NZD/USD Price Analysis: Aims to recapture 0.6150 amid lackluster USD Index ahead of US CPI

- NZD/USD is aiming to reclaim the 0.6150 resistance as the focus shifts to US Inflation.

- Kiwi’s quarterly GDP is seen contracting by 0.1% against a prior contraction of 0.6%.

- NZD/USD has climbed above the 0.6111 resistance, which has turned into a cushion for the Kiwi bulls.

The NZD/USD pair is looking to recapture the previous day’s high of 0.6150 in the early European session. The Kiwi asset is getting strength as the US Dollar Index (DXY) is showing a non-directional performance ahead of the release of the United States Consumer Price Index (CPI) data.

This time, the US CPI (May) data has become a much-anticipated one as it will provide crucial guidance for the Federal Reserve (Fed) policy. US labor market conditions have started releasing heat now, economic activities remained weak and further softening of US inflation would bolster the case of a neutral policy with hawkish guidance.

Meanwhile, New Zealand’s Q1 Gross Domestic Product (GDP) will remain spotlight. Quarterly GDP is seen contracting by 0.1% against a prior contraction of 0.6%. On an annualized basis, the economic data is expected to expand by 2.6%, higher than the prior contraction of 2.2%.

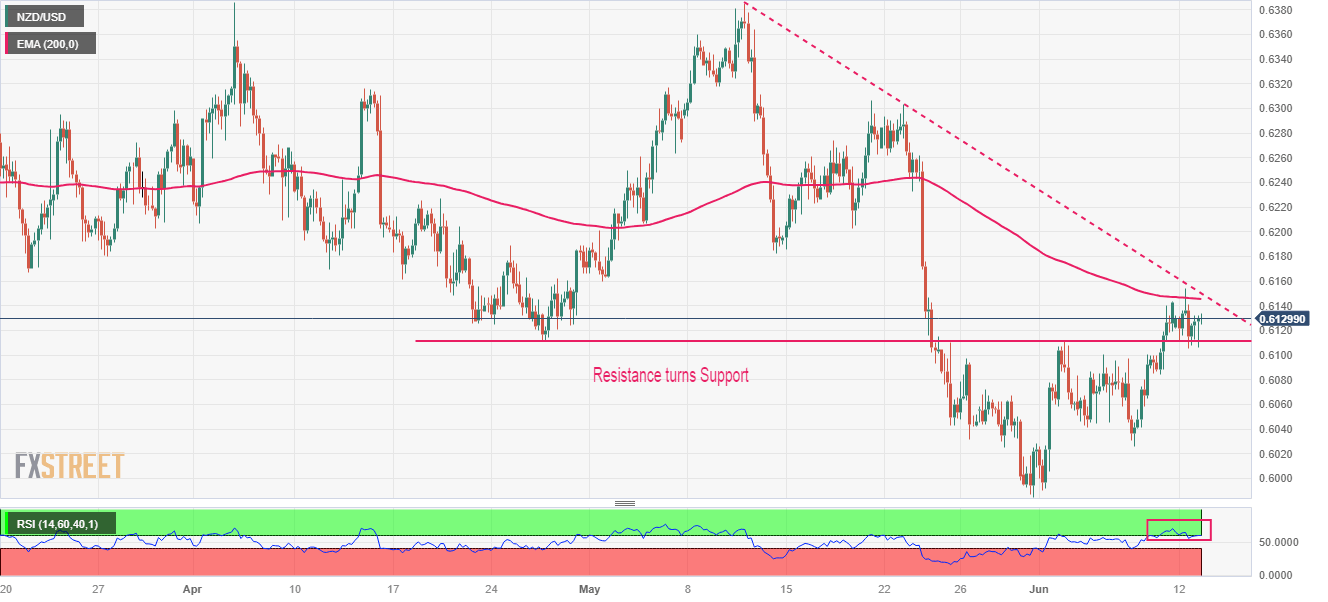

NZD/USD has climbed above the horizontal resistance plotted from April 26 low at 0.6111, which has turned into a cushion for the Kiwi bulls. The downward-sloping trendline plotted from May 11 high at 0.6385 is acting as a barricade of the New Zealand Dollar.

Also, the 200-Exponential Moving Average (EMA) at 0.6147 is restricting the New Zealand Dollar from any upside move.

The Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates that upside momentum has been triggered.

A confident break above May 01 low at 0.6160 will drive the Kiwi asset toward the round-level resistance at 0.6200 followed by May 17 high at 0.6261.

Alternatively, a downside move below the intraday low at 0.6015 will expose the asset for a fresh six-month low toward 11 November 2022 low at 0.5984. A slippage below the latter would expose the asset toward 02 November 2022 high at 0.5941.

NZD/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.