NZD/USD Price Analysis: Kiwi climbs above 20-day SMA, signaling renewed momentum

- NZD/USD advances to 0.5650 on Tuesday, extending recent gains.

- The pair breaks above the 20-day SMA, reinforcing bullish sentiment.

- An overall bullish trend wouldbe confirmed if it breaks above 0.5800.

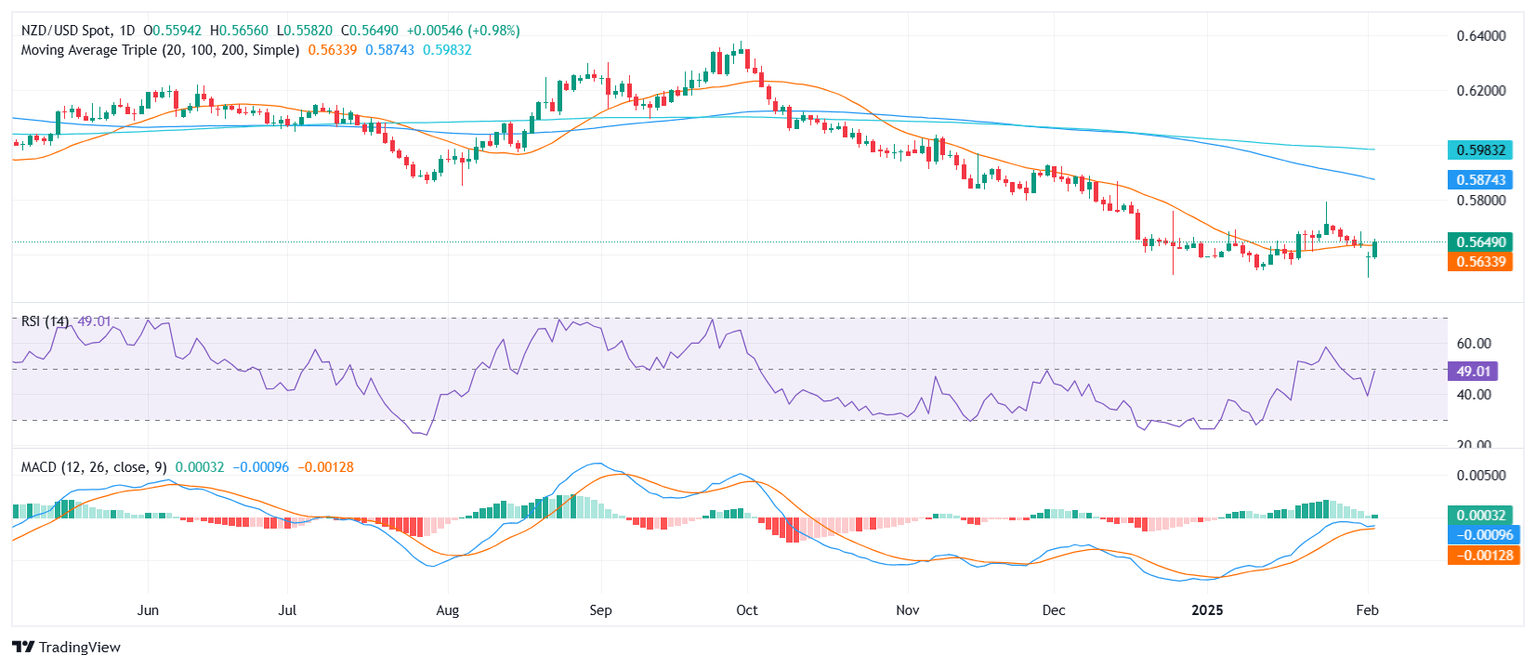

The NZD/USD pair continued its upward trajectory on Tuesday, rising 0.39% to 0.5650 and breaking above its 20-day Simple Moving Average (SMA). This move suggests a potential shift in sentiment, with buyers gaining control after a prolonged period of range-bound movement. The breakout above this technical level could pave the way for further gains in the near term so the pair should focus in building support around this area to secure it.

From a technical perspective, indicators point to growing bullish momentum. The Relative Strength Index (RSI) has climbed to 50, confirming increasing buying pressure, while the Moving Average Convergence Divergence (MACD) histogram prints rising green bars, reinforcing the improving outlook.

Looking ahead, if NZD/USD manages to hold above the 20-day SMA, the next resistance levels to watch are at 0.5680 and 0.5725. On the downside, immediate support lies at 0.5620, with a break below this level potentially leading to a retest of 0.5585. Maintaining a position above the 20-day SMA will be crucial for sustaining the current bullish bias.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.