NZD/USD is struggling to regain the 0.6000 level after the RBNZ’s “dovish hold”

- The New Zealand Dollar remains trading near two-week lows, with 0.6000 limiting upside attempts.

- The RBNZ kept interest rates on hold on Wednesday but hinted to further rate cuts.

- NZD/USD has a key resistance at the 0.6025 - 0.6030 area.

The New Zealand Dollar picked up as the market digested the RBNZ’s dovish statement and tested the 0.6000 psychological level, as the market mood brightened somewhat in Wednesday’s early European session. The pair, however, failed to break above it and retreated to levels close to two-week lows, at 0.5975.

The Reserve Bank of New Zealand kept its Official Cash Rate (OCR) unchanged at 3,25%, as widely expected. Wednesday’s decision follows six consecutive rate cuts that have slashed borrowing costs from its 5.5% peak in August 2024.

The minutes of the meeting, however, have been tilted to the dovish side. The highly uncertain economic outlook and the easing inflationary pressures have prompted the committee to signal another rate cut, probably in August

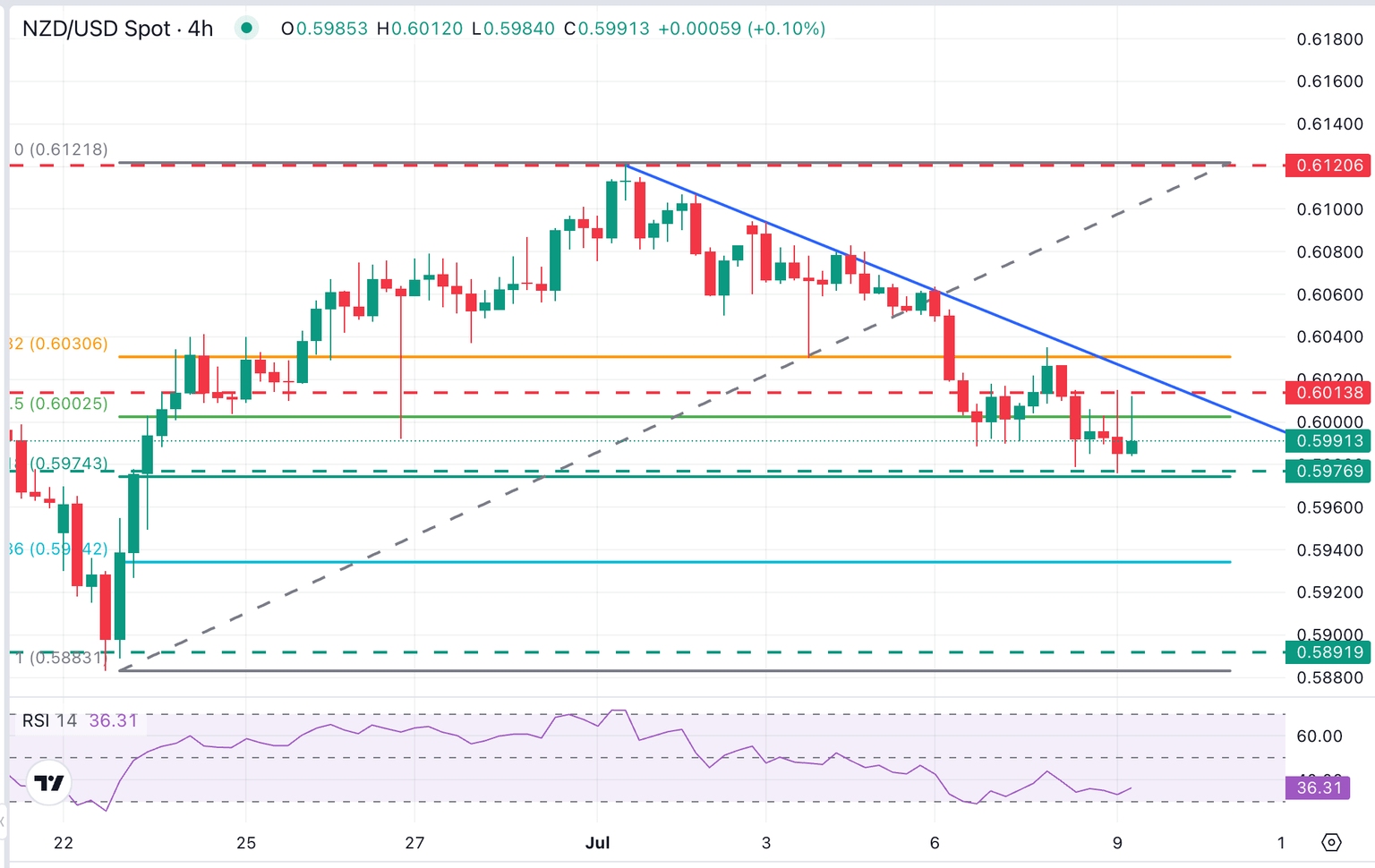

Technical analysis: NZD/USD has a key resistance area at 0.6025 - 0.6030

The KIwi, however, has been showing a mild positive tone following the decision. The NZD/USD bounced up from two-week lows at 0.5975, favoured by a mild US Dollar pullback at the European session opening times.

The broader technical picture remains bearish, with the pair depressed nearly 2% below early July highs, on track for a five-day losing streak. Failure to breach 0.6000 keeps the 0.5975 - 05980 area (July 8 and intra-day low) on the bears' focus auth scoe for further depreciation to the 0.78.6% Fibonacci retracement of the late June rally, at 0.5935.

(This story was corrected on July 22 at 09:15 GMT to say that the Reserve Bank of New Zealand kept its Official Cash Rate (OCR) unchanged, not the Reserve Bank of Australia, as previously reported.)

Economic Indicator

RBNZ Interest Rate Decision

The Reserve Bank of New Zealand (RBNZ) announces its interest rate decision after each of its seven scheduled annual policy meetings. If the RBNZ is hawkish and sees inflationary pressures rising, it raises the Official Cash Rate (OCR) to bring inflation down. This is positive for the New Zealand Dollar (NZD) since higher interest rates attract more capital inflows. Likewise, if it reaches the view that inflation is too low it lowers the OCR, which tends to weaken NZD.

Read more.Last release: Wed Jul 09, 2025 02:00

Frequency: Irregular

Actual: 3.25%

Consensus: 3.25%

Previous: 3.25%

Source: Reserve Bank of New Zealand

The Reserve Bank of New Zealand (RBNZ) holds monetary policy meetings seven times a year, announcing their decision on interest rates and the economic assessments that influenced their decision. The central bank offers clues on the economic outlook and future policy path, which are of high relevance for the NZD valuation. Positive economic developments and upbeat outlook could lead the RBNZ to tighten the policy by hiking interest rates, which tends to be NZD bullish. The policy announcements are usually followed by interim Governor Christian Hawkesby's press conference.

To the upside, resistance levels are at the intraday high 0.6000 level and the downtrend resistance, now at 0.6025. Further up, the pair would need to confirm above the July 8 high and July 1 low, at 0.6030 to break the current bearish structure.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.