NZD/USD Price Analysis: Expects more gains above 0.6250 as risk-on impulse strengthens

- NZD/USD has displayed a sheer recovery to near 0.6250 as the risk-on mood solidifies.

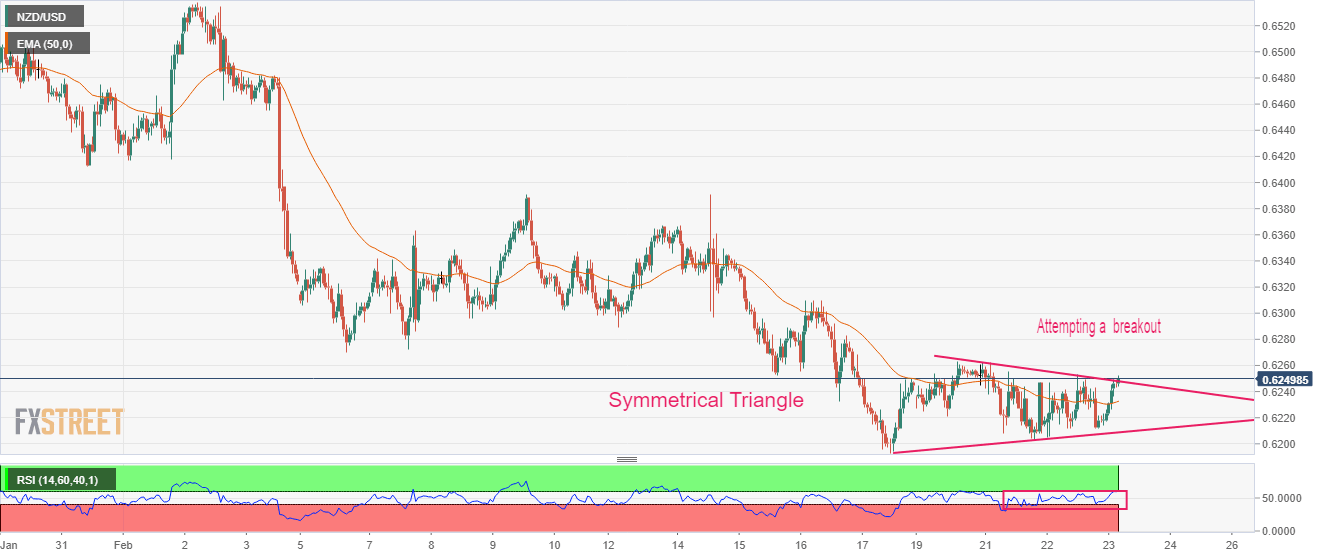

- The Kiwi asset is attempting to deliver a breakout of the Symmetrical Triangle.

- The RSI (14) is on the verge of delivering a break into the bullish range of 60.00-80.00.

The NZD/USD pair has recovered dramatically after sensing a buying interest around 0.6210 in the Asian session. The Kiwi asset has extended its recovery to near 0.6250 after a responsive buying action and is looking to drive its range extension further as the risk-on impulse has solidified.

Investors have digested the fact that galloping inflation in the United States needs immediate treatment, therefore, the Federal Reserve (Fed) cannot pause the policy tightening spell as it could dampen the efforts yet made to bring it down. The US Dollar Index (DXY) is resisting in continuing the downside further after correcting to near 104.00. However, the positive market sentiment could continue sending pressure on the safe-haven assets.

NZD/USD is attempting to deliver a breakout of the Symmetrical Triangle chart pattern that indicates a sheer volatility contraction on an hourly scale. The downward-sloping trendline of the above-mentioned chart pattern is placed from February 20 high at 0.6262 while the upward-sloping trendline is placed from February 17 low at 0.6204.

The Kiwi asset has successfully shifted its auction above the 50-period Exponential Moving Average (EMA) at 0.6233, which indicates more upside ahead.

Meanwhile, the Relative Strength Index (RSI) (14) is on the verge of delivering a break into the bullish range of 60.00-80.00, which will trigger the upside momentum.

For further upside, the Kiwi asset needs to surpass January 8 low at 0.6272, which will drive the asset towards January 9 low at 0.6320, followed by February 7 high at 0.6363.

Alternatively, a breakdown of January 6 low at 0.6193 will drag the asset toward November 28 low at 0.6155. A slippage below the latter will expose the asset for more downside toward the round-level support at 0.6100.

NZD/USD two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.