NZD/JPY Technical Analysis: Fresh round of bullish lift into 78.50

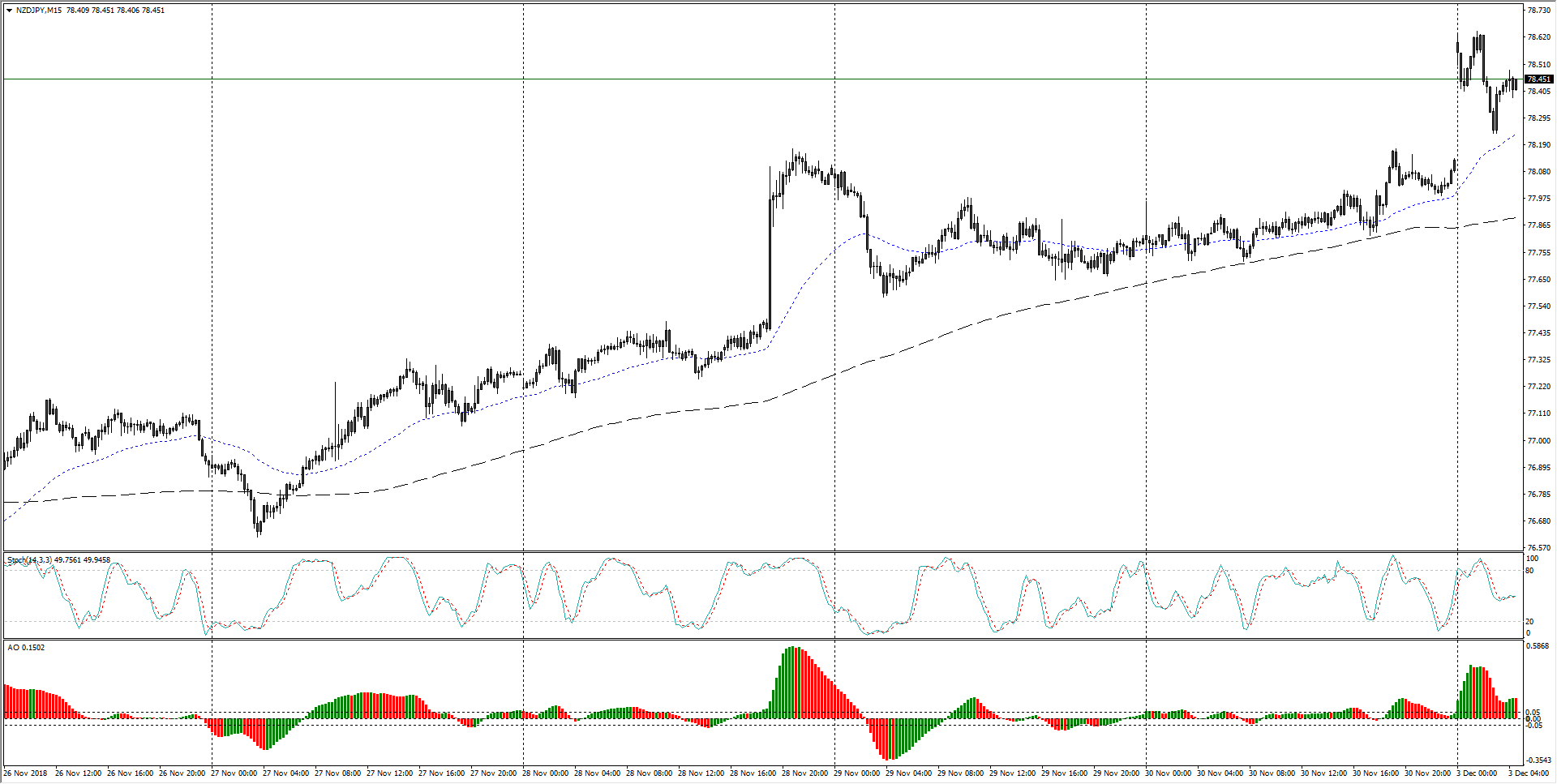

- NZd/JPY is trading into the 78.50 zone after a bullish pop to open the new trading week, and although Monday's bullish gap has left the Kiwi-Yen pair outside of current averages, the pair remains firmly bullish in the near-term.

NZD/JPY, 15-Minute

- Hourly candles have NZD/JPY climbing into new highs after clearing a bout with the 200-hour moving average, which currently sits at 77.25.

NZD/JPY, 1-Hour

- The Kiwi is seeing continued bullish support against the safe-haven Yen, climbing to new medium-term highs as NZD/JPY continues to pull away from the 200-period moving average with support building from the 50-period moving average at 77.50.

NZD/JPY, 4-Hour

NZD/JPY

Overview:

Today Last Price: 78.46

Today Daily change: 43 pips

Today Daily change %: 0.551%

Today Daily Open: 78.03

Trends:

Previous Daily SMA20: 76.99

Previous Daily SMA50: 75.17

Previous Daily SMA100: 74.75

Previous Daily SMA200: 75.77

Levels:

Previous Daily High: 78.18

Previous Daily Low: 77.72

Previous Weekly High: 78.19

Previous Weekly Low: 76.29

Previous Monthly High: 78.19

Previous Monthly Low: 73.55

Previous Daily Fibonacci 38.2%: 78

Previous Daily Fibonacci 61.8%: 77.9

Previous Daily Pivot Point S1: 77.77

Previous Daily Pivot Point S2: 77.52

Previous Daily Pivot Point S3: 77.31

Previous Daily Pivot Point R1: 78.23

Previous Daily Pivot Point R2: 78.44

Previous Daily Pivot Point R3: 78.69

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.