NZD/JPY Price Analysis: Failure around 76.70s put sellers in control as the pair heads towards 76.00

- The commodity-linked New Zealand dollar ended Friday’s session with losses of 0.69%.

- The NZD/JPY retracement from weekly tops could lead to further losses below 76.00.

The NZD/JPY slumps for the second time in the week as traders get headed into the weekend. As Wall Street closed and thin liquidity conditions hit the FX market, the NZD/JPY is trading at 76.17 at the time of writing.

On Friday, Wall Street closed with gains, led by the Nasdaq, and the S&P 500, up 1.37% and 0.52%. Meanwhile, the Dow Jones Industrial finished flat in the day.

In the FX market, the low-yielder EUR was the gainer of the session, while the commodity currencies led by the AUD, CAD, and NZD were the principal losers, down 0.80%, 0.70%, and 0.69%, each.

NZD/JPY Price Forecast: Technical outlook

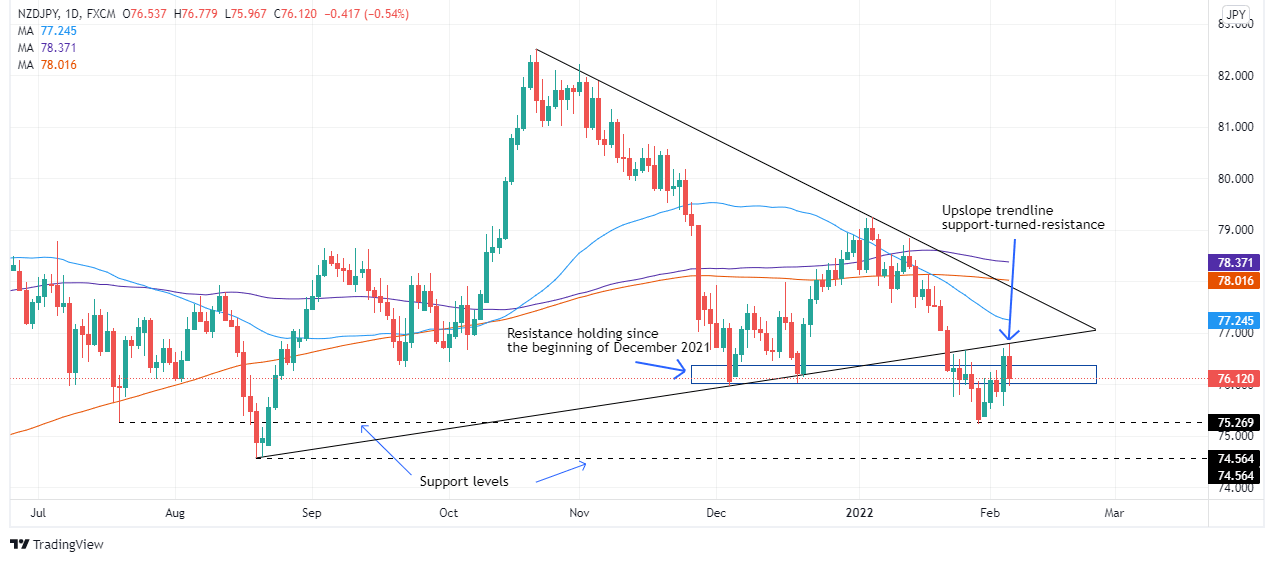

Putting Friday’s recap on the side, the NZD/JPY, as abovementioned, finished the week with losses but clung to the 76.00 figure. It is worth noting that the daily moving averages (DMAs) reside above the spot price, suggesting the pair might be headed downwards. Additionally, the failure of an upbreak of an upslope trendline drawn from August 2021 lows previous support-turned-resistance exacerbated the retracement from weekly tops near 76.80s towards the 76.10 area.

That said, the NZD/JPY first support would be 76.00. Breach of the latter would send the pair tumbling to February 3 low at 75.57, followed by January 26 cycle and YTD low at 75.21, a zone that could witness some buying pressure, before reaching 2021 yearly low at 74.55.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.