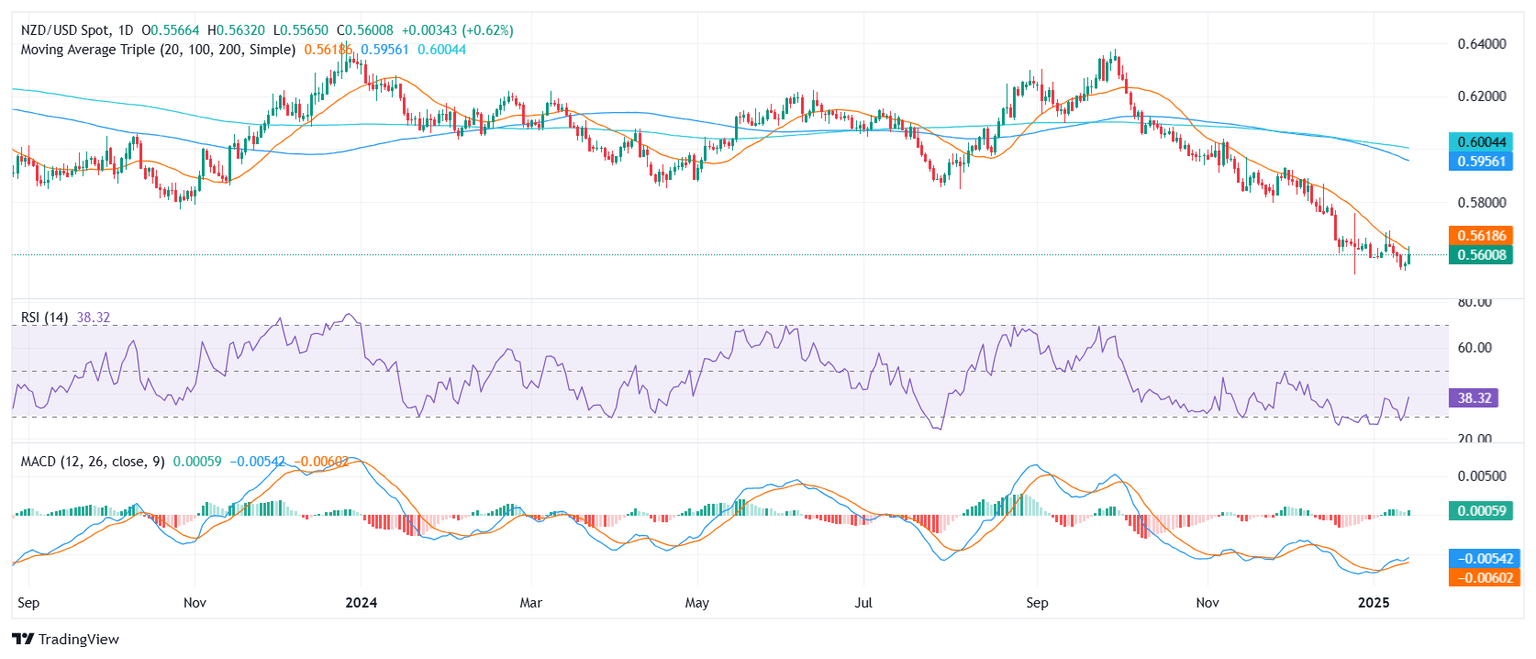

- NZD/USD edges up 0.11% on Tuesday, hovering near 0.5600 after a brief recovery attempt.

- MACD histogram shows decreasing green bars, pointing to limited follow-through despite the rebound.

The NZD/USD pair gained modestly on Tuesday, inching up to approximately 0.5600 following a prolonged slump to levels unseen since October 2022. Although this slight uptick provides temporary relief from the recent selling streak, the overarching bias remains tilted to the downside.

From a technical perspective, the Relative Strength Index (RSI) has climbed to 43, an indication of some stabilizing momentum while still embedded in negative territory. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram is printing fewer green bars, suggesting that any ongoing recovery could be fragile without additional bullish impetus.

On the downside, should the pair fail to hold above 0.5570, sellers may seize control once more, potentially targeting the 0.5530 mark. Conversely, a rally beyond the 0.5620 region could set the stage for a test of 0.5650, though any extended move higher would likely hinge on a more decisive shift in market sentiment.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.