NZD/USD Price Analysis: Bears extend control as pair erases most recent gains

- NZD/USD posts a four-day losing streak and approaches the 20-day SMA.

- RSI trends lower in negative territory, reflecting a decline in bullish momentum.

- The pair is down by more than 1% over the week.

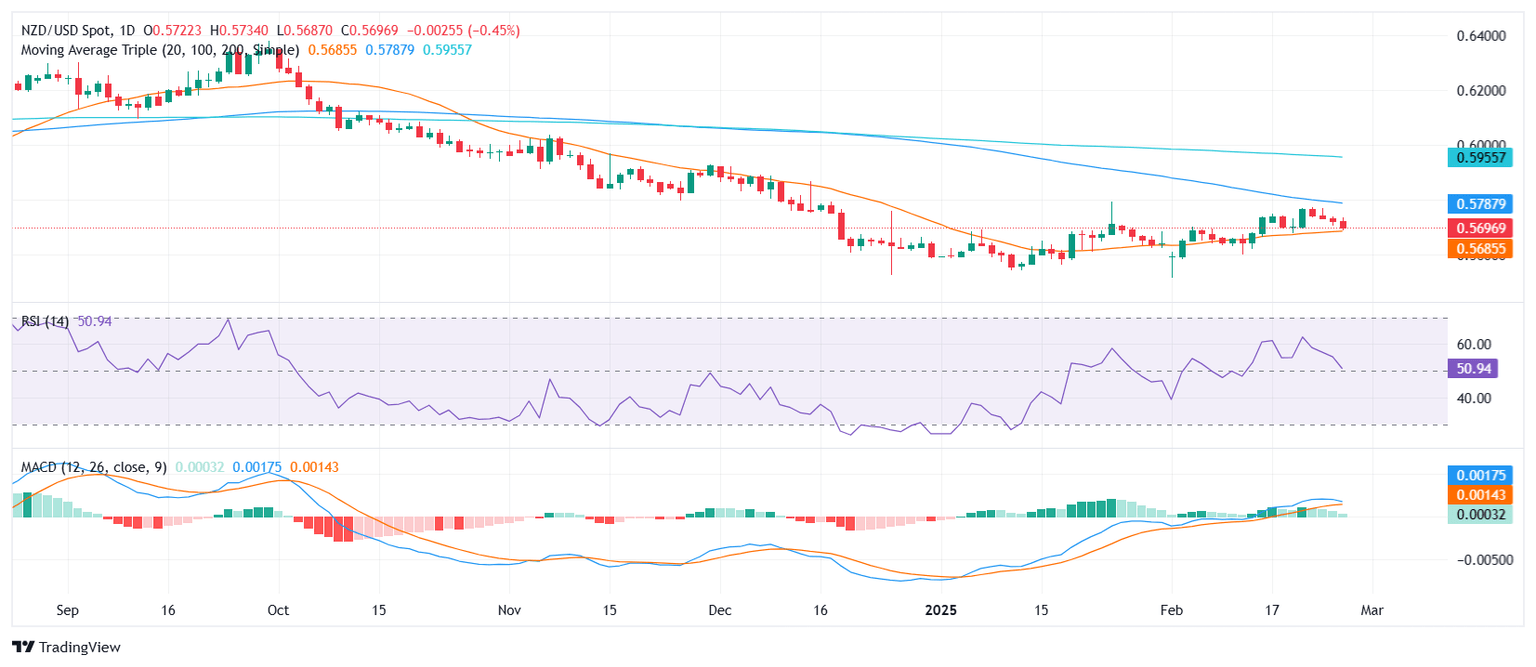

The NZD/USD pair continued its decline on Wednesday slightly below 0.5700, marking its fourth consecutive daily loss as sellers remained in control. The pair has now erased the majority of last week’s gains and is approaching a key technical threshold, the 20-day Simple Moving Average (SMA), which could determine the next directional move.

Technical indicators are turning increasingly bearish. The Relative Strength Index (RSI) is declining and approaching negative territory, suggesting that buyers are struggling to regain traction. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram prints flat green bars, indicating a slowdown in upward momentum rather than a decisive shift towards renewed strength.

If the pair breaches the 20-day SMA, it could confirm a bearish outlook, potentially leading to further downside. However, if buyers manage to defend this support level, a corrective bounce may materialize. Market participants will be closely watching price action around this technical barrier for clues on the next move.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.