NZD/USD Price Analysis: Bulls move in from critical support, bears eye an opportunity

- NZD/USD bears ere a downside extension for the coming days.

- Bulls are moving in at a key level of support.

NZD/USD is under pressure towards a critical area of supporting structure. However, the bulls are moving in and there are prospects of a move to test a key area of resistance as the following analysis will illustrate:

NZD/USD daily charts

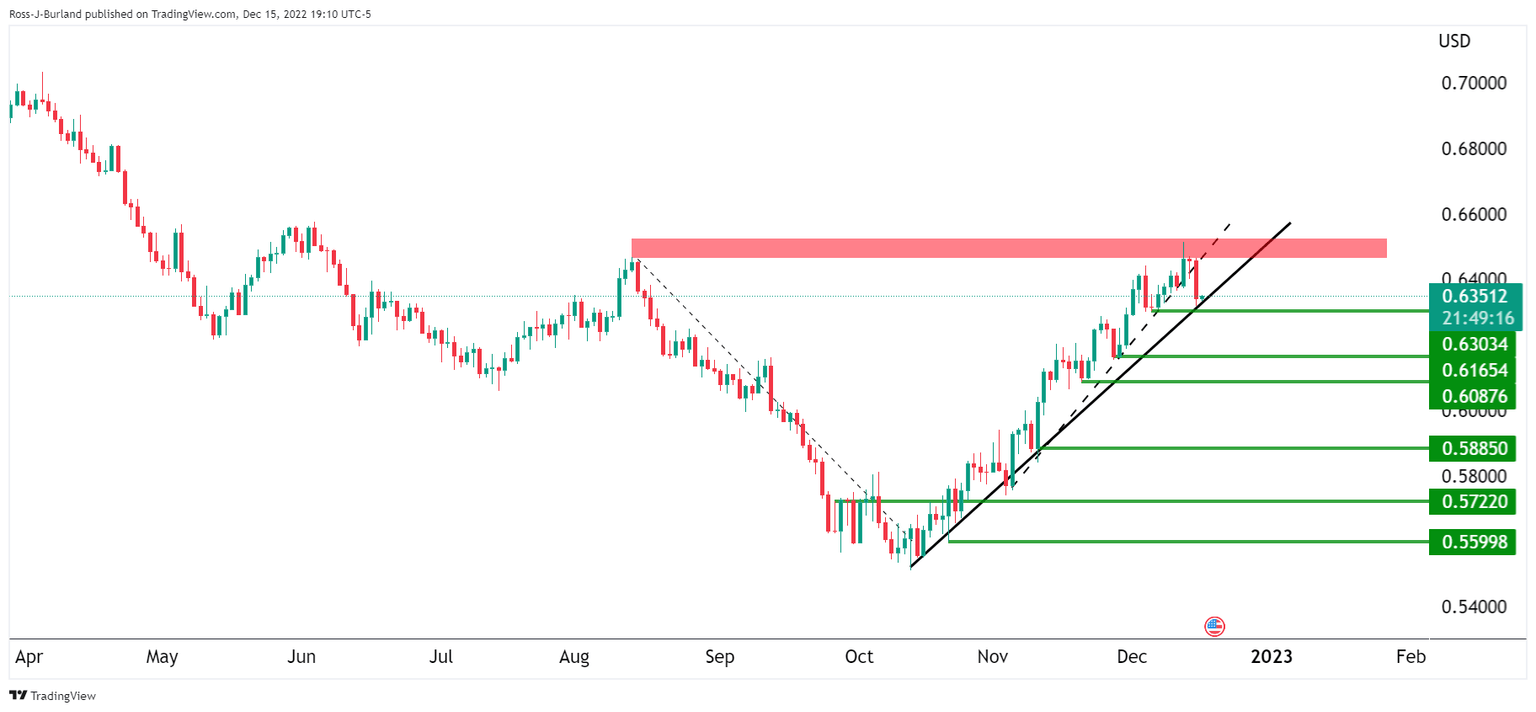

The price has carved out an M-formation as it homes in on the major dynamic trendline support and the round 0.63 figure horizontal support.

The pattern is a reversion formation and the price would be expected to restest the neckline prior to the next surge to the downside. The 38.2% Fibonacci retracement level has a confluence of this area near 0.6390/00. A break of 0.6300 opens risk to 0.6150/65 and then 0.6080/00.

NZD/USD H4 chart

The 4-hour time frame shows the price correcting towards the upside, in accordance to the above daily chart analysis.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.