NZD/USD Price Analysis: Kiwi edges higher but bears keep control below key moving averages

- NZD/USD trades near the 0.5530 zone ahead of Asia after modest intraday gains on Tuesday.

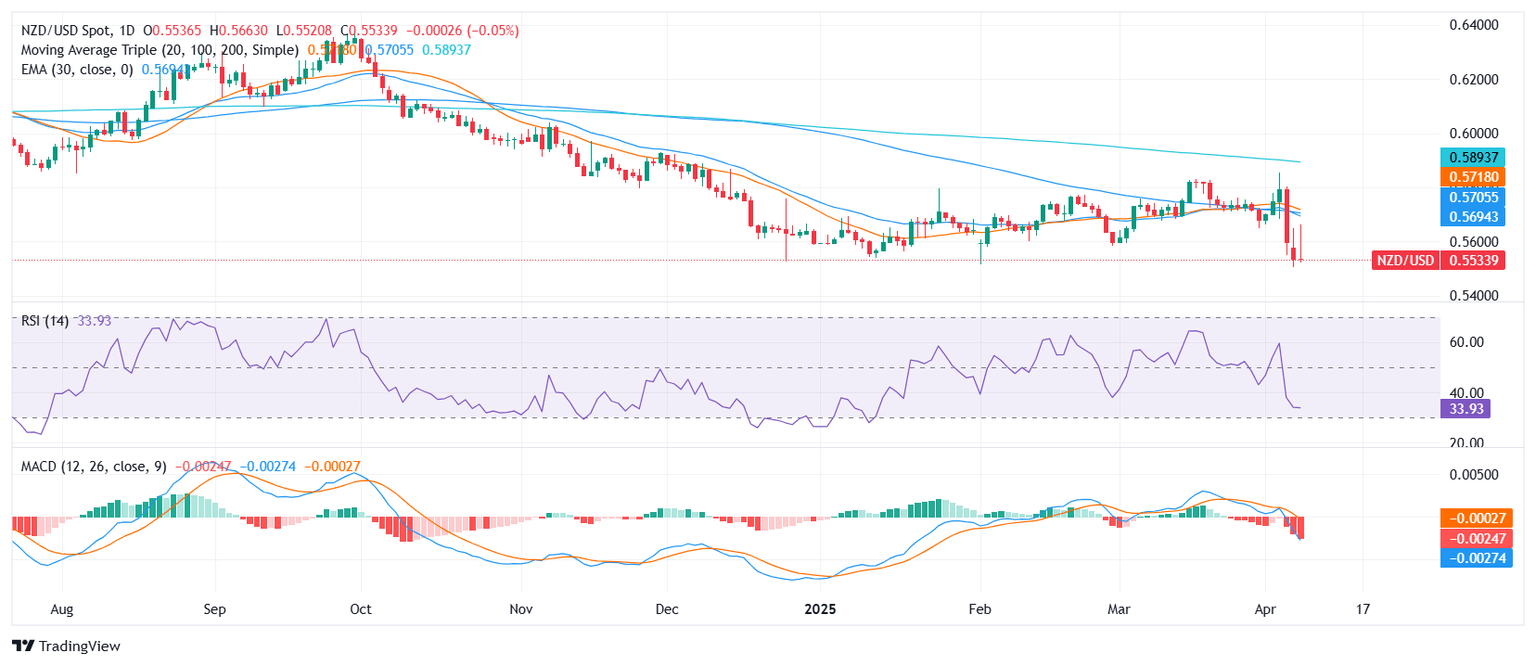

- Despite the uptick, broader signals remain bearish with price capped by multiple moving averages.

- Key resistance stands around the 0.5567–0.5674 band, with downside pressure building below the 0.5657 zone.

The NZD/USD pair registered neutral movements during Tuesday’s session, with the pair seen moving around the 0.5530 region but cleared gains which took it to highs above 0.5600.

Daily chart

Technically, the Relative Strength Index (RSI) at 35.28, with subdued momentum but deep in negative terrain. The Moving Average Convergence Divergence (MACD) continues to flash a sell signal, reinforcing the broader downside outlook. Meanwhile, the Bull Bear Power indicator sits neutral at −0.01859, and 10-period Momentum at −0.01851 leans slightly bullish.

The bigger picture remains under pressure. The 10-day Exponential Moving Average (EMA) at 0.56571 and 10-day Simple Moving Average (SMA) at 0.56787 continue sloping downward. Additionally, the 20-day SMA (0.57184), 100-day SMA (0.57116), and 200-day SMA (0.58985) all support the bearish case, forming a zone of confluence that reinforces the pair’s inability to sustain rebounds.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.