NIO Stock Forecast: Nio Inc extends losing streak and hits 14-month low

- NYSE: NIO fell by 4.66% during Wednesday’s trading session.

- Chinese ADRs struggle again as AliBaba ponders sale of stake in Weibo.

- December delivery numbers are the next catalyst that could reverse Nio’s downward trend.

NYSE: NIO is running out of support levels as the stock erases most of the gains it made during the bull run of 2020. On Wednesday, shares of Nio tumbled a further 4.66% and closed the trading session at $28.25. The drop in price represents Nio’s lowest trading levels in fourteen months, just another reminder of how badly the stock has performed in 2021. Nio has lost nearly 50% of its value this year alone and it’s market cap has been cut in half after nearly touching $100 billion earlier this year. Nio is being hit by two different storms as 2021 comes to a close: the continued sell off of high growth stocks combined with the ongoing pullback of Chinese tech companies.

Stay up to speed with hot stocks' news!

If there is one Chinese ADR that has suffered more than Nio in 2021, it is eCommerce giant AliBaba (NYSE: BABA). Many point to AliBaba’s founder Jack Ma as the catalyst for the Chinese government cracking down on big tech companies, and perhaps fittingly, AliBaba has seen its stock fall by 51% in 2021. On Wednesday, the sell off of Chinese ADRs continued as AliBaba is apparently interested in selling its stake in Chinese social media platform Weibo. Investors also saw ride-hailing company Didi (NYSE: DIDI) plummet a further 8.2% as the stock prepares to delist from the US markets.

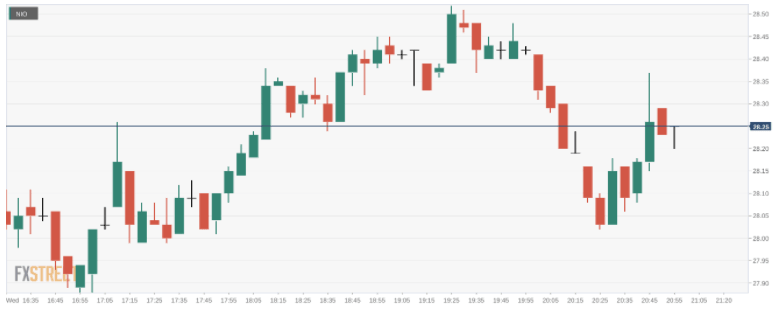

NIO stock price

Next week Nio will report its December vehicle delivery figures, a report that has largely had a direct effect on the company’s stock. After a disappointing report in October that was explained by Nio closing down production to improve its facilities, Nio once again broke records in November. It is anticipated that December will continue that trend, so Nio investors could see a spike as early as next week.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet