NZD/USD Price Analysis: Bulls seek out 0.6300 while bears eye signs of distribution

- NZD/USD bears could be about to make their moves.

- Bulls eye a run to test 0.6300 while above 0.6250.

As per the prior analysis, NZD/USD Price Analysis: The Bird is in full flight, whereby the bulls were creeping higher in Asian trade despite the ground it had already made since the central bank events in the week, fresh highs were made as follows:

NZD/USD prior analysis

NZD/USD update

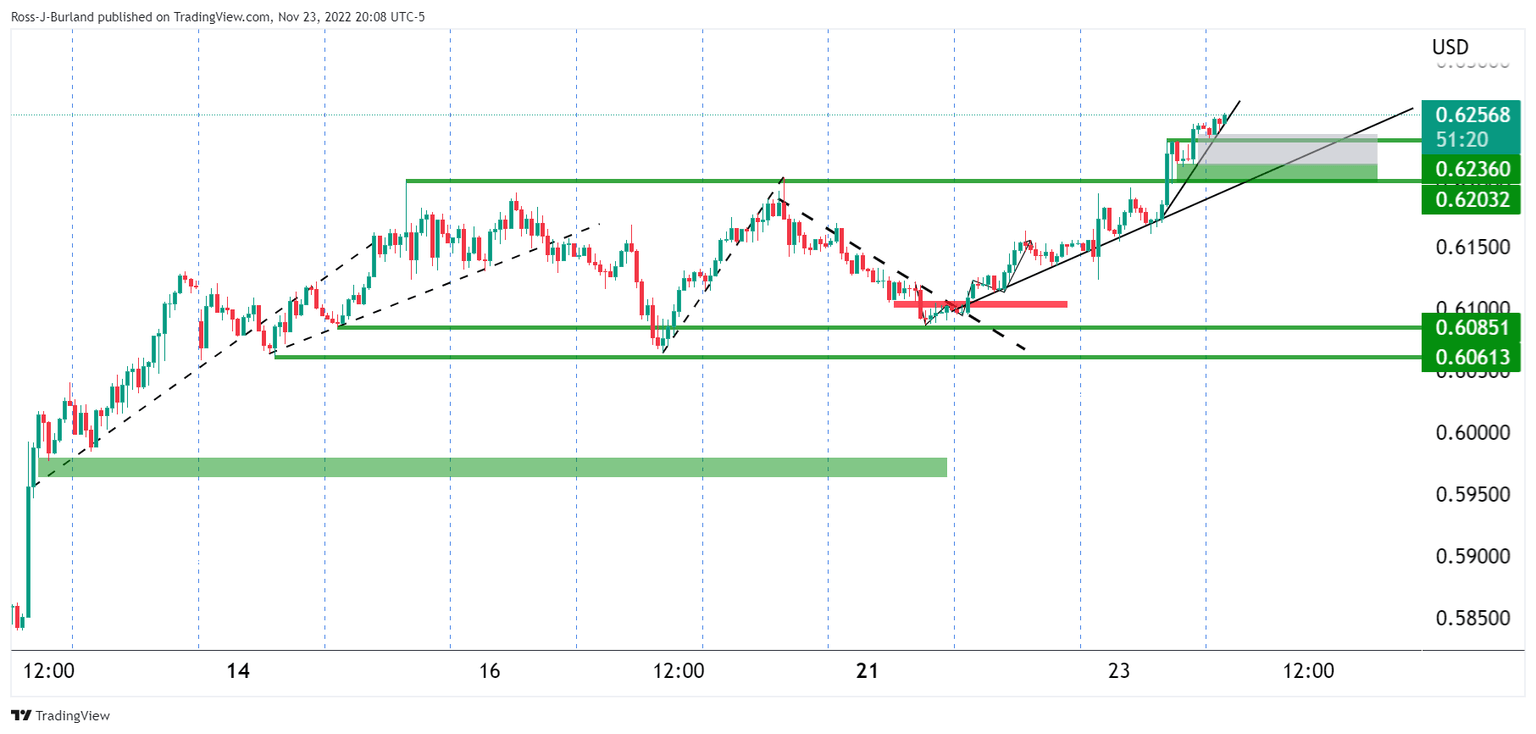

While the trendline broke, the support held and the price moved higher. At this juncture, the bulls need to commit in the upper quarter of the 0.62 area. However, the tweezer top is a bearish candle stick combination pattern that shows sellers are in the market.

The price is now testing the next trendline support a break there opens the risk of a move to the downside to test below 0.6250 and with eyes on 0.6236 prior lows and trendline before 0.6200:

With that being said, it would be unusual for the market to simply melt without a revisit to the peak formation as distribution takes a while to play out, usually as per the following topping scenario on the 15-minute chart:

NZD/USD M15 chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.