NZD/USD Price Analysis: Kiwi pulls back ahead of RBNZ decision

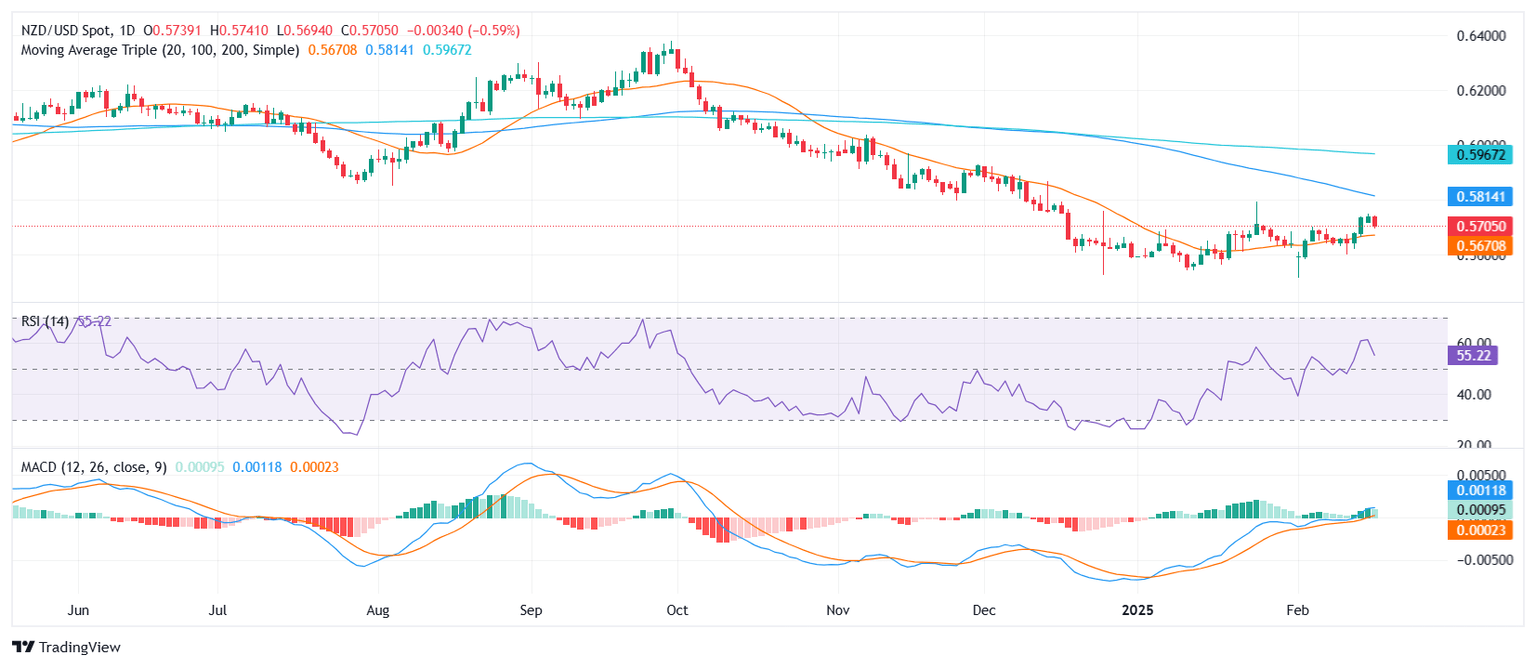

- NZD/USD declines to 0.5700 on Tuesday after hitting its highest level since late January last week.

- Bulls remain in control as long as the pair holds above the 20-day SMA, with the RBNZ decision set to drive the next move.

The New Zealand dollar faced selling pressure on Tuesday, dropping 0.58% agains the US Dollar to 0.5700 after last week’s rally saw the pair climb to its highest levels since late January above 0.5730. Despite the pullback, the broader outlook remains positive, with the 100-day Simple Moving Average (SMA) at 0.5825 still in focus.

Looking ahead, market participants are gearing up for the Reserve Bank of New Zealand’s (RBNZ) policy decision during the Asian session. The central bank’s guidance will likely dictate the pair’s next major move, with a hawkish tone potentially reigniting the upside momentum, while a dovish stance could extend the ongoing pullback.

In the meantime,technical indicators point to a natural correction rather than a shift in trend. The Relative Strength Index (RSI) declined sharply to 56 but remains in positive territory, suggesting that buyers are still in control. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram prints rising green bars, indicating that bullish momentum has not been completely exhausted. A break below the 20-day SMA, however, could tilt the balance in favor of the bears.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.