NZD/JPY Price Analysis: Pair rebounds to 88.65 but bearish risks persist

- NZD/JPY rises by 1.39% on Monday, settling at 88.65 after approaching oversold levels.

- Indicators rebound from oversold conditions but remain in negative territory.

- Bears maintain control below key resistance levels, despite the pair's recovery.

The NZD/JPY pair staged a recovery on Monday, climbing by 1.39% to 88.65 as buyers emerged near oversold levels. This rebound comes after a steep decline last week, offering some relief to the bulls while keeping the broader bearish outlook intact.

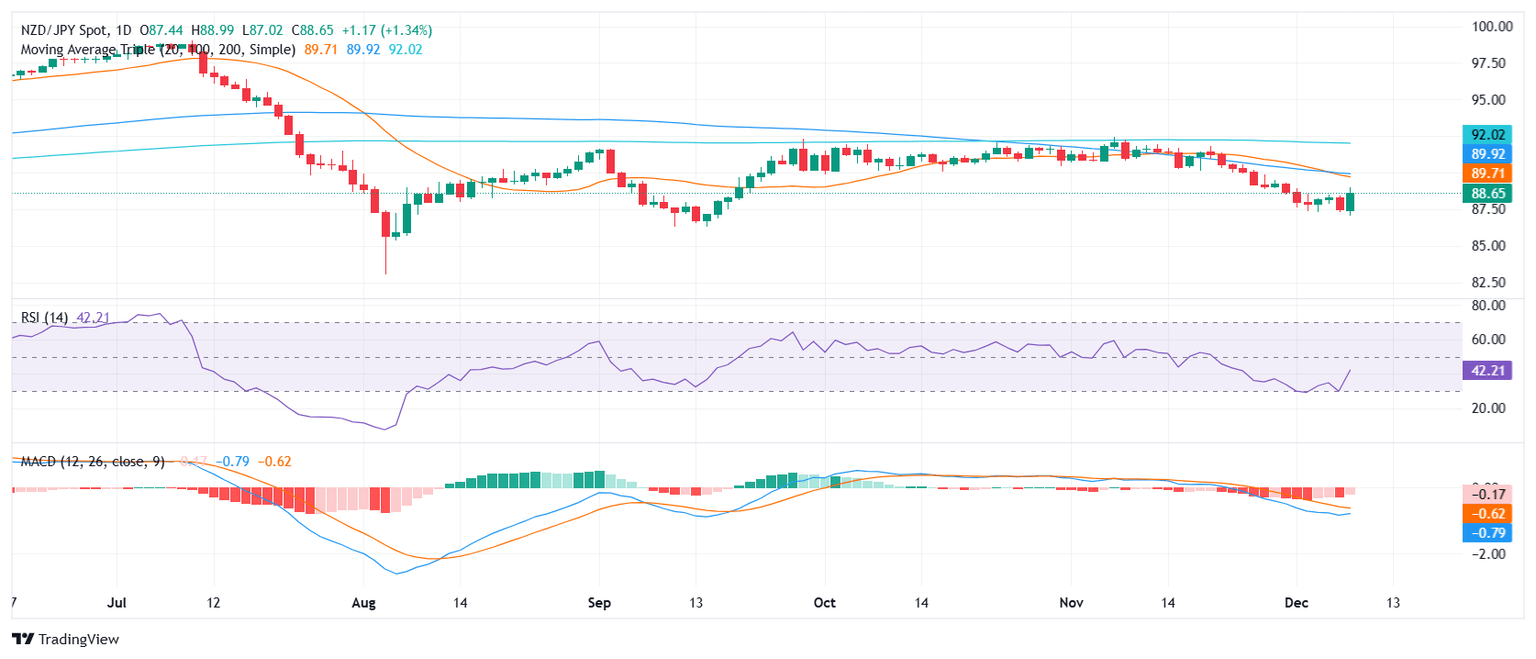

Technical indicators reflect the ongoing battle between buyers and sellers. The Relative Strength Index (RSI) has risen sharply to 43, signaling improving momentum but remaining in the negative area, suggesting caution. Similarly, the Moving Average Convergence Divergence (MACD) histogram has shifted to flat green bars, indicating a temporary pause in bearish momentum while still reflecting underlying selling pressure.

For the recovery to gain traction, the pair must reclaim the 89.00 resistance level, which would open the door for further gains toward the 90.00 area. However, failure to sustain the rebound could see the pair revisiting the 88.00 support level, with risks of a renewed decline toward the 87.00 handle and potentially the 85.00-86.00 range if selling pressure resumes.

NZD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.