Northern Star Resources Ltd Elliott Wave forecast [Video]

![Northern Star Resources Ltd Elliott Wave forecast [Video]](https://editorial.fxsstatic.com/images/i/supermicro-02_XtraLarge.jpg)

ASX: Northern Star Resources Ltd – NST Elliott Wave technical analysis

Market overview

Our current Elliott Wave assessment updates the outlook for NORTHERN STAR RESOURCES LTD (ASX:NST). Based on recent data, the stock is showing signs of short-term bearish momentum. We anticipate a downward move toward the 16.86 level. This outlook signals no bullish potential at the moment.

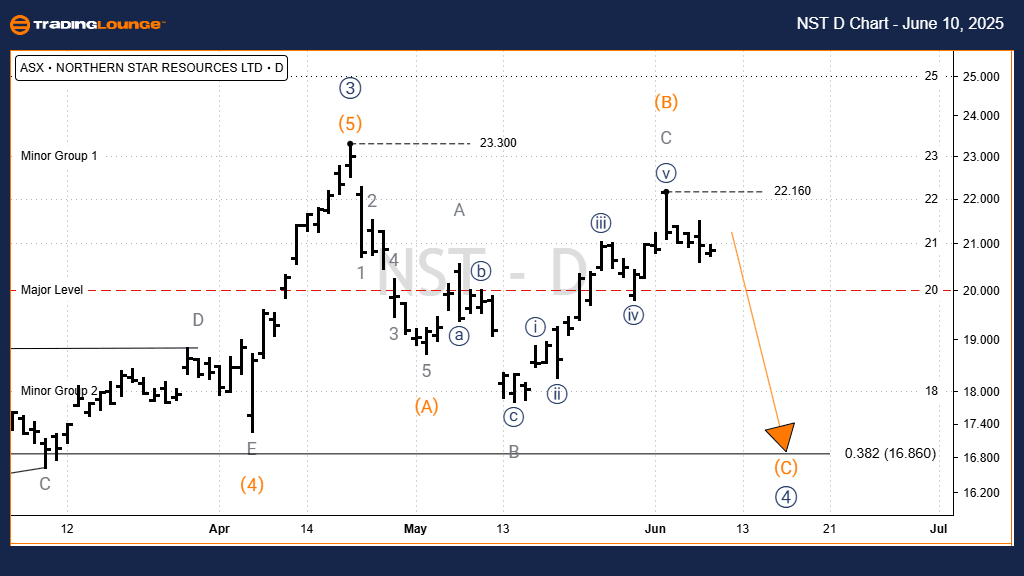

Technical analysis: One-day chart (semilog scale)

-

Function: Major trend (Minor degree, grey).

-

Mode: Motive.

-

Structure: Impulse.

-

Current position: Wave C (orange) of Wave 4 (navy).

Details

Wave 4 (navy) appears to be unfolding as an ABC Zigzag pattern. The A and B waves (orange) have completed, and now wave C (orange) is in motion, heading toward the target of 16.86. Since the last high of 22.16, the chart presents a strong bearish case. A reversal is invalidated if prices reach or exceed 23.30.

ASX: Northern Star Resources Ltd – NST Elliott Wave technical analysis

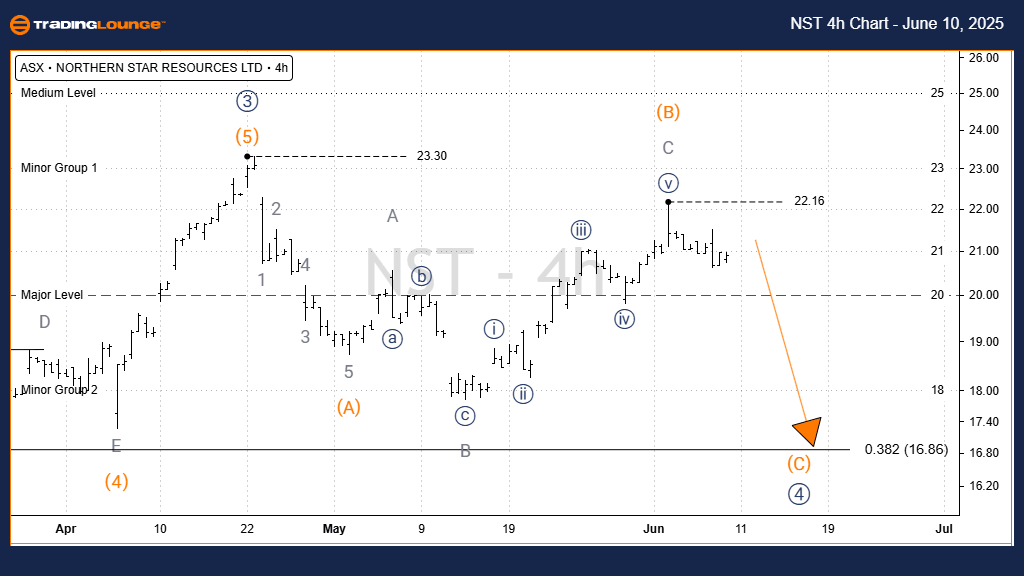

Technical analysis: Four-hour chart

-

Function: Major trend (Minor degree, grey).

-

Mode: Motive.

-

Structure: Impulse.

-

Current position: Wave C (orange) of Wave 4 (navy).

Details

Aligning with the 1D chart, the 4-hour chart also confirms that wave C (orange) has been progressing downward since the 22.16 high, aiming for the 16.86 support level. The invalidation level for this bearish forecast is 22.16.

Conclusion

Our analysis and short-term projection for ASX:NST help traders understand current market direction. With clearly defined validation and invalidation points, we enhance confidence in the wave count outlook. This structured method offers traders a solid framework for decision-making in volatile conditions.

Northern Star Resources Ltd Elliott Wave forecast [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.