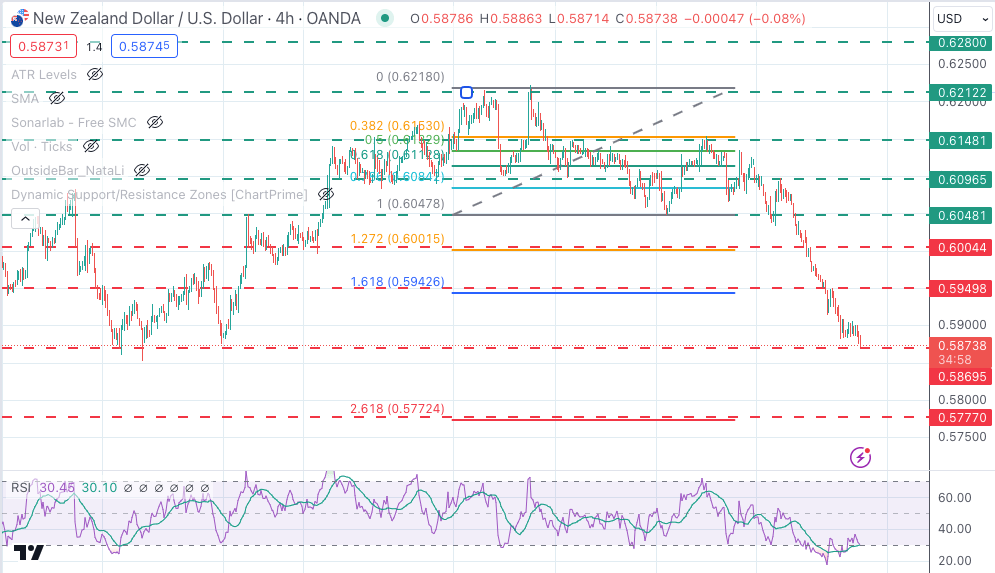

NZD/USD Price Analysis: Bears are back in control, testing key support at 0.5870

- Kiwi sellers return to test year-to-date lows at 0.5970-60.

- The sour market mood is weighing on the risk-0sensitive NZD.

- Below 1.5960, the next bearish target is the 2023 low, at 0.5770.

Kiwi’s feeble recovery attempt seen on Friday has been short-lived, and the has resumed its bearish trend on Monday. Sellers showed up at 0.5900 to send the pair towards the 0.5870-60 support area, which is being tested at the moment.

The US Dollar is firming up across the board with geopolitical concerns weighing investors' mood. This will keep the risk-sensitive Kiwi on the defensive.

Technical indicators are strongly bearish, with the 4h RSI (14) close but not yet at oversold levels. Below 0.5760, the next target would be the 2023 low, at 0.5770. This is also the 261.8% Fibonacci extension of the June sell-off, which is a common exhaustion level.

Resistances are the mentioned 1.5900 and 0.5955.

NZD/USD 4-hour chart

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.