NZD/USD Price Analysis: 50-day EMA test sellers as RBNZ’s Orr refrains from dovish talk

- NZD/USD consolidates RBNZ-led losses near one-month low.

- Sellers are in command but catching a breather following four-day losing streak.

- Bulls will have to cross 0.6700 to regain the market’s confidence.

NZD/USD extends the post-RBNZ pullback while taking rounds to 0.6550, intraday low of 0.6524, amid early Wednesday. While the Reserve Bank of New Zealand’s (RBNZ) expansion of the Large Scale Asset Purchases (LSAP) to New Zealand dollar 100 billion dragged the quote to the monthly low, the Governor’s modest statements licked wounds afterward.

Read: RBNZ’s Orr: NZ dollar appreciation has moderated returns for exporters

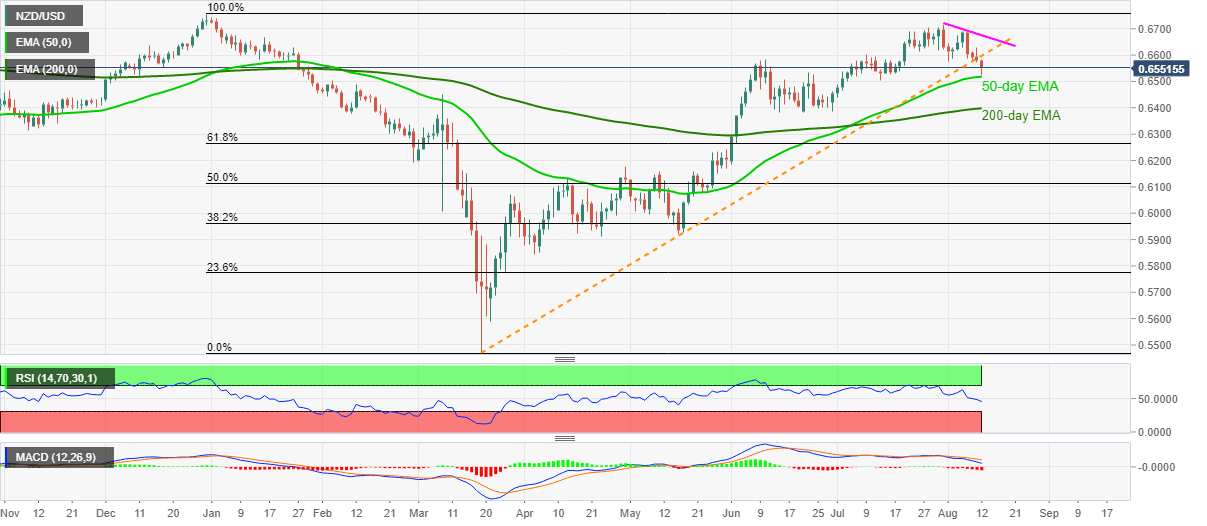

On a technical basis, the break of a three-month-old support line joins downbeat conditions of MACD and RSI to favor the sellers. However, the 50-day EMA level of 0.6518 offers immediate rest to the bears.

During the pair’s extended south-run below 50-day EMA, the pair may take a halt around 0.6500 before visiting the 0.6400 round-figures comprising 200-day EMA.

Meanwhile, the support-turned-resistance trend line stretched from March 19, at 0.6600 now, restricts the pair’s immediate upside ahead of a two-week-long falling resistance line near 0.6665 and July 31 top surrounding 0.6715.

NZD/USD daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.