Novo Nordisk continues to fall: Where I am buying the stock

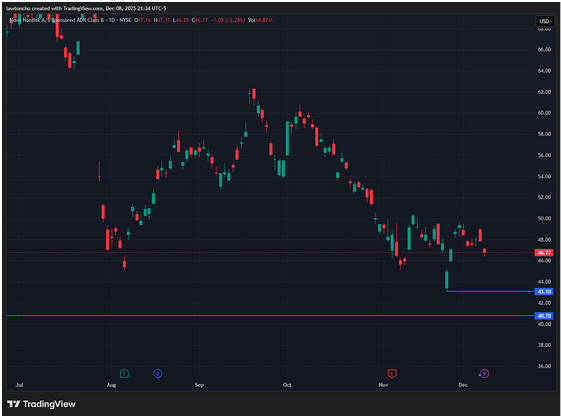

Novo Nordisk (NVO) had another tough session yesterday, finishing more than 2% lower compared to Friday’s close. The pharmaceutical company behind well-known drugs like Wegovy and Ozempic has struggled throughout the year, and the stock now sits more than 50% below its highs from earlier in 2024. Watching the recent price action pull back this sharply, I’ve been focusing closely on the technicals to determine where I want to step in.

Before getting into my levels, I want to share some brief background on Novo Nordisk and why the stock is on my radar. The company has grown into one of the most recognizable names in the pharmaceutical space, with its work in metabolic and chronic disease treatments becoming a central part of its identity. As demand for its leading products increased, so did market interest—making this year’s steep decline even more notable. With that backdrop, I’m approaching the pullback with patience, relying on technicals to guide where I believe the next high-probability opportunities may form.

As NVO continues to slide, I’m mapping out the exact levels where I plan to buy. The first area I am watching is near the $43 region, which represents the most recent pivot low and the lowest price the stock has hit this year. If we revisit that zone, I expect it to act as meaningful support and potentially trigger a reaction bounce. My secondary level sits lower, lining up with a gap fill around $40.78. Whenever a stock approaches a gap, I treat it as an area of interest, and in this case it’s a clear technical target that I will be ready for if the chart gets there.

These two levels are where I anticipate the strongest probability of a bounce in NVO. As always, no matter how clean the technicals look, proper risk management remains the foundation of every trade I take. Nothing in the market is guaranteed, and respecting risk is just as important as identifying opportunity.

Author

Lawton Ho

Verified Investing

A marketing expert sharing his journey to mastering the charts.