Nio Inc. Stock News and Forecast: NIO sell-off continues, targets year-to-date low

- NIO stock slumps 15% in US trading as delisting fears grow.

- The EV automaker share price down 11% overnight in Hong Kong, just following US losses.

- SEC added NIO to its list of stocks that could be delisted.

Update: NIO stock continues to fall following the dismal performance on the US stock markets. The Chinese EV shares are losing around 4% at the time of this update, almost one hour into Wall Street trading on Friday, while the S&P 500 and the Nasdaq are losing more than 1%. Despite a better-than-expected US jobs report, equity markets continue to be routed as the Federal Reserve might be more inclined to control inflation through more aggressive interest rate hikes. Nio Inc. has also been selling off as fears that the SEC might de-list the stock in the US stock markets have grown. Several Chinese companies currently trading in the United States are under review and could be erased from the US indexes.

NIO stock suffered on Thursday as investors bailed on the Chinese electric vehicle builder stock as soon as they heard the news of its potential delisting. The SEC added Nio and XPeng (XPEV) to its growing list, along with other popular Chinese tech names such as JD.com (JD) and Pinduoduo (PDD).

Chinese tech has not been a good place to park your investment as the chart below shows us. KWEB, the Chinese internet ETF, is down over 60% in the past 12 months.

KWEB chart, daily

NIO stock news: Underperforming the dismal stock market performance

Thursday was not a good day to park your cash anywhere near the stock market, with a 90%+ down day. That simply means over 90% of all stocks listed on the NYSE finished lower on the day. The Nasdaq crashed 5% while the S&P 500 was down over 3%. So, we need to put that into our calculations when outlined NIO's performance on Thursday. Falling 15% was not unexpected in such a market.

The SEC added NIO to its delisting list and that has sent investors rushing for the exit. US retail investors will not be all that interested in the fact that shares in Hong Kong are fully fungible. Or that Nio Inc. has plans to list in Singapore. Retail investors have been a large part of the volume in the stocks and once out they will not return if the SEC delists the stock.

NIO stock forecast: Remains under heavy selling pressure

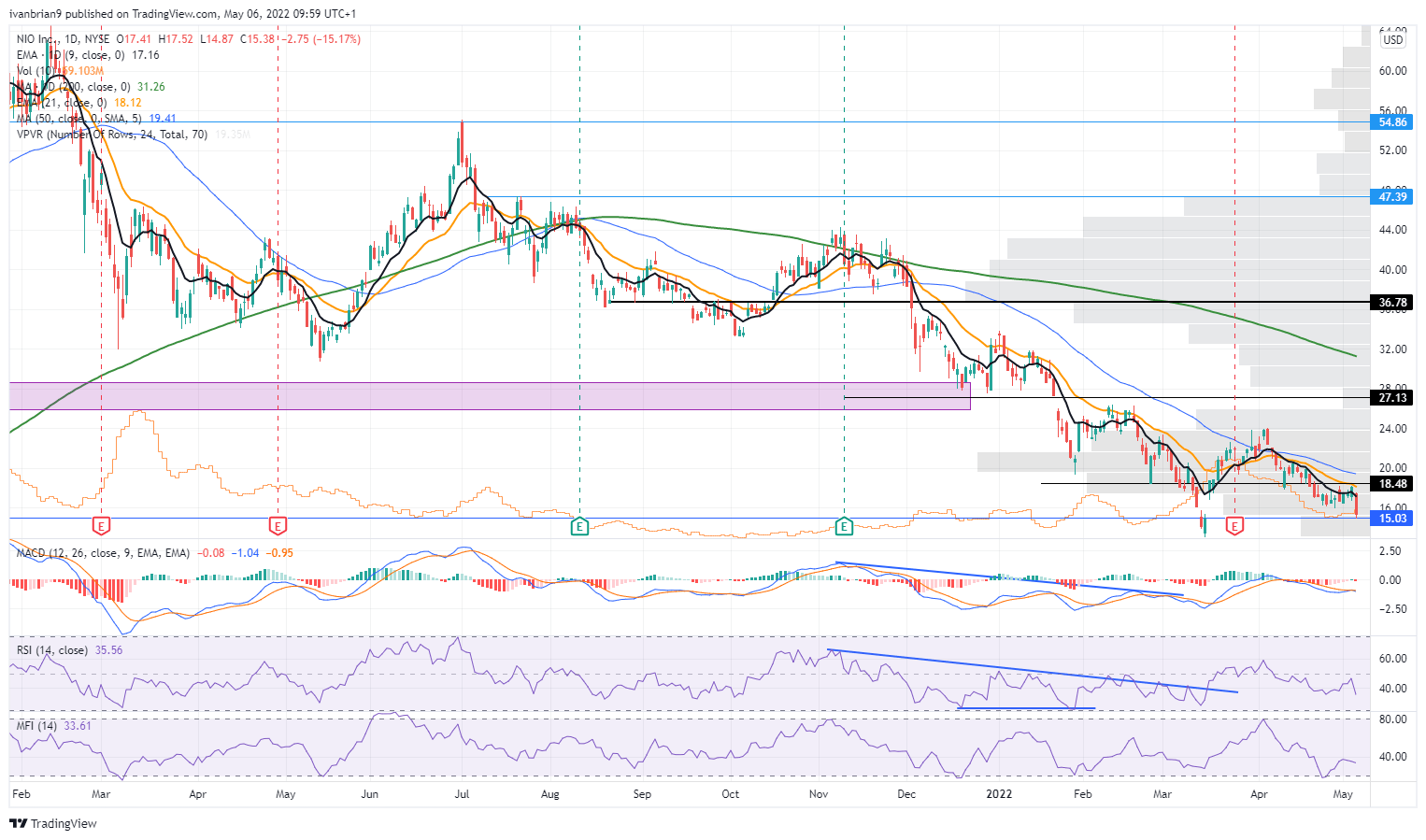

NIO stock stopped close to our support at $15.03 on Thursday but it remains under incredible selling pressure. No real let up here but volatility is always an issue. Bear-market rallies can be huge but unless NIO share price breaks above $27 then that is what they are, just bear market rallies.

RSI and MFI remain bearish below 50 and the MACD remains in a bearish crossover. NIO stock is trading below all major moving averages.

NIO stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.