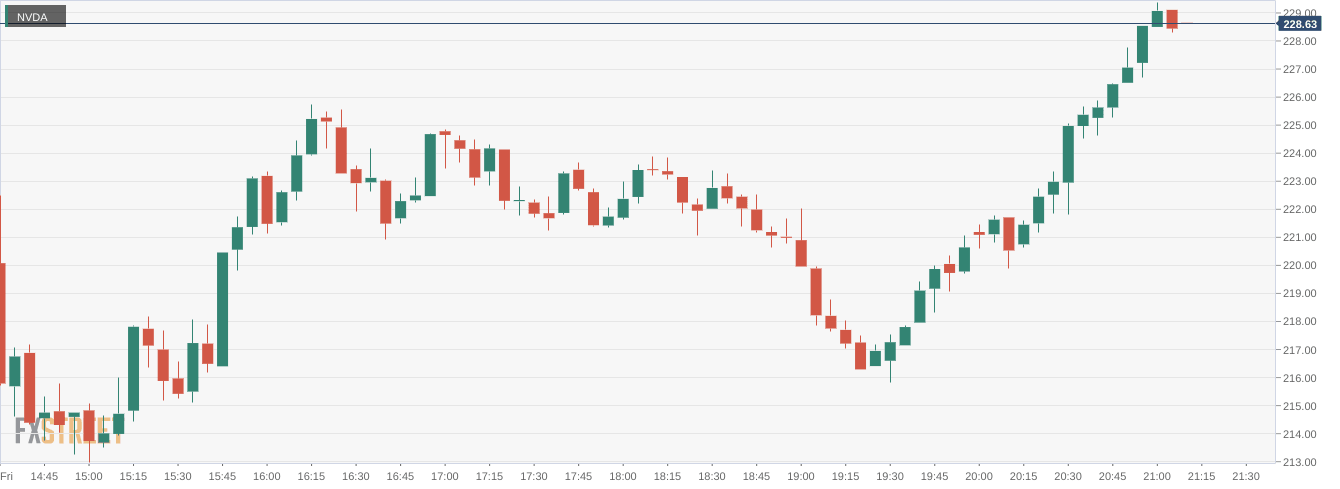

NVDA Stock Price: Nvidia soars into the weekend as NASDAQ rallies to close the week

- NASDAQ:NVDA gained 4.08% during Friday’s trading session.

- NVIDIA investors are optimistic ahead of its earnings call.

- China approves AMD’s acquisition of Xilinx but is opposed to NVIDIA’s Arm deal.

NASDAQ:NVDA investors are hoping that the stock has snapped out of its recent funk with a strong showing to close the week. On Friday, shares of NVIDIA gained 4.08% and closed the trading session at $228.40. Shares of the semiconductor giant are still down 24% so far this year, as the tech sell-off has hit the stock particularly hard. On Friday, investors finally received some relief as all three major indices closed higher, led by the tech-heavy NASDAQ which rebounded by 3.13%. The Dow Jones gained 564 basis points and the S&P 500 added 2.43% as the markets were lifted by a strong quarter from Apple (NASDAQ:AAPL), which is a major component of all three indices.

Stay up to speed with hot stocks' news!

Ahead of NVIDIA’s earnings call on February 16th, investors are using recent results from its rivals as a barometer. Intel (NASDAQ:INTC) beat on earnings and revenue although the stock has suffered from weaker guidance for this quarter. Seagate (NASDAQ:STX) and Western Digital (NASDAQ:WDC) also reported strong earnings, although Western Digital echoed Intel’s potential woes in the quarters ahead. NVIDIA shareholders will certainly be interested in what CEO Jensen Huang forecasts for the rest of 2022.

NVIDIA stock forecast

The Chinese Government has come out in support of NVIDIA rival AMD (NASDAQ:AMD) and its acquisition of Xilinx. It is interesting to note that China was one of the major opponents to NVIDIA’s recent proposed takeover of Arm Ltd., a deal that seems like it has collapsed. AMD has already received approval from the US, the UK, and Europe, something that NVIDIA also didn’t receive for its acquisition attempt.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet