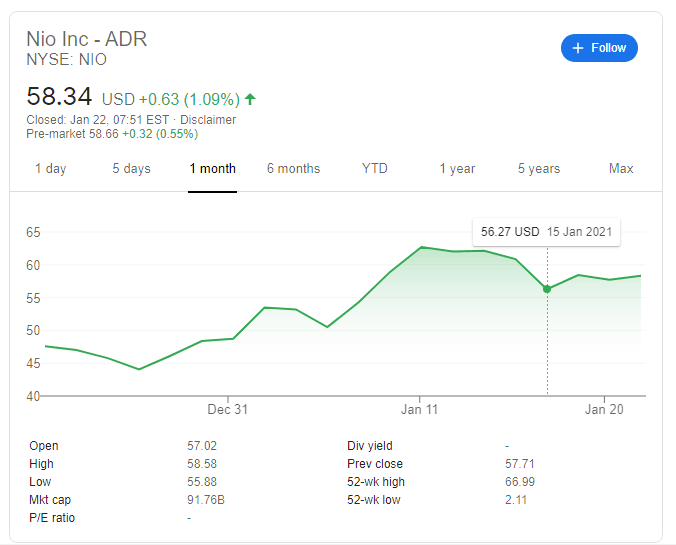

NIO Stock Price and Forecast: Set to end the week higher after dropping car down payment to zero

- NYSE: NIO has closed Thursday's trade 1% higher and is set to extend its gains on Friday.

- Nio has announced it is offering a limited zero downpayment for its vehicles.

- The chart shows that clear a low hurdle may open the door to the monthly highs.

A financial risk or the best way to capture market share? Nio Inc (NYSE: NIO) has been betting on expanding its sales, even at the expense of handing out cars without any initial cost. Investors seem to like the idea, pushing shares higher.

After closing at $58.34 on Thursday, an increase of 1.09%, Friday's premarket trading is pointing to another increase of 0.55%, which would send shares to the highest since January 14. It would not take much more for NIO to surpass the peak closing price of 2021, which stands at $62.70.

NIO Stock News

The Shanghai-based electric vehicle maker has announced that customers may grab one of three different models without making a down payment. The limited-time proposition runs through February 28 – which is ample time to make a substantial amount of sales.

This recent move is no the first by NIO – it is repeating a similar feat it initially performed back in September 2019. Back then, the trigger was an attempt to raise sales, while the 2021 zero downpayment approach could be an attempt to compete with Tesla in China.

Investors were happy to see large growth percentages in the company's earnings reports – even at the cost of slower cash flow. At this juncture, markets seem to support NIO's move to expand its reach. It is essential to remember that every car sale implies servicing costs – including those for batteries.

More NIO Stock Price Forecast: Carmaker weathers comments calling for a correction, a sign of strength

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.